From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineDeclining Steel Market in Germany: Volkswagen Plant Closures Signal Broader Industry Struggles

Germany is facing challenges in its steel industry, as recent news highlights a significant downturn. The Volkswagen shuts down factory in Germany for the first time in 88 years underscores the pressures impacting automotive suppliers, which in turn affects steel demand, particularly from key automotive sectors. Additionally, the VW closes plant in Germany for first time indicates a structural shift towards electrification amid declining traditional vehicle manufacturing. This directly correlates to a noticeable decrease in steel plant activity, suggesting an urgent need for strategic procurement planning.

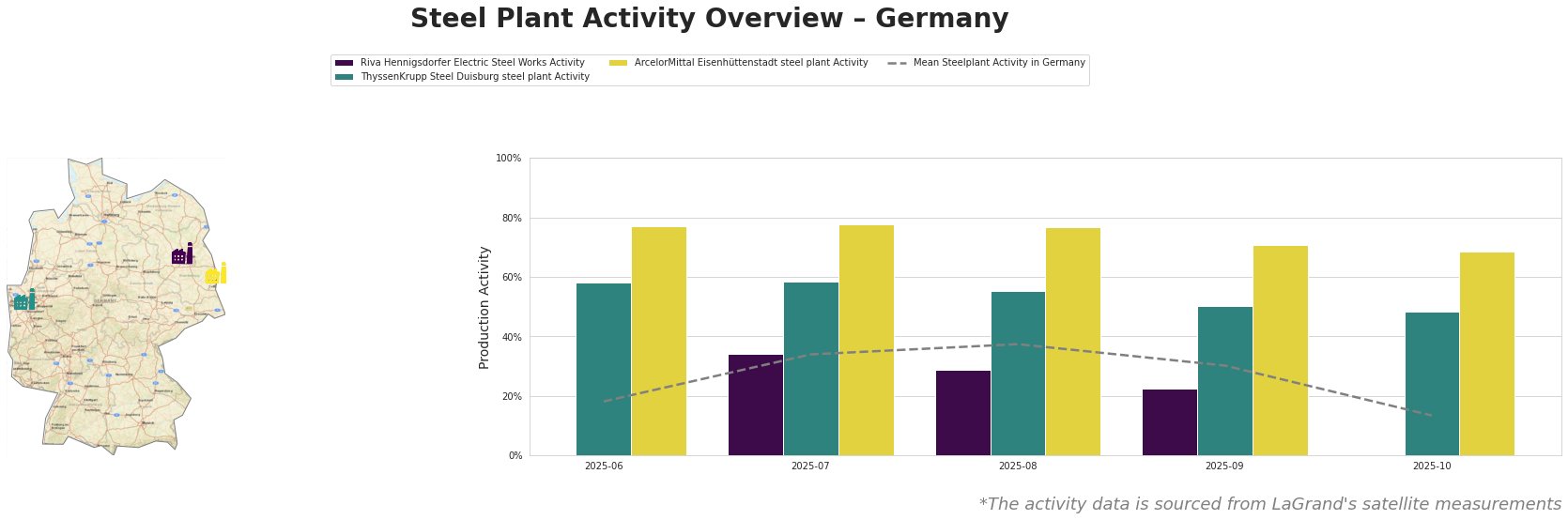

The data reveals a stark downturn in overall steel activity from a mean of 34% in July to just 13% by October 2025, reflecting a significant market contraction. ThyssenKrupp Steel Duisburg’s activity declined from 59% in July to 48% in October, while ArcelorMittal Eisenhüttenstadt maintained higher activity levels but still saw a drop from 78% in July to 68% in October. Riva Hennigsdorfer remains inactive as of October, reflecting a lack of demand.

-

Riva Hennigsdorfer Electric Steel Works: Located in Brandenburg, this plant primarily processes steel using Electric Arc Furnace (EAF) technology. Its observed inactivity and the significant drop to 0% is linked to the closure of the Volkswagen Dresden factory, reducing demand for automotive supplies. No activity recorded aligns with recent market shifts outlined in the VW articles.

-

ThyssenKrupp Steel Duisburg: This integrated steel plant saw a decline to 48% activity in October. As VW reduces workforce and non-essential production, lowered automotive demand and broader economic pressures can explain the downturn in this facility’s output, especially since it caters largely to the automotive sector.

-

ArcelorMittal Eisenhüttenstadt: Despite facing a decline in activity levels from 78% to 68%, compared to other plants, this facility remains relatively active. However, its reliance on automotive demand makes it susceptible to the ongoing market disruptions outlined in the related news.

Given the current environment, procurement professionals should consider the following actionable insights:

-

Advance Stockpiling: With activity levels decreasing, securing materials before further reductions are observed may mitigate supply disruptions, especially for products reliant on automotive demand.

-

Diversification of Suppliers: Engage with alternative suppliers not solely linked to the automotive sector to ensure continued access to steel products while navigating these market changes.

-

Monitor Plant Activity Closely: Watch for further announcements similar to the VW closes plant in Germany for first time as they may foreshadow additional shifts in supply chains and impact pricing strategies.

In summary, the interconnectedness of Volkswagen’s strategic retractions and corresponding steel production outputs emphasizes the need for tailored procurement strategies amidst a challenging landscape.