From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia-UK FTA Boosts Steel Demand: Kalyani Steels Activity Surge Signals Optimism Despite CBAM Concerns

The Asian steel market shows a generally positive outlook, particularly in India, partly driven by the recently signed India-UK FTA. While the “India-UK FTA Deal: CBAM Omitted, Talks On Proposed Carbon Tax Ongoing” reflects ongoing uncertainty regarding carbon border adjustments, the anticipated reduction in tariffs on goods like medical devices, as highlighted in “India-UK Trade Deal To Ease Access For Domestic Medical Devices In Britain“, is expected to boost manufacturing activity and, consequently, steel demand. While there appears to be no direct link between the news articles and the satellite data available for the Erdemir Eregli steel plant, a rise in Kalyani Steels’ activity data over the monitored period hints at possible rising steel demand, with no direct relationship to the Japan steel plant.

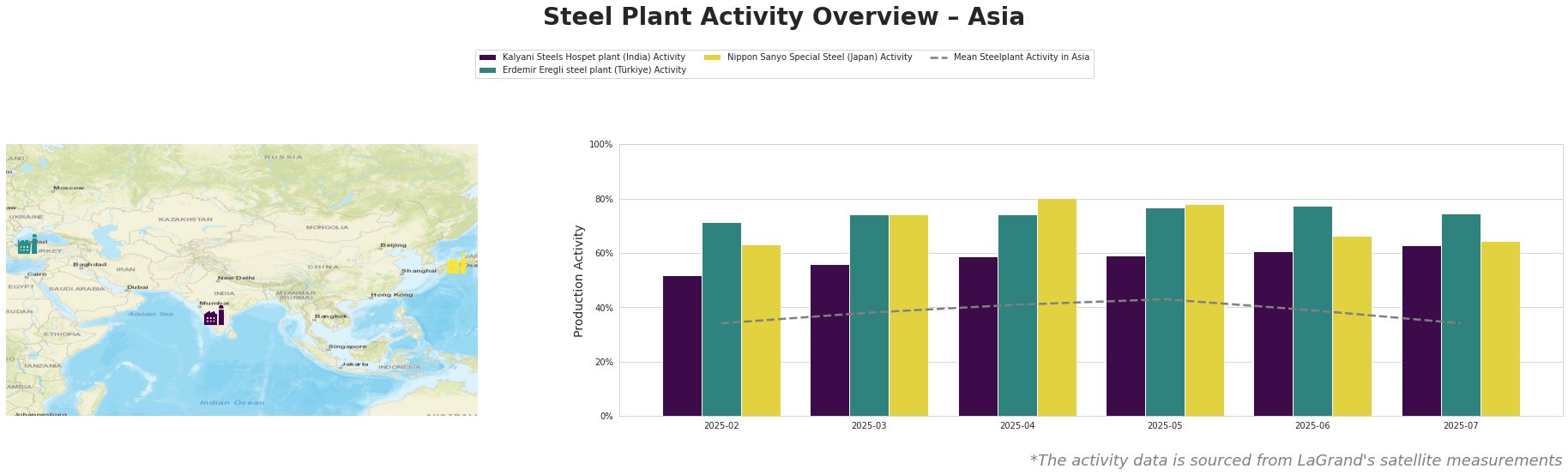

The mean steel plant activity in Asia fluctuated over the monitored period, peaking at 43% in May before dropping to 34% in July. Kalyani Steels demonstrated the highest activity relative to the Asian mean, consistently operating above average and reaching a peak of 63% in July. Erdemir Eregli also operated well above the mean activity level throughout the period. Nippon Sanyo Special Steel experienced a peak activity of 80% in April, before declining to 64% in July.

Kalyani Steels Hospet plant (India), an integrated steel plant utilizing both BF and DRI processes with a crude steel capacity of 860 ttpa, has shown a consistent increase in activity from 52% in February to 63% in July. This increase aligns with the positive sentiment surrounding the India-UK FTA, as the company supplies steel to key sectors like automotive and building & infrastructure, which are expected to benefit from the trade agreement. The observed activity increase could be linked to anticipated higher demand resulting from tariff reductions for downstream industries as mentioned in “India-UK FTA: From Basmati Rice To Whisky — Here’s What Gets Cheaper“.

Erdemir Eregli steel plant (Türkiye), an integrated BF-based steel plant with a crude steel capacity of 4000 ttpa, maintained a consistently high activity level, ranging from 71% to 77% throughout the observed period, dropping slightly to 75% in July. There is no direct news link that would explain the plant activity levels.

Nippon Sanyo Special Steel (Japan), an EAF-based special steel plant with a crude steel capacity of 1596 ttpa, experienced fluctuating activity. From a high of 80% in April, the activity declined to 64% in July. There is no direct connection to the provided news articles, but its strong reliance on the automotive industry makes it susceptible to indirect influence from the India-UK FTA.

Evaluated Market Implications:

The signing of the India-UK FTA, specifically the provisions outlined in “India-UK Trade Deal To Ease Access For Domestic Medical Devices In Britain,” is expected to increase demand for steel in India. The rise in activity at Kalyani Steels supports this assessment.

Given India’s concerns about the UK’s proposed CBAM, as expressed in “India Reserves Right To Retaliate If Proposed Carbon Tax Hurts Domestic Exports: Goyal,” steel buyers should closely monitor developments in carbon taxation and their potential impact on long-term steel costs, especially after 2027.

Recommended Procurement Actions:

- For steel buyers focusing on the Indian market: Given the increased activity at Kalyani Steels and the potential for higher demand due to the India-UK FTA, secure supply contracts with Kalyani Steels and other Indian steel producers to mitigate potential price increases.

- For analysts monitoring the Asian steel market: Closely track developments related to carbon border adjustment mechanisms and their potential impact on the competitiveness of Indian steel exports to the UK after 2027. While the CBAM was omitted from the initial FTA, further negotiations and implementations could affect steel demand.

- For steel buyers reliant on special steel: Be aware of fluctuations within the Japanese steel market, particularly for downstream industries like automotive. Keep an eye on political news related to trade.