From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Rebar Market Under Pressure: Falling Prices & Regional Disparities Despite Earlier Gains

Italy’s steel market faces downward pressure, particularly in the north, amidst a pessimistic European long steel market despite earlier rebar price gains. These developments are occurring amidst concerns around military events and the Carbon Border Adjustment Mechanism (CBAM). The situation is highlighted by the news articles “Rebar prices in Northern Italy are under pressure, the domestic market is expanding downward” and “European longs market stable to lower amid pessimistic mood“. While the article “Rebar prices in Italy are rising amid reports of new deals and declining supply; traders are taking a wait-and-see attitude” initially suggested upward price movement, the subsequent news indicates a reversal, potentially driven by regional imbalances and broader European market trends. No direct correlation between these news items and satellite-observed plant activity can be definitively established based solely on the provided information.

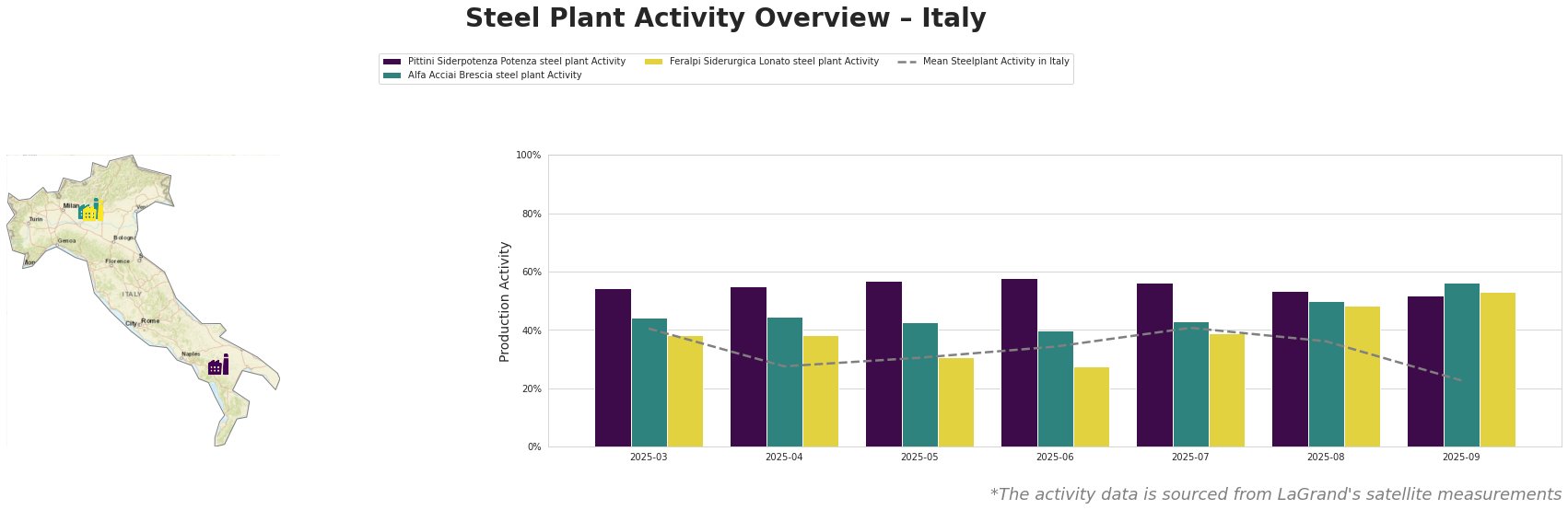

The mean steel plant activity in Italy shows a fluctuating trend, dropping significantly to 23% in September after a peak of 41% in July. Pittini Siderpotenza consistently operates above the mean, while Alfa Acciai and Feralpi Siderurgica fluctuate around the mean, with Alfa Acciai showing a notable activity increase to 56% in September and Feralpi Siderurgica reporting 53% in September. No direct connection between these plant-specific activity levels and the named news articles can be established based solely on this data.

Pittini Siderpotenza Potenza steel plant, located in the Province of Potenza, has a crude steel capacity of 700ktpa via EAF technology, focusing on rebar production for the building and infrastructure sector. Activity levels have remained relatively stable but consistently above the national average. Although activity decreased from 58% in June to 52% in September, it continues to be high compared to the average across all the observed Italian steel plants. No explicit link can be drawn between the observed activity and the provided news articles.

Alfa Acciai Brescia steel plant, with a larger crude steel capacity of 1700ktpa using two EAFs, produces billets and rebar. The plant’s activity decreased steadily until June, from 44% in March to 40%, before subsequently rising to 56% in September, well above the mean. This rise potentially offsets capacity reduction in the North. No direct connection can be established between this September increase in activity and the provided news articles.

Feralpi Siderurgica Lonato steel plant, located in the Province of Brescia, operates a 1100ktpa EAF-based steel plant producing rebar, billets, mesh, and wire rod. Its activity decreased between March and June, followed by an increase to 53% in September, mirroring the activity trend observed at Alfa Acciai and suggesting a possible shift in focus to the Brescia area. No explicit link can be drawn between the observed activity and the provided news articles.

Given the reported price decline in Northern Italy as highlighted in “Rebar prices in Northern Italy are under pressure, the domestic market is expanding downward“, coupled with the pessimistic outlook reported in “European longs market stable to lower amid pessimistic mood“, steel buyers should exercise caution. Buyers in Northern Italy should postpone large rebar purchases in anticipation of further price decreases. However, the relatively stable activity levels at Pittini Siderpotenza and the increased activity at Alfa Acciai and Feralpi, suggest that supply chain disruptions are unlikely in the immediate term, especially in Southern Italy, which benefits from “good” finished steel demand, despite the overall pessimistic mood.