From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Construction Slowdown Impacts German Output; Mixed Plant Activity Signals Uncertainty

In Europe, the steel market faces headwinds as the construction sector experiences a slowdown, particularly impacting German manufacturing. The “Euro area construction output down 0.8 percent in June 2025 from May” and “Construction in the European Union fell by 0.5% m/m in June” articles highlight the sector’s struggles. The “Improving German economic sentiment misses out manufacturing, construction” and “The improvement in economic sentiment in Germany is not reflected in manufacturing and construction” articles directly link this construction weakness to a difficult period for the steel industry. No direct relationship between these articles and specific satellite-observed changes in plant activity levels can be established.

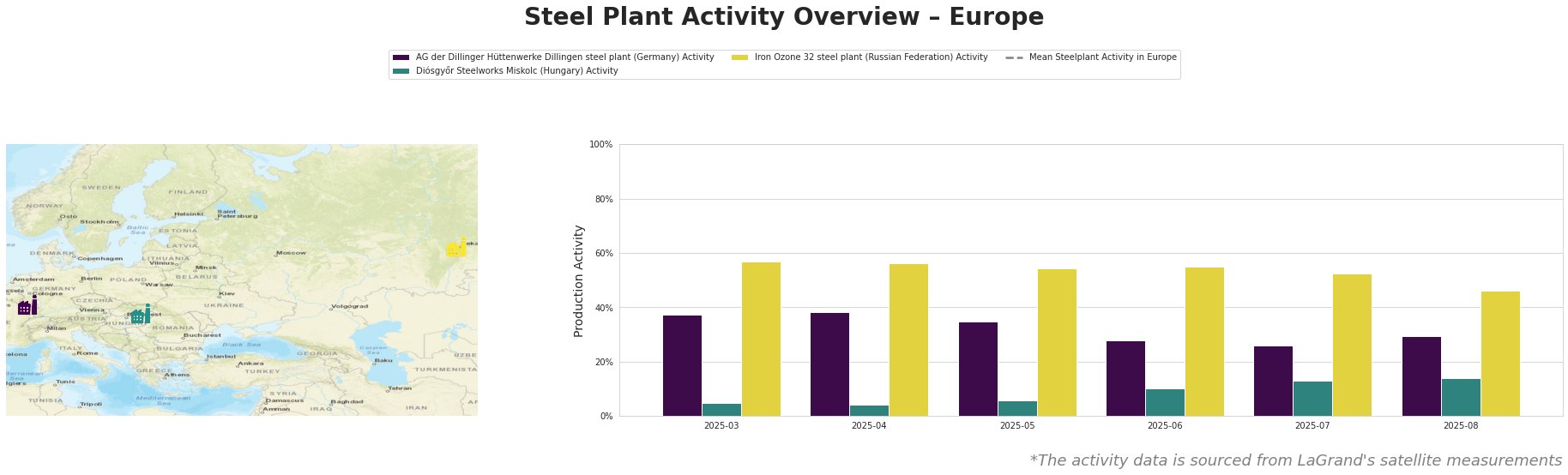

The mean steel plant activity level is negative across all periods. The AG der Dillinger Hüttenwerke plant in Germany shows a decline in activity from March to July, bottoming out at 26.0 in July, before recovering to 30.0 in August. Diósgyőr Steelworks in Hungary steadily increased activity from 5.0 in March to 14.0 in August. The Iron Ozone 32 plant in Russia shows a decreasing trend, starting at 57.0 in March and falling to 46.0 in August.

AG der Dillinger Hüttenwerke Dillingen steel plant, an integrated BF-BOF plant with a crude steel capacity of 2.76 million tonnes, experienced a notable activity drop from 38.0 in April to 26.0 in July before partially recovering to 30.0 in August. This decline may be related to the slowdown in the German construction and manufacturing sectors noted in “Improving German economic sentiment misses out manufacturing, construction” and “The improvement in economic sentiment in Germany is not reflected in manufacturing and construction”, given the plant’s product mix caters to the building and infrastructure end-user sector.

Diósgyőr Steelworks Miskolc, an EAF-based plant with a capacity of 550,000 tonnes, showed a consistent increase in activity from 5.0 in March to 14.0 in August. Despite this increase, the overall activity level remains low. This plant focuses on construction steels, so the increase might be influenced by specific regional projects that offset the general downward trend highlighted in “Euro area construction output down 0.8 percent in June 2025 from May” and “Construction in the European Union fell by 0.5% m/m in June”.

Iron Ozone 32 steel plant, an EAF-based plant with a capacity of 1.25 million tons, had a drop from 57.0 in March to 46.0 in August. The plant produces billet for the energy sector; this activity decrease is not directly linkable to provided news articles related to the European construction sector.

Given the construction sector downturn and the activity decrease at AG der Dillinger Hüttenwerke, steel buyers should carefully monitor lead times for heavy plate products, especially non-alloy structural steels. Consider diversifying suppliers to mitigate potential supply disruptions from integrated steel producers reliant on the construction sector. Conversely, the increased activity at Diósgyőr Steelworks suggests a potential opportunity for sourcing construction-grade steels; however, given its smaller capacity, buyers should confirm volume availability beforehand. The drop in activity at Iron Ozone 32, with no direct connection to EU construction news, warrants monitoring broader energy sector trends and potential supply chain adjustments.