From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Production Mixed: Germany & Spain Rise, DRI Imports Fall Amidst Global Uncertainty

Europe’s steel market presents a mixed picture. According to the news article “Germany increased steel production by 15.4% m/m in September“, German steel production saw a significant monthly increase, contrasting with a year-over-year decline. The article “Spain increased steel production by 11% m/m in September” shows similar monthly growth in Spain. However, the article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August” indicates a substantial decrease in DRI imports. While there are reports like “Poland reduced steel production by 11.3% y/y in September“, the country managed to keep production from January to September increased by 5.2% year-on-year. The recent monthly increase in steel production in Germany and Spain cannot be directly linked to the EU’s decreased DRI imports based solely on the provided information.

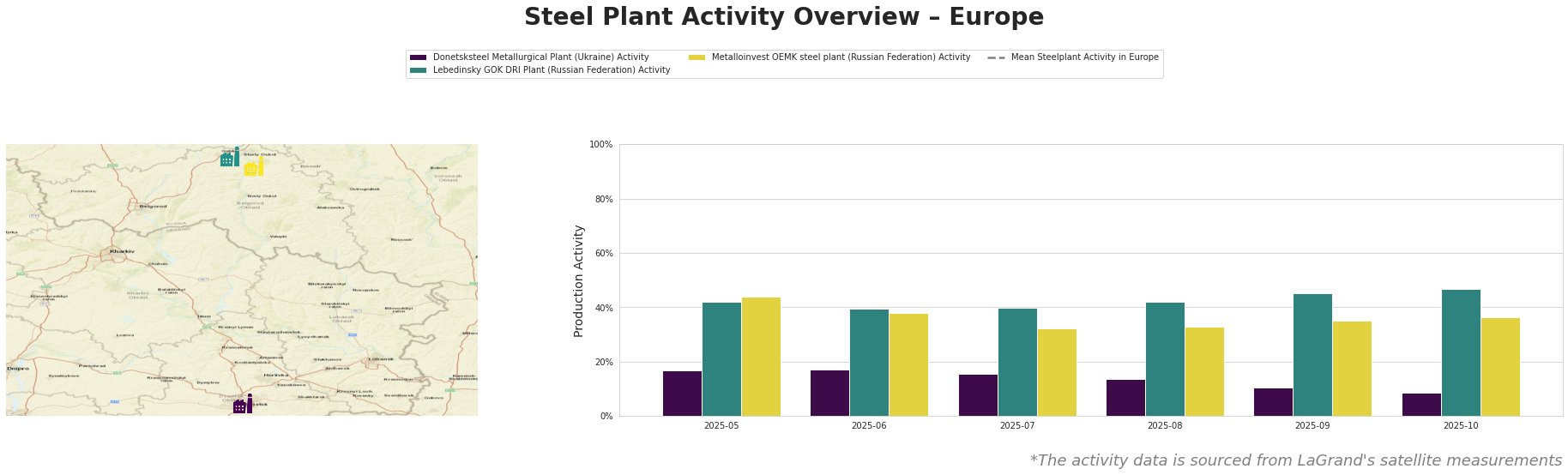

Observed plant activity in Europe, represented as percentage of highest activity level measured:

The mean steel plant activity in Europe shows significant fluctuations throughout the period. The highest mean activity was observed in July and August 2025, with a substantial drop in September and October.

The Donetsksteel Metallurgical Plant in Ukraine, an integrated plant relying on blast furnace technology, shows a consistent decline in activity from May (17%) to October (9%). This decline cannot be directly linked to any of the provided news articles, but potentially may reflect geopolitical uncertainties or regional economic factors.

The Lebedinsky GOK DRI Plant in Russia, a major producer of HBI (DRI) using Midrex technology, exhibits a relatively stable activity level, fluctuating between 39% and 47%. Activity increased from 42% in August to 47% in October. While the article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August” mentions decreased EU DRI imports and Russia remains the largest supplier, no direct connection can be established between this article and the plant’s increased observed activity, or how this may or may not affect EU DRI imports after August.

The Metalloinvest OEMK steel plant in Russia, which uses DRI and EAF technology to produce crude, semi-finished, and finished rolled steel, including DRI, billets, and pipes, demonstrates a slight overall decline in activity from 44% in May to 36% in October. As with Lebedinsky GOK DRI Plant, while the article “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August” is relevant, there is no concrete evidence linking the overall decreased European DRI imports to any fluctuations in activity at this specific plant beyond August.

Given the mixed signals in the European steel market, with increased production in Germany and Spain, declining DRI imports, and fluctuating plant activity levels, caution is advised. The article “German crude steel output down 10.7 percent in Jan-Sept 2025” shows the longer term perspective on German crude steel production which should be noted. With regards to DRI, steel buyers should closely monitor DRI supply chains in light of “The EU reduced imports of direct reduced iron by 24.8% y/y in January-August“. Specifically, given the rise of Venezuelan DRI exports to the EU, procurement teams should assess the potential of diversifying their DRI sourcing strategies to include Venezuelan suppliers, while conducting thorough due diligence to ensure compliance with relevant regulations and sustainability standards. Evaluate the impact on supply costs when increasing supply from sources in the US as well.