From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Rising SIJ Acroni Activity Offsets Concerns Over Decarbonization and Policy Inaction

Europe’s steel market presents a mixed outlook. Concerns regarding EU decarbonization policies and industrial strategy, as highlighted in “EU decarbonisation causing steel output decrease: Marcegaglia” and “Europe needs a breakthrough in industrial policy – Federacciai,” are juxtaposed against observed increases in activity at specific steel plants. While the news articles do not directly address specific activity level changes, they frame the broader economic and political context influencing steel production.

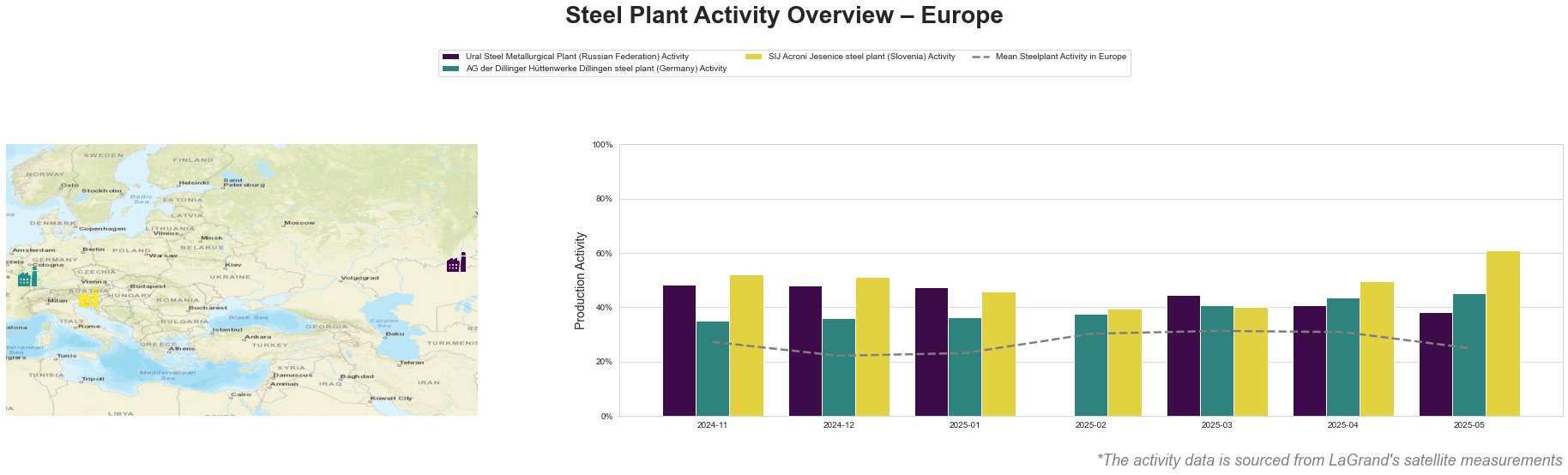

Steel Plant Activity Overview

Overall European mean activity decreased to 25% in May 2025, from a high of 31% in March and April 2025.

The Ural Steel Metallurgical Plant shows a steady decline from November 2024 to May 2025, dropping from 48% to 38%. AG der Dillinger Hüttenwerke shows an increase in activity throughout the period, from 35% in November 2024 to 45% in May 2025. SIJ Acroni Jesenice shows a significant increase to 61% in May 2025, well above the European mean, marking its highest activity level in the observed period.

Steel Plant Name: Ural Steel Metallurgical Plant

Ural Steel Metallurgical Plant, located in the Orenburg region of Russia, is an integrated steel plant with a crude steel capacity of 1.6 million tonnes produced via EAFs and an iron capacity of 2.7 million tonnes via BF. While the plant holds ResponsibleSteel Certification, its activity has consistently declined since November 2024, reaching 38% in May 2025. No direct link can be established between this decline and the European steel market concerns voiced in “EU decarbonisation causing steel output decrease: Marcegaglia” or “Europe needs a breakthrough in industrial policy – Federacciai” as the plant resides outside of the EU.

Steel Plant Name: AG der Dillinger Hüttenwerke Dillingen steel plant

AG der Dillinger Hüttenwerke Dillingen steel plant, situated in Saarland, Germany, operates as an integrated BF-BOF plant with a crude steel capacity of 2.76 million tonnes. The plant’s activity has steadily increased from 35% in November 2024 to 45% in May 2025, exceeding the European mean. Despite the concerns raised by Marcegaglia regarding the potential negative impacts of EU decarbonization policies on steel production within Europe in “EU decarbonisation causing steel output decrease: Marcegaglia,” Dillinger’s activity indicates a degree of resilience or an effective adaptation to the current regulatory environment.

Steel Plant Name: SIJ Acroni Jesenice steel plant

SIJ Acroni Jesenice, an EAF-based steel plant in Slovenia with a crude steel capacity of 726,000 tonnes, shows a notable increase in activity, reaching 61% in May 2025. This surge significantly surpasses both the European mean and its own previous activity levels, suggesting a potential increase in demand for its flat-rolled steel products used in building and infrastructure. While the news articles address general steel market conditions, there is no direct connection to explain the specific increase in activity at this plant.

Evaluated Market Implications

The increasing activity at AG der Dillinger Hüttenwerke Dillingen steel plant and, more notably, SIJ Acroni Jesenice steel plant, suggests that targeted segments of the European steel market remain robust, despite general concerns about decarbonization policies.

Recommended Procurement Actions:

- Steel Buyers: Given the increased activity at SIJ Acroni Jesenice and their focus on flat-rolled products, buyers sourcing these products should consider securing supply contracts to mitigate potential price increases due to higher demand. Closely monitor SIJ Acroni’s activity levels for indications of sustained high production.

- Market Analysts: Monitor the discrepancy between overall European mean activity and the high activity levels at Dillinger and Acroni. Identify specific factors driving the increased demand for the product segments produced by these plants, especially flat rolled steel. Focus on the impact of European industrial policy for EAF based flat rolled steel producers.

The potential for supply disruptions due to policy uncertainties, as highlighted in “EU decarbonisation causing steel output decrease: Marcegaglia” and “Europe needs a breakthrough in industrial policy – Federacciai,” necessitates a diversified sourcing strategy, focusing on suppliers demonstrating both resilience and adaptability within the evolving regulatory landscape.