From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Production Mixed: German Output Dips, Italian Demand Wavers Amidst Global Uncertainty

European steel market dynamics present a mixed picture, with Germany facing production declines while Italy shows some resilience amidst global tensions. Assofermet’s report, “Assofermet on the Italian steel market: Lack of momentum in April amid global tensions and slowing industrial growth in the EU,” highlights weak demand for carbon steel in Italy. This coincides with production cuts by European factories due to increasing competition from Asian manufacturers. German output declines as reported in “Germany reduced steel production by 10.1% y/y in April” and “German crude steel output down 11.9 percent in Jan-Apr” do not show an immediate direct relationship with specific satellite-observed changes in plant activity levels.

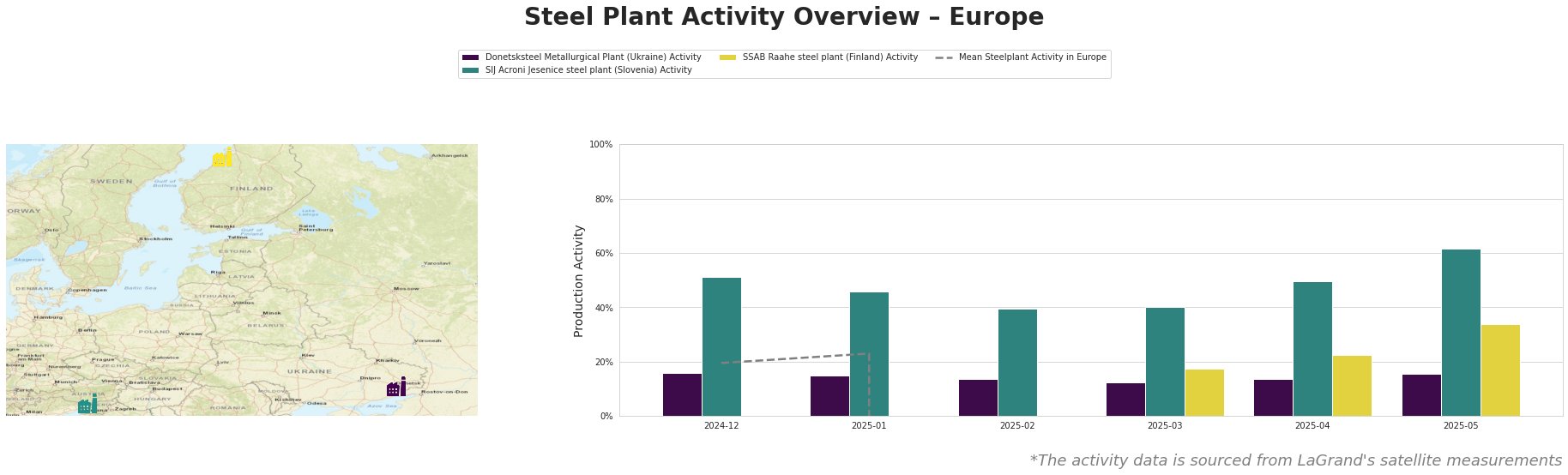

Here’s a summary of activity levels based on satellite data (activity is indexed, 0% = lowest ever measured, 100% = all time high). Negative values are data artefacts of the automated processing pipeline, and therefore are invalid and should be interpreted as data unavailable.

The mean European steel plant activity level is not reliably measurable from the provided data. Donetsksteel shows relatively stable activity. SIJ Acroni Jesenice steel plant shows an increasing trend over the observed period, with its activity rising from 39% in February 2025 to 62% in May 2025, surpassing its activity level in December 2024. SSAB Raahe shows a similar trend, with a notable increase between March and May 2025, but starting at a lower absolute level. No direct connection between the satellite-observed activity changes at SIJ Acroni and SSAB Raahe and the provided news articles could be established.

Donetsksteel Metallurgical Plant

Donetsksteel Metallurgical Plant, an integrated (BF) steel plant primarily producing pig iron, saw a slight fluctuation in activity between December 2024 and May 2025, ranging from 12% to 16%. While the plant utilizes both BF and EAF technology, the BOF is not operating. The relative stability of Donetsksteel’s activity does not show an immediate direct relationship with the information from the news articles.

SIJ Acroni Jesenice steel plant

SIJ Acroni Jesenice, an electric arc furnace (EAF) based steel plant producing flat rolled steel products, plates, and hot and cold rolled products, has shown an increasing activity trend, reaching 62% in May 2025. This suggests potential increased production capacity. No direct relationship to the provided news articles can be confirmed, but it could indicate resilience in its niche markets (building and infrastructure, tools, and machinery).

SSAB Raahe steel plant

SSAB Raahe, an integrated (BF) steel plant in Finland, producing hot rolled and coiled products, experienced a significant rise in observed activity between March and May 2025. Although SSAB Raahe is planning to transition from BOF-BF production to EAF production by 2030, this recent increase in activity does not show an immediate direct relationship with any specific news articles and this transition is not expected to happen in the short term.

Evaluated Market Implications

The news articles “Germany reduced steel production by 10.1% y/y in April,” “Italy reduced steel production by 10.8% m/m in April” and “German crude steel output down 11.9 percent in Jan-Apr” suggest potential supply constraints in Germany.

- Procurement Action for Steel Buyers: Given the reported decline in German steel sales by 5% in April, driven by reduced demand from the automotive sector as stated in “Steel sales in Germany decreased by 5% in April, inventories decreased“, steel buyers should diversify their sources to mitigate potential supply disruptions. Actively explore alternative suppliers, particularly for flat rolled steel products, and consider forward purchasing to secure volumes amidst potential price volatility as Assofermet reported in “Assofermet on the Italian steel market: Lack of momentum in April amid global tensions and slowing industrial growth in the EU“. Buyers should closely monitor inventory levels and proactively manage their supply chains to avoid potential shortages.