From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Braces for Further Downturn Amid Production Cuts and Rising Inventories

China’s steel market faces increasing headwinds as production adjustments clash with rising inventories. According to “China’s Crude Steel Output Falls Below 80 Million mt in July, down 3.1% in Jan-July“, July saw a significant dip in crude steel output. While “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” indicates a short-term rebound in daily output among CISA members in early August, the concurrent rise in finished steel inventories suggests underlying demand weakness. No direct relationship between these news articles and specific plant activity levels can be definitively established based on the current data.

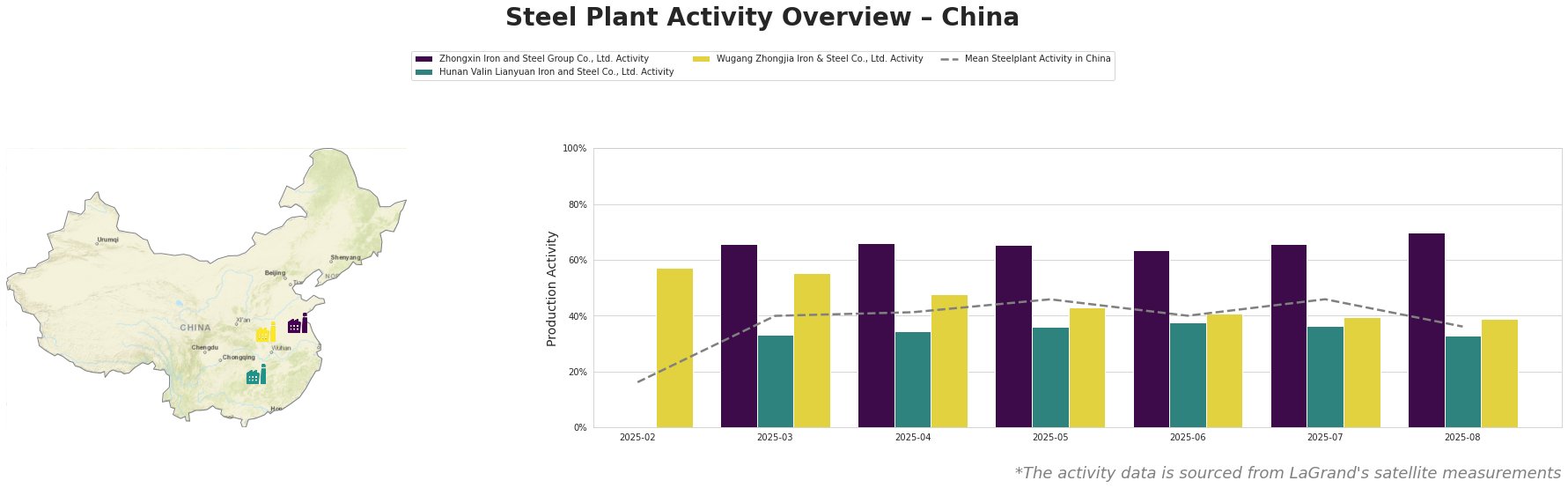

Overall, average steel plant activity in China has decreased to 36% in August, down from 46% in July.

Zhongxin Iron and Steel Group Co., Ltd., a Jiangsu-based integrated steel producer with a 5.7 million tonne BOF capacity, saw its activity increase to 70% in August, up from 66% in July. This activity level is considerably higher than the national average. No direct connection between this increase and the recent news articles can be established based on the provided information. The company’s reliance on BF/BOF technology suggests a focus on commodity-grade steel production.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., a Hunan-based integrated producer with a 9 million tonne BOF capacity, experienced a decrease in activity to 33% in August, down from 36% in July. This activity level is below the national average. Specializing in finished rolled products, including automotive and pipeline steel, the decrease in activity does not appear to be directly linked to any specific news item, although general concerns about slowing demand mentioned in “China’s crude steel output falls below 80 million mt in July, down 3.1% in Jan-July” may be contributing to the trend.

Wugang Zhongjia Iron & Steel Co., Ltd., a Henan-based ironmaking facility with a 1.22 million tonne BF capacity, also saw a slight decrease in activity to 39% in August from 40% in July. Its activity remains slightly above the national average. Focused on crude steel production, no direct connection between its relatively stable activity and recent news can be established.

Given the mixed signals of increased daily output reported in “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” against the backdrop of declining overall monthly production as reported in “China reduces steel output for the third month in a row” and rising inventories, steel buyers should adopt a cautious procurement strategy. Specifically:

- Prioritize short-term contracts: Given the volatile production landscape and the potential for further output adjustments, buyers should favor short-term contracts to maintain flexibility.

- Closely monitor inventory levels: The “CISA mills’ daily crude steel output up 4.7% in early August, stocks also up” indicates rising inventories; buyers should closely track inventory levels at both producers and distributors to anticipate potential price corrections.

- Diversify sourcing (limited): While the satellite data offers insights on activity at specific plants, given the overall market conditions, steel buyers should evaluate the potential to ensure the stability of supply chains, if possible.