From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: Chinese Imports & Auto Downturn Impact Plant Activity

Germany’s steel market faces pressure from increased Chinese imports and automotive sector challenges. The article “Chinesische Anbieter drängen mit Billigware auf deutschen Markt” highlights a surge in Chinese goods entering the German market, potentially impacting domestic steel demand. The article “Autobranche: Zahl der Beschäftigten erreicht Tiefstand seit Mitte 2011” indicates struggles within the automotive industry, a key steel consumer, which could further influence market dynamics. There is no clear relationship established between the third article and the observed plant activity.

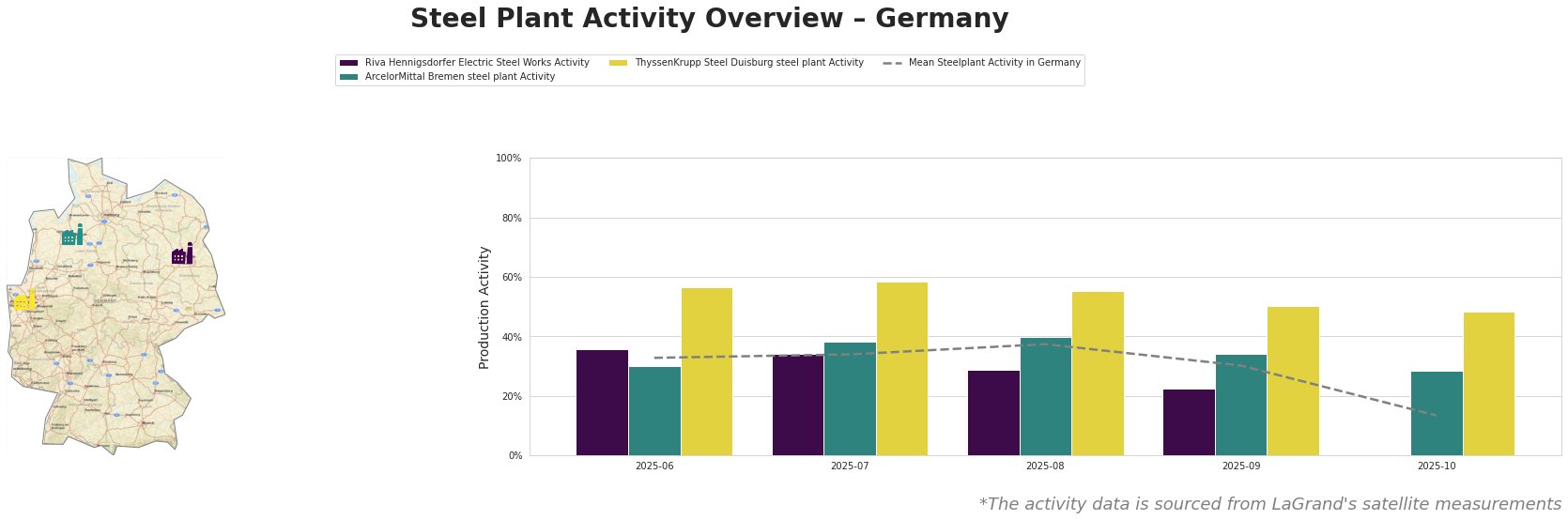

Here’s a table of recent steel plant activity:

Overall, the mean steel plant activity in Germany shows a declining trend from 37.0 in August to 13.0 in October. Riva Hennigsdorfer Electric Steel Works experienced a significant drop, from 36.0 in June to 22.0 in September, with no data available for October. ArcelorMittal Bremen showed fluctuations, peaking at 40.0 in August and then dropping to 29.0 in October. ThyssenKrupp Steel Duisburg consistently showed higher activity levels than the other plants, but also experienced a decrease from 59.0 in July to 48.0 in October.

Riva Hennigsdorfer Electric Steel Works, located in Brandenburg, operates with EAF technology and a capacity of 1,000kt crude steel production. Its focus is on semi-finished and finished rolled products, including rebar and bright steel, with the automotive sector as an end-user. The plant’s activity drop from 36.0% in June to 22.0% in September might reflect decreased demand from the automotive sector, as highlighted in “Autobranche: Zahl der Beschäftigten erreicht Tiefstand seit Mitte 2011“, or increased competition from Chinese imports.

ArcelorMittal Bremen steel plant, an integrated BF-BOF plant with a 3,800kt crude steel capacity, produces finished rolled products such as hot and cold rolled coils, serving the automotive, building, and energy sectors. The plant’s activity peaked in August (40.0%) before declining to 29.0% in October. This decrease could be linked to the automotive industry downturn mentioned in “Autobranche: Zahl der Beschäftigten erreicht Tiefstand seit Mitte 2011“.

ThyssenKrupp Steel Duisburg, a major integrated steel plant with a 13,000kt crude steel capacity, produces a wide range of products, including hot strip, sheet, and coated products, catering to various sectors, including automotive and construction. While consistently showing the highest activity levels, the plant’s decline from 59.0% in July to 48.0% in October suggests a broader market slowdown. While the influx of cheap steel from China as mentioned in “Chinesische Anbieter drängen mit Billigware auf deutschen Markt” could play a role here, no direct connection can be established from the provided information.

The observed activity decline at Riva Hennigsdorfer Electric Steel Works and ArcelorMittal Bremen, coupled with news of automotive sector challenges, indicates potential supply disruptions in rebar, bright steel, and hot/cold rolled coils. Steel buyers should consider diversifying suppliers and negotiating contracts that allow for flexibility in volume. Market analysts should closely monitor import data from China and developments in the German automotive industry to anticipate further market shifts. Given the reported influx of cheaper Chinese steel, buyers should thoroughly evaluate the quality certifications and standards compliance of alternative suppliers.