From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustria’s Steel Market: A Positive Outlook Amid Stable Production

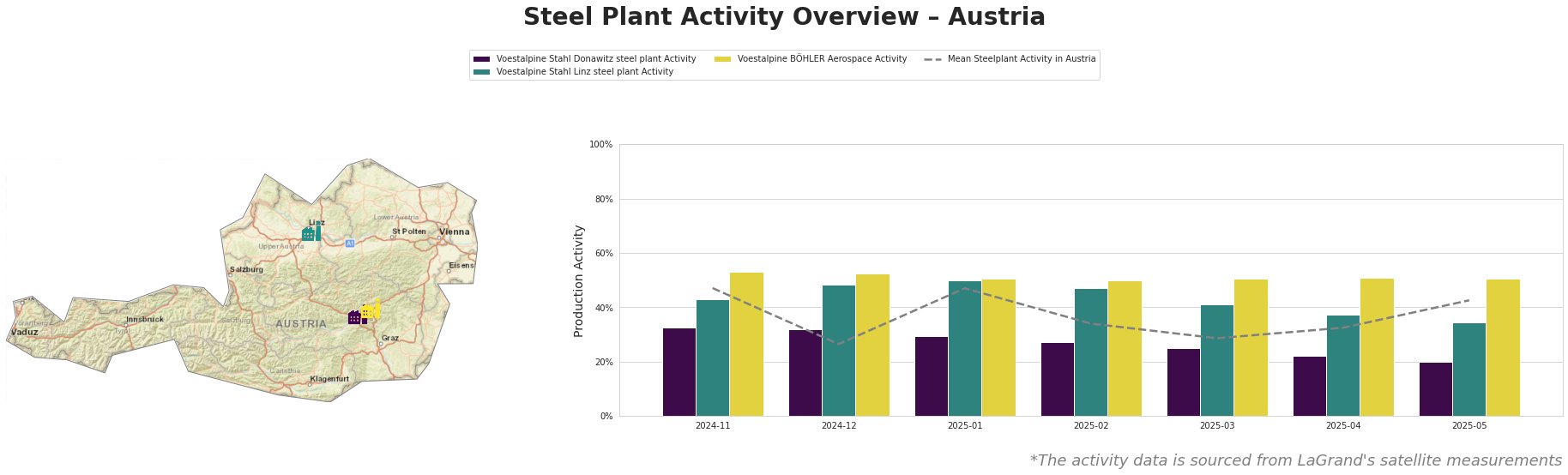

In Austria, the steel market exhibits a very positive sentiment, as indicated by recent reports and observed plant activity levels. Notably, the article titled “Australia’s Labor win may aid low-carbon Fe, Al sectors” (Published: 2025-05-04) highlights that the re-elected Labor party’s policies will likely benefit the low-carbon sectors, providing stability that can influence European markets, including Austria. This sentiment is supported by a general uptick in activity at Austrian steel plants, with satellite data confirming these trends.

Activity levels at Voestalpine Stahl Donawitz fell over the past months, reaching a low of 20% in May 2025, and showed notable drops in preceding months, likely uninfluenced by recent political shifts. In contrast, the Voestalpine Stahl Linz plant maintained activity levels up to 50%, aligning with the policy aspirations for the steel sector stressed in “Australia’s Labor win may aid low-carbon Fe, Al sectors.” Similarly, the Voestalpine BÖHLER Aerospace plant reported consistent performance, with activity around 51%. However, there’s no direct link between the recent performance drops at Donawitz and any observable news events.

The Voestalpine Stahl Donawitz plant, an integrated facility with a crude steel capacity of 1.57 million tonnes, showed concerning declines in operational activity. The plant employs a workforce of 1,356, but recorded a 10% decline from April to May 2025. This drop occurs despite overall market optimism, suggesting potential disturbances that buyers must consider. Conversely, the Linz plant, with a capacity of 6 million tonnes, maintains steady output, which may underline a divergence from Donawitz’s performance given the broader economic indicators from new government policies.

Evaluated market implications:

– The significant drop in activity at the Voestalpine Stahl Donawitz raises alarms for potential supply disruptions. Given its integrated operations, buyers should consider diversifying their supply sources to mitigate risks associated with production decreases.

– Steel buyers should leverage resources from the Linz and BÖHLER Aerospace plants, which both maintain stable outputs and align with low-carbon strategies emphasized by recent political narratives. Specifically, engaging contracts with the Linz facility could yield advantages from an anticipated increase in demand for sustainably produced steel as market conditions evolve.

Conclusion:

The Austrian steel market outlook is bolstered by a supportive political environment and stable production capacity, especially at the Linz plant. However, immediate actions should address the potential supply vulnerabilities arising from fluctuations at Donawitz. Proactive procurement strategies will be essential for navigating these emerging dynamics effectively.