From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Surges on Green Initiatives & Modernization: Positive Outlook

Europe’s steel market exhibits a very positive sentiment, driven by advancements in green steel production and plant modernizations, despite recent dips in activity at key plants. The establishment of green hydrogen infrastructure, as indicated by “Andritz opens a gigafactory for electrolyzers in Germany” and “Andritz’ new electrolyzer plant to support Salzgitter’s low-carbon steelmaking,” is set to support low-carbon steel production at facilities like Salzgitter. Further, Thyssenkrupp’s modernization efforts, detailed in “Thyssenkrupp launches new continuous casting line,” highlight the industry’s commitment to increasing efficiency and high-quality steel output.

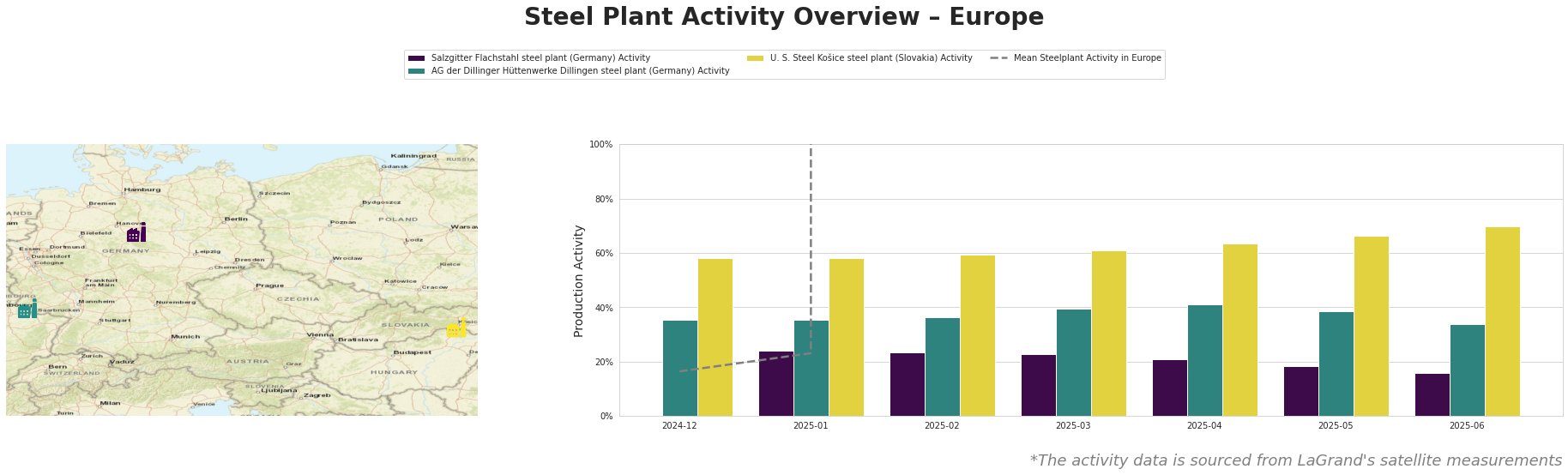

The mean steel plant activity in Europe has been extremely volatile in the recent months, and registered a high in May 2025, followed by a decline in June 2025. AG der Dillinger Hüttenwerke Dillingen showed a generally upward trend from December 2024 to April 2025, and then declined again. U. S. Steel Košice steel plant showed a steady upward trend in its activity levels over the observed period. Salzgitter Flachstahl steel plant, on the other hand, had a drop in activity in each of the recent months.

Salzgitter Flachstahl, an integrated BF steel plant with a crude steel capacity of 5.2 million tonnes, is transitioning to hydrogen-based steel production by 2050. Activity at the Salzgitter Flachstahl steel plant has decreased in recent months, from 24% in January 2025 to 16% in June 2025. This decrease may be due to ongoing preparations for integrating green hydrogen into its production processes, aligning with the “Andritz’ new electrolyzer plant to support Salzgitter’s low-carbon steelmaking” article, as the facility prepares to utilize hydrogen from Andritz’s new electrolyzer plant.

AG der Dillinger Hüttenwerke Dillingen, also an integrated BF steel plant with a crude steel capacity of 2.76 million tonnes, produces a wide range of heavy-plate products. The Dillinger steel plant increased its activity from 35% in December 2024 to a peak of 41% in April 2025, followed by a decrease to 34% in June 2025. No direct connection can be established between this activity and the provided news articles.

U. S. Steel Košice, an integrated BF steel plant with a crude steel capacity of 4.5 million tonnes, produces both semi-finished and finished rolled products. The U. S. Steel Košice steel plant demonstrated a continuous rise in activity, from 58% in January 2025 to 70% in June 2025, consistently exceeding the mean European activity. No direct connection can be established between this upward activity trend and the provided news articles.

The Voestalpine plant in Linz, Austria, isn’t directly observed via satellite data. However, the “Voestalpine company has launched a new pickling line in Andrice” news article indicates a focus on high-strength steel production, particularly for automotive and electric vehicle applications, complementing Thyssenkrupp’s modernization efforts at its Duisburg plant highlighted in “Thyssenkrupp launches new continuous casting line,” which aims to produce high-quality steel for similar sectors.

Given the decrease in activity at Salzgitter Flachstahl steel plant, and the known future integration of the company towards green steel production, steel buyers should carefully monitor Salzgitter’s production schedules and proactively diversify their supply sources to mitigate potential disruptions. Prioritize suppliers that can offer certified low-carbon steel options to align with evolving sustainability demands, particularly if sourcing for automotive or energy sector applications, where high-strength and specialized steels are crucial. Closely monitor the progress of Thyssenkrupp’s new continuous casting line in Duisburg, and use the increased capacity and production of high-quality steel as an opportunity to negotiate supply contracts, especially if requiring steel for electric mobility, lightweight construction, or the energy sector.