From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Shows Resilience Despite Economic Headwinds: Production Adapts to Climate Goals

Germany’s steel market exhibits resilience amidst economic challenges, with activity levels showing a general upward trend. This positive development occurs alongside discussions regarding Germany’s economic strategy and climate goals, as highlighted in the news articles “Friedrich Merz: „Mit 4-Tage-Woche und Work-Life-Balance können wir den Wohlstand nicht erhalten“,” “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft“, and “Deutschland ist laut Expertenrat vorerst auf Klimakurs“. While these articles discuss broader economic issues and climate targets, no direct causal relationship can be established between these broad issues and specific steel plant activity changes in the observed period.

The steel sector is navigating a complex landscape of economic pressures and environmental objectives. Though no direct link to steel plant activity is evident, the sentiment expressed in “Bundeskanzler Merz: „Mit Vier-Tage-Woche und Work-Life-Balance können wir den Wohlstand nicht erhalten“” suggests a potential future shift towards prioritizing productivity, which could eventually impact steel production strategies.

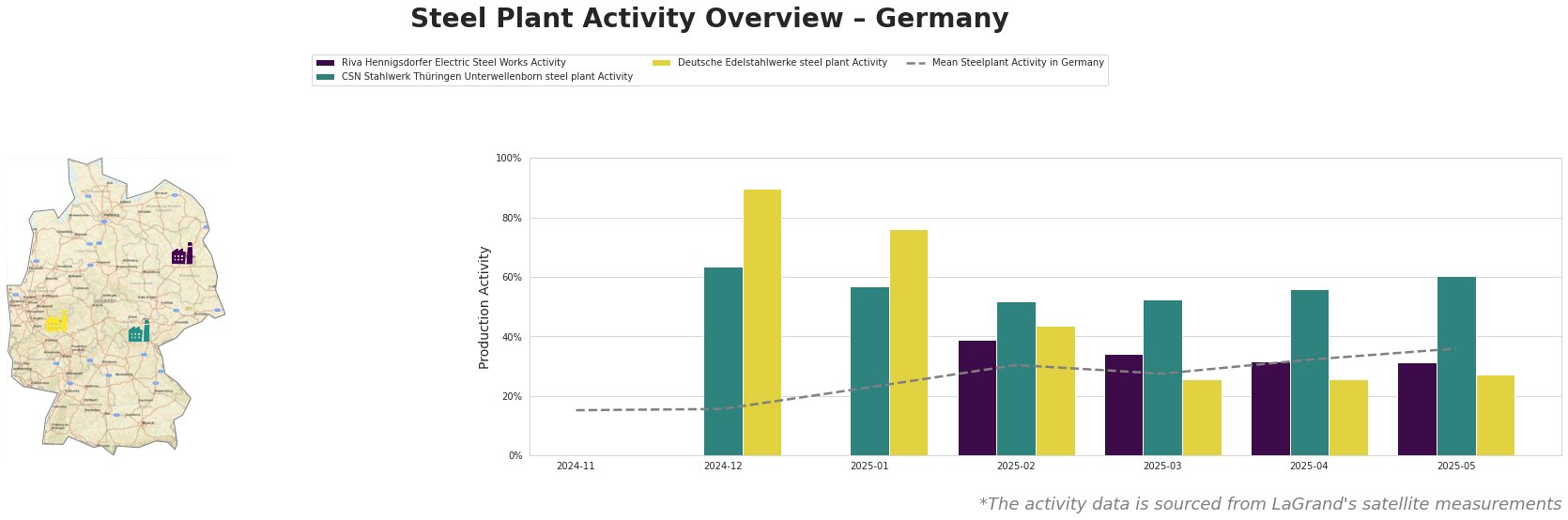

Overall, average steel plant activity in Germany has steadily increased from 15% in November 2024 to 36% in May 2025, indicating a positive trend. CSN Stahlwerk Thüringen consistently operated above the mean activity level, while Deutsche Edelstahlwerke showed high activity initially, with a significant drop in March and April, followed by a slight recovery in May. Riva Hennigsdorfer consistently operated below the mean activity level.

Riva Hennigsdorfer Electric Steel Works: This Brandenburg-based plant, with a crude steel capacity of 1000 thousand tonnes per annum (ttpa) produced via EAF technology, focuses on semi-finished and finished rolled products, including rebar and bright steel, primarily serving the automotive sector. The satellite data shows a fluctuating activity level. Starting from 39% in February 2025, it decreased to 31% in May 2025, consistently operating below the national average. There is no direct connection that can be established between its activity and the named news articles.

CSN Stahlwerk Thüringen Unterwellenborn steel plant: Located in Thuringia, this plant also utilizes EAF technology with a crude steel capacity of 1100 ttpa. Its main products are sections and billets, primarily for the building and infrastructure sectors. The plant consistently showed activity levels significantly above the national average, peaking at 63% in December 2024 and settling at 60% in May 2025. No direct link to the provided news articles can be explicitly established.

Deutsche Edelstahlwerke steel plant: Situated in North Rhine-Westphalia, this plant produces 600 ttpa of crude steel using EAF technology. Its product range includes billets, square, and forged products, serving diverse sectors like automotive, building, energy, and transport. Activity dropped considerably from 90% in December 2024 to 27% in May 2025. This decline is particularly notable, although no specific connection with the provided news articles can be definitively established.

Given the observed fluctuations in plant activity, especially the significant drop at Deutsche Edelstahlwerke, and the general upward trend in mean activity, steel buyers should:

- Closely monitor Deutsche Edelstahlwerke’s production and inventory levels. While no direct link is established, the activity drop warrants monitoring to avoid potential disruptions in supply, particularly for buyers in the automotive, energy, and transport sectors that rely on their specialized steel products.

- Consider diversifying suppliers for billets and forged products. The activity trend suggests shifting procurement strategies might be prudent to mitigate risks associated with relying on a single supplier facing potential production slowdowns.

- Maintain open communication with steel suppliers to understand their production outlook and any potential impact from economic or policy changes discussed in the news articles.