From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineStrong Steel Surge in Germany: Knauf’s Expansion and Klöckner’s Potential Acquisition Drive Positive Outlook

Germany’s steel market is experiencing a significant upward shift, highlighted by Knauf Interfer’s major investment initiatives as reported in Knauf Interfer reorganises steel activities and ongoing acquisition talks involving Klöckner & Co, referenced in Worthington Steel is in talks to acquire Germany’s Klöckner & Co. Recent satellite observations indicate increased operational activity, notably at Knauf’s Delta Stahl plant in Barsinghausen, corroborating the positive sentiment built by these news developments.

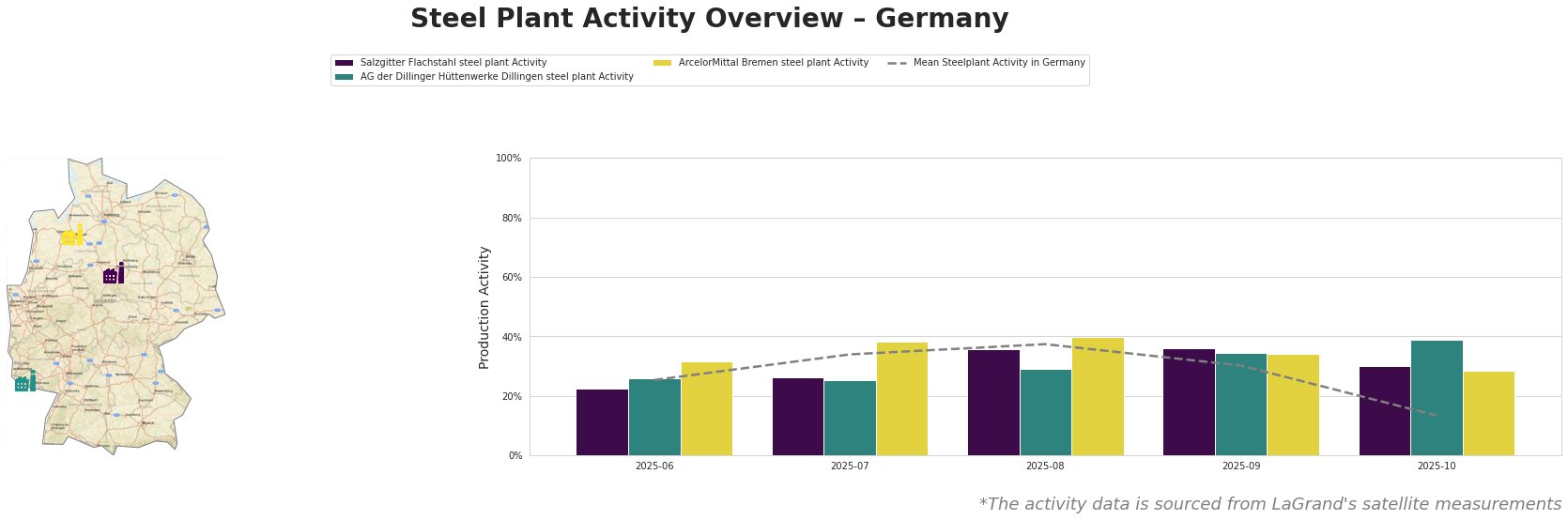

The activity data reveals a notable spike in August 2025, where the mean activity reached 37.0%, markedly stronger than the 25.0% reported in June 2025. However, a sharp decline to 13.0% was observed in October 2025. While the decline can be alarming, the preceding months saw healthy contributions from ArcelorMittal Bremen, peaking at 40.0% in August, possibly due to increased demand driven by the ongoing developments in the broader market.

At the Salzgitter Flachstahl steel plant, the activity peaked at 36.0% in August, indicating a period of robust operations. While the subsequent decrease to 30.0% in October may appear concerning, it is essential to cross-reference this with Knauf’s announced expansion at Delta Stahl, signaling strong future potential as new investments come online.

The AG der Dillinger Hüttenwerke Dillingen experienced consistent outputs, ranging from 26.0% to 39.0% activity levels, reflecting steady market engagement amidst acquisition talks surrounding Klöckner, which may generate increased demand for Dillinger’s semi-finished and finished products as their operating performance improves.

The ArcelorMittal Bremen steel plant demonstrated the highest activity levels in August and a slight decline thereafter, yet it remains aligned with the overall market sentiment shaped by Knauf’s strategic restructuring. The plant’s capability to produce critical finished goods highlights its role in servicing both the automotive and building sectors, which are predicted to see growing orders due to improvements in procurement and distribution reported by Knauf.

Given these developments, steel buyers should consider the following actions:

- Monitor Changes: Keep a close watch on Knauf Interfer’s activity at Delta Stahl; expansion efforts could lead to supply increases.

- Evaluate Procurement Strategies: Given Klöckner’s ongoing negotiations, assess the stability of current suppliers and prepare for potential shifts in market pricing and availability stemming from these talks.

- Explore Strategic Partnerships: Investigate aligning with growing distributors like Knauf to secure supply amidst heightened competition for available production capacities.

These actions should be prioritized to capitalize on favorable market conditions and ensure continuity in supply amid evolving dynamics in Germany’s steel landscape.