From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market Falters: Production Decline Signals Procurement Challenges

Germany’s steel sector faces headwinds as demand lags and production declines persist. The situation is highlighted by the article “Germany lags behind in steel demand among industrialized countries,” which notes the weak demand and the need for protective measures. While “Germany increased steel production by 15.4% m/m in September” showed a momentary increase, this proved to be a false dawn as the larger trend “German crude steel output down 10.7 percent in Jan-Sept 2025” indicates a significant overall contraction. A direct relationship between these trends and steel plant activity will be explored.

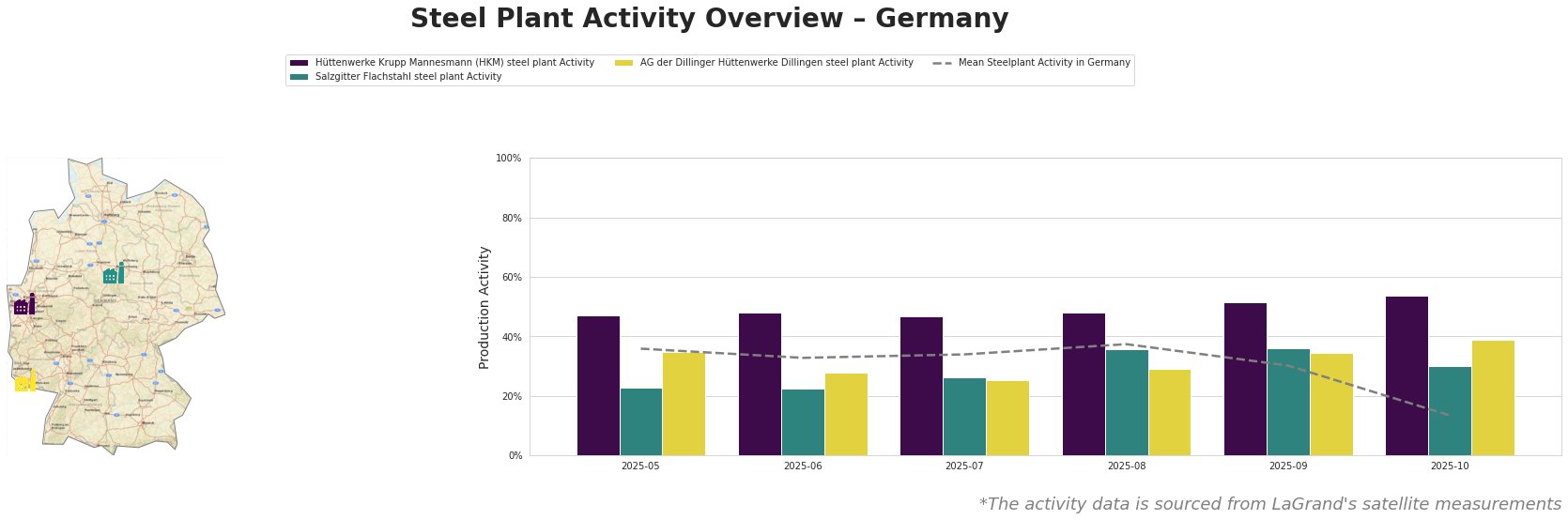

The mean steel plant activity in Germany reveals a considerable drop in October to 13%, after fluctuating between 33% and 37% for the preceding months. Individual plant activities show varying trends. Hüttenwerke Krupp Mannesmann (HKM) exhibits a consistently higher activity level compared to the mean, peaking at 54% in October. Salzgitter Flachstahl experienced a significant increase from 22% in June to 36% in August and September, before falling back to 30% in October. AG der Dillinger Hüttenwerke showed relatively stable activity until a rise to 39% in October. The October decline in the national mean correlates with the production decline highlighted in “German crude steel output down 10.7 percent in Jan-Sept 2025,” which points to the industry’s struggle to maintain output levels.

Hüttenwerke Krupp Mannesmann (HKM) steel plant in North Rhine-Westphalia, an integrated BF-BOF producer with a crude steel capacity of 6 million tons per annum, consistently operated well above the German average. Activity climbed from 47% in May to 54% in October, indicating continued operation despite the overall market downturn described in “German crude steel output down 10.7 percent in Jan-Sept 2025“. No direct connection to the news articles can be established

Salzgitter Flachstahl steel plant, located in Lower Saxony, is also an integrated BF-BOF producer with a crude steel capacity of 5.2 million tons annually. The plant’s activity increased significantly from 22% in June to 36% in August and September, before dropping to 30% in October. Salzgitter is actively transitioning its BF plants to DRI as part of the Salcos Green Steel project, which could be influencing short-term production fluctuations. The September production increase reported in “Germany increased steel production by 15.4% m/m in September” may have been fueled by increased activity at this plant.

AG der Dillinger Hüttenwerke Dillingen steel plant in Saarland, another integrated BF-BOF producer, with a capacity of 2.76 million tons of crude steel per year, experienced relatively stable activity between May and September, rising from 35% to 34%, followed by a rise to 39% in October. This increase in activity may be due to their ongoing investment in their BOF shop. No direct connection to the news articles can be established.

The German steel market faces persistent challenges as highlighted by the negative sentiment in “Germany lags behind in steel demand among industrialized countries” and “German crude steel output down 10.7 percent in Jan-Sept 2025“. The significant drop in mean steel plant activity in October warrants caution. Steel buyers should anticipate potential price volatility and extended lead times, particularly for products sourced from plants showing reduced activity. Diversifying suppliers and closely monitoring inventory levels are advisable strategies. Given the overall decline in German steel production, procurement analysts should closely monitor import trends and potential supply chain disruptions, especially if domestic demand increases unexpectedly.