From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Market Signals: Positive Growth in Australian Steel Activity

Recent developments indicate a very positive sentiment in the Australian steel market, as evidenced by increased plant activity levels noted in conjunction with significant geopolitical engagements. Notably, “India-US Trade Pact, Global Issues: Top Agendas Of JD Vance’s India Visit” highlights the strategic importance of strengthening trade ties, an initiative that may influence steel demand dynamics moving forward, though direct links to plant activity changes were not established.

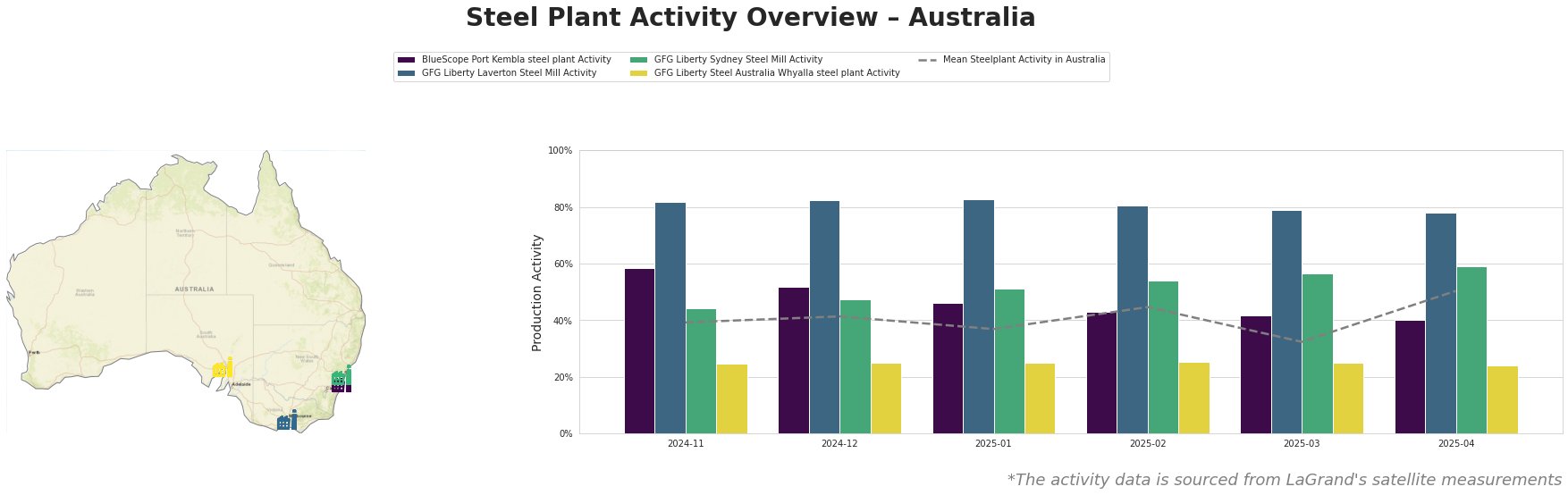

Observational data from April 2025 shows peaks in activity across several Australian steel plants, with BlueScope Port Kembla notably at 40%, a minor decline from 42% in March, while GFG Liberty Laverton Steel Mill remains highly productive at 78%, closely aligning with its average of 82%. Meanwhile, GFG Liberty Steel Australia Whyalla’s activity has stabilized at a low 24%, the lowest observed, revealing a worrying trend that may pose future supply risks in that region.

BlueScope Port Kembla is central to the New South Wales sector, with a capacity of 3,200 kt/y primarily utilizing the BOF process. Despite a recent decline to 40% activity, it maintains a robust operational framework supporting infrastructure needs. The drop may be tied to fluctuating demand patterns resulting from international negotiations, although a direct link to the cited news is not evident.

The GFG Liberty Laverton Steel Mill benefits from consistent productivity levels reaching 78%. Leveraging electric arc furnace (EAF) technology, this plant produces vital structural products appealing to diverse sectors including energy and transportation—a key area likely to grow as U.S.-India relations strengthen.

GFG Liberty Sydney has seen a 59% operational rate in April, enhancing its position in the market as it processes steel long products. Its proximity to emerging demand from infrastructure projects further solidifies its strategic importance.

Conversely, the GFG Liberty Steel Australia Whyalla steel plant‘s persistent low activity at 24% signals potential supply disruptions which could impact local consumers. The plant’s reliance on integrated blast furnace technology suggests a need for diversification to mitigate low demand and enhance resilience.

In light of these developments:

- Steel buyers should consider increasing procurement from GFG Liberty Laverton and Sydney, given their robust activity levels and product availability.

- Monitor the Whyalla plant closely for possible supply constraints, advising contingency plans on steel sourcing to avoid delays, as the low operational percentage indicates ongoing capacity challenges.

Leveraging strengths in operational efficiency while addressing potential vulnerabilities will be essential in navigating the evolving market landscape.