From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: Thyssenkrupp’s WV Stahl Exit Signals Restructuring Amidst Fluctuating Plant Activity

Germany’s steel sector faces restructuring as evidenced by “Thyssenkrupp Steel leaves German steel association WV Stahl” and related articles, highlighting financial strain and strategic shifts. These news developments coincide with recent fluctuations in satellite-observed steel plant activity, although no direct causal relationship can be explicitly established between the activity levels and Thyssenkrupp’s decision to leave the association.

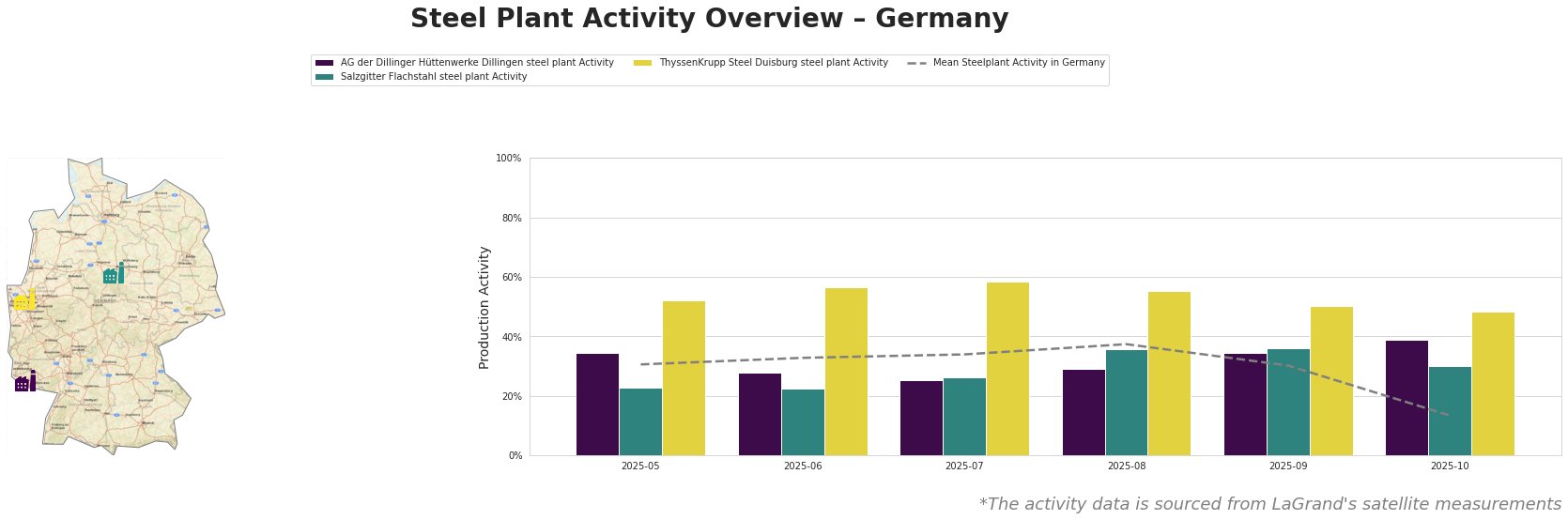

Recent monthly activity trends across selected German steel plants are detailed below:

The mean activity level across the observed German steel plants shows a significant drop to 13% in October 2025, after a peak of 37% in August 2025.

AG der Dillinger Hüttenwerke Dillingen steel plant: Located in Saarland, this integrated steel plant with a crude steel capacity of 2.76 million tonnes primarily utilizes BOF technology. The plant’s activity level has fluctuated, peaking at 39% in October after a low of 25% in July. Given the lack of direct connections to the named news articles, these fluctuations might be driven by factors not addressed in the provided information.

Salzgitter Flachstahl steel plant: Situated in Lower Saxony, this integrated BF-BOF steel plant has a crude steel capacity of 5.2 million tonnes. The plant demonstrates an activity profile mostly in line with the mean activity. Activity has decreased from 36% in September to 30% in October 2025, which does not have a clearly identified cause linked to the news articles. Salzgitter is transitioning to hydrogen-based steel by 2050, as part of its Salcos Green Steel project.

ThyssenKrupp Steel Duisburg steel plant: This plant in North Rhine-Westphalia is the largest of the three, with a crude steel capacity of 13 million tonnes and relies on integrated BF-BOF production. Its activity has shown a decreasing trend since its peak in July (59%) and is at 48% in October, however, these fluctuations have no explicitly established connection to the news surrounding the company’s WV Stahl exit. The articles “Thyssenkrupp Steel withdraws from WV Stahl” note the company faces economic challenges, including weak demand, and is in negotiations with Jindal Steel International for green steel investments, but the precise influence of these factors cannot be inferred from the plant activity data alone.

Evaluated Market Implications

The withdrawal of Thyssenkrupp Steel, the largest steel producer in Germany, from WV Stahl, as reported in “Thyssenkrupp Steel leaves German steel association WV Stahl” and related articles, suggests a potential shift in the German steel landscape. While plant activity data shows recent fluctuations, a direct correlation with the news developments or individual plant circumstances cannot be established conclusively.

Recommended Procurement Actions:

- Monitor Thyssenkrupp’s Restructuring: Steel buyers should closely monitor the progress of Thyssenkrupp Steel’s negotiations with Jindal Steel International, mentioned in “Thyssenkrupp Steel withdraws from WV Stahl”, as this may impact the availability and pricing of specific product lines (hot strip, sheet, heavy plate).

- Diversify Supplier Base: Consider diversifying the supplier base, particularly for products sourced from Thyssenkrupp Steel Duisburg, to mitigate potential supply chain risks associated with the company’s restructuring efforts.

- Focus on Green Steel Investments: Given Thyssenkrupp’s plans to invest in green steel production with Jindal, steel buyers interested in sustainable sourcing should engage with Thyssenkrupp to explore long-term supply agreements for environmentally friendly steel products.

- Assess Industry-Wide Impacts: Given the struggles of WV Stahl, steel buyers need to monitor how the association will operate going forward, and what the impact on policy changes will be.