From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: ArcelorMittal Surge Offsets Overall Dip Amidst Climate Policy Concerns

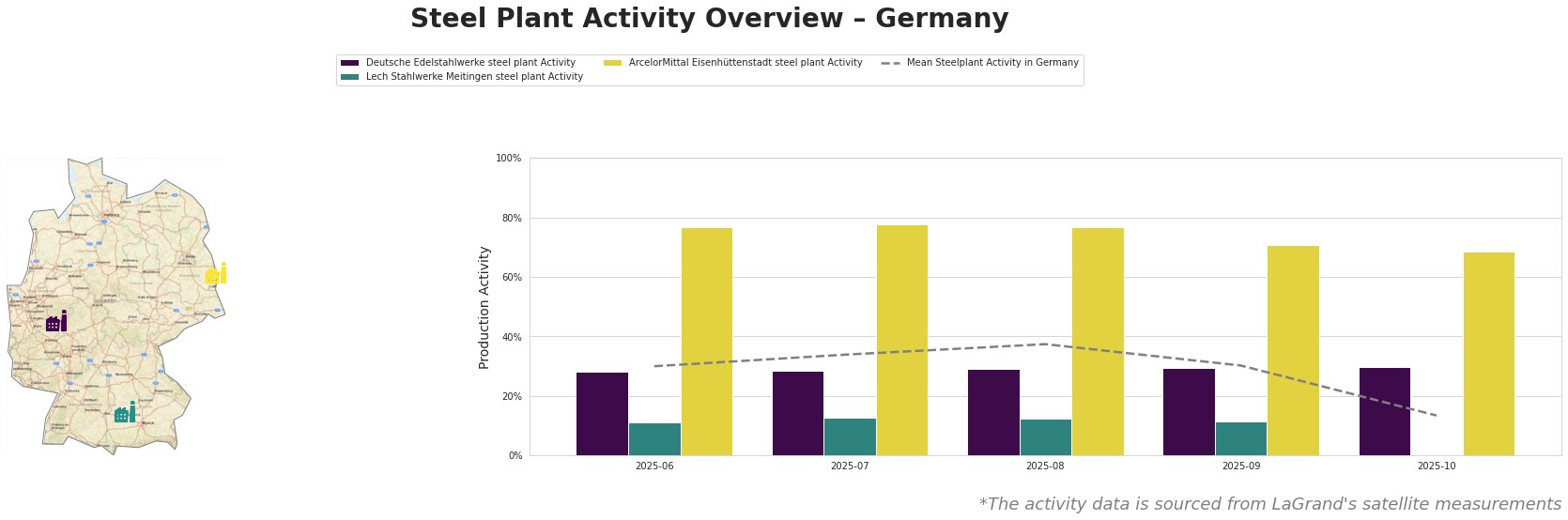

Germany’s steel market presents a mixed picture, with a significant activity surge at ArcelorMittal Eisenhüttenstadt contrasting with an overall decline. While the political debate regarding climate policy implications for the steel industry rages on.

Observed changes in plant activity levels can be partially linked to broader concerns raised in “Hamburgs Klimasenatorin: „Da kann man mit bestimmten Entscheidungen schnell eine ganze Region in Schockstarre versetzen“” and “Stehen Umwelt- und Klimaschutz im Abseits,”. These articles highlight the potential disruption from climate-related decisions and a shifting societal focus away from environmental protection. However, no explicit connection can be established between the described activity data and the arguments made in the article “Handelsverträge brauchen Anreize zum Klimaschutz“.

The mean steel plant activity in Germany shows a significant drop in October to 13%, from a high of 37% in August. Deutsche Edelstahlwerke maintained a stable activity level around 30%. Lech Stahlwerke Meitingen’s activity remained consistently low, fluctuating between 11% and 13%. ArcelorMittal Eisenhüttenstadt demonstrated the highest activity levels, consistently above the mean, and experienced only a slight decrease from 77-78% to 68% in the reported period.

Deutsche Edelstahlwerke, located in North Rhine-Westphalia, operates two EAFs with a total crude steel capacity of 600 ttpa, focusing on semi-finished and finished rolled products for the automotive, building, and energy sectors. The plant maintained a stable activity level around 30% from June to October. While the steadiness is notable, no direct link can be established to the news articles provided.

Lech Stahlwerke Meitingen, based in Bavaria, utilizes two EAFs to produce 1400 ttpa of crude steel, specializing in pipes, tubes, and billets for similar end-user sectors as Deutsche Edelstahlwerke. Activity at Lech Stahlwerke Meitingen remained consistently low, fluctuating between 11% and 13%. This could reflect local economic headwinds, but no direct connection to the provided news articles can be explicitly drawn.

ArcelorMittal Eisenhüttenstadt, situated in Brandenburg, is an integrated steel plant with a BF/BOF process and a crude steel capacity of 2400 ttpa. Its products include slabs, plates, and coated steel for the automotive and construction industries. The plant showed consistently high activity, dropping slightly to 68% in October. Despite the positive performance, no specific connection to any of the provided news articles can be explicitly established.

The significant drop in overall mean steel plant activity, coupled with concerns about climate policy impacts as highlighted in “Hamburgs Klimasenatorin: „Da kann man mit bestimmten Entscheidungen schnell eine ganze Region in Schockstarre versetzen“” and “Stehen Umwelt- und Klimaschutz im Abseits,” suggests potential near-term supply chain risks.

Procurement Action: Steel buyers should prioritize securing supply from ArcelorMittal Eisenhüttenstadt, given its consistently high production levels. Furthermore, due to the volatility, steel buyers should closely monitor climate policy developments in Germany and diversify their sourcing to mitigate potential risks stemming from policy changes and regional economic disparities. The long-term stability of supply is uncertain, warranting proactive risk management.