From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Steel Market: Activity Mixed Amidst Production Declines, Strategic Procurement Advised

In Europe, steel market dynamics are showing mixed signals. While overall sentiment remains positive, recent industrial production declines present potential challenges. The observed variations in steel plant activity, when juxtaposed with news headlines such as “Industrial production in the EU declined by 1.8% m/m in April” and “Euro area industrial output down 2.4 percent in April from March“, highlight the need for strategic procurement decisions. These articles report drops in industrial production, and while a direct causal relationship is not explicitly evident in the satellite data, the coincidence of these events warrants close attention.

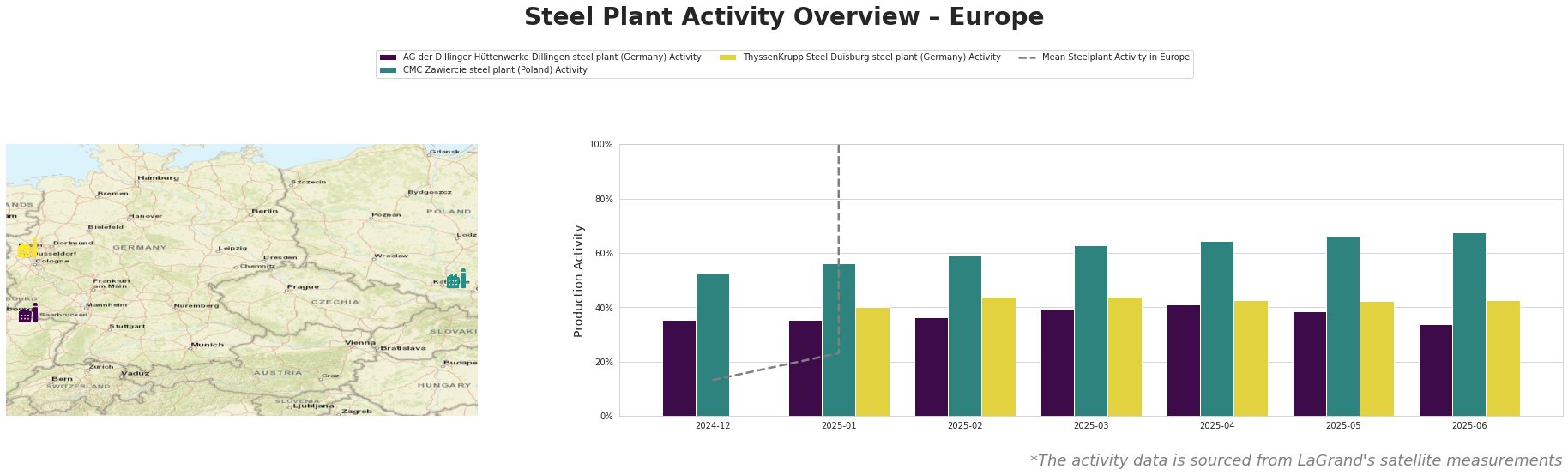

The mean steel plant activity shows considerable fluctuations. Note that some mean activity values are unusually high, likely due to a sensor anomaly. These values should not be used for analysis. Focusing on the relative trends, CMC Zawiercie in Poland demonstrates a consistent upward trend, reaching 68% activity in June 2025. AG der Dillinger Hüttenwerke saw activity peak in April 2025 (41%) before declining to 34% in June 2025. ThyssenKrupp Steel Duisburg shows a relatively stable activity level around the low 40s.

AG der Dillinger Hüttenwerke Dillingen steel plant (Germany), an integrated BF-BOF producer with a crude steel capacity of 2.76 million tonnes, specializing in heavy plate products for automotive, building, energy, and machinery sectors, exhibited a decline in activity from 41% in April to 34% in June. While the news articles report an overall industrial production decline, a specific causal link to Dillinger’s activity drop cannot be definitively established from the provided information.

CMC Zawiercie steel plant (Poland), an EAF-based producer with a 1.7 million tonne capacity, serving sectors like automotive, construction, and energy, showed a consistent activity increase, reaching 68% in June 2025. This growth occurs during a period of reported industrial production decrease across Europe, as detailed in “Industrial production in the EU declined by 1.8% m/m in April”. However, the data suggests CMC Zawiercie is bucking the trend, potentially due to regional factors or specific market demands.

ThyssenKrupp Steel Duisburg steel plant (Germany), a major integrated steel producer with a 13 million tonne capacity, focusing on flat steel products for automotive and construction, demonstrates relatively stable activity in the low 40s throughout the observed period. Although the article “Euro area industrial output down 2.4 percent in April from March” indicates a general downturn, ThyssenKrupp’s steady activity could imply resilience or pre-existing order backlogs.

Given the industrial production declines reported in “Industrial production in the EU declined by 1.8% m/m in April” and “Euro area industrial output down 2.4 percent in April from March” coinciding with activity fluctuations at key plants like AG der Dillinger Hüttenwerke, steel buyers should prioritize securing medium-term contracts with multiple suppliers, particularly focusing on plants like CMC Zawiercie demonstrating consistent output. The decline at Dillinger, while not directly linked, warrants careful monitoring of their order fulfillment capabilities. Additionally, given ThyssenKrupp’s stable activity, buyers heavily reliant on them should confirm order lead times and potentially explore alternative sources for critical projects to mitigate potential disruptions if the overall market weakens further.