From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market Faces Prolonged Weak Demand; Plant Activity Varied Ahead of Expected 2026 Recovery

Europe’s steel market faces continued headwinds, with weak demand expected to persist until 2026. The outlook is underpinned by reports such as “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026” and “OECD: EU steel demand expected to see gradual recovery from 2026“, yet a direct, quantifiable link between these forecasts and immediate, broad changes in plant activity, beyond the trends described below, is difficult to firmly establish from the provided data.

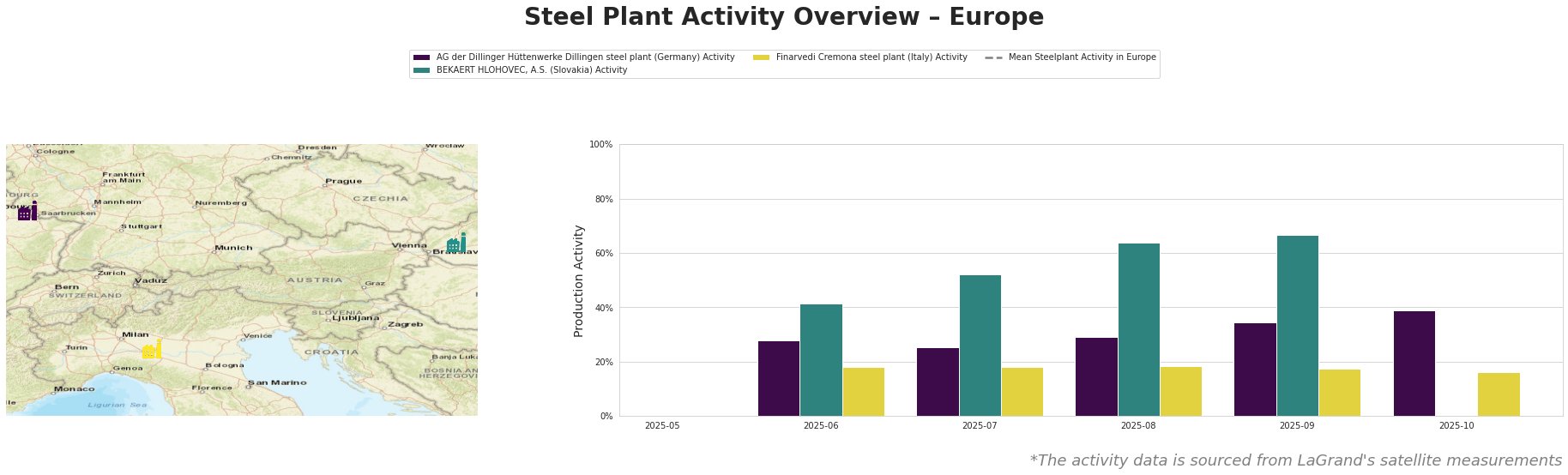

The mean steel plant activity in Europe fluctuates significantly between the reported months. AG der Dillinger Hüttenwerke Dillingen steel plant activity increased gradually from 25% in July to 39% in October. BEKAERT HLOHOVEC, A.S. activity showed a stronger upward trend, increasing from 41% in June to 67% in September. The Finarvedi Cremona steel plant remained relatively stable at low levels with some fluctuations, decreasing to 16% in October. The significant decrease of the average activity in September and October is visible, even if a direct connection to news articles is not possible.

AG der Dillinger Hüttenwerke Dillingen, an integrated BF/BOF steel plant in Germany producing heavy-plate products for various sectors, saw a steady increase in activity from 25% in July to 39% in October. This rise occurred amidst the broader context of weak demand highlighted in “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026”. However, no direct correlation can be definitively established between this increase and the overall negative market sentiment.

BEKAERT HLOHOVEC, A.S. in Slovakia, focused on wire rod production using EAF technology, experienced a significant surge in activity, reaching 67% in September. While both automotive and construction sectors, key end-users for BEKAERT HLOHOVEC, A.S., are mentioned as facing challenges in the news articles, no direct link can be made between this plant’s activity increase and those specific demand dynamics.

Finarvedi Cremona, an Italian EAF steel plant producing hot rolled coil and galvanized products primarily for the automotive sector, maintained a consistently low activity level, fluctuating around 17-18% before dropping to 16% in October. This aligns with the “OECD: EU steel demand expected to see gradual recovery from 2026”, given the plant’s focus on automotive steel and the reported weakness in that sector.

The “EUROFER: Apparent steel consumption not expected to improve substantially before Q1 2026” article points to potential trade disruptions caused by US tariffs. Given the weak demand and uncertainty, steel buyers should prioritize securing supply contracts with built-in flexibility to adjust volumes based on evolving market conditions. For buyers relying on steel from Finarvedi Cremona, the consistently low activity levels suggest a need to diversify suppliers to mitigate potential disruptions. Buyers dependent on Dillinger should monitor activity for signs of reversal, but the current trend is not a concern. The increasing activity at BEKAERT HLOHOVEC, A.S. could indicate a regional opportunity for buyers in the wire rod market.