From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market: CCUS Initiatives Boost Positive Sentiment Amidst Plant Activity Shifts

Asia’s steel market sentiment remains very positive, fueled by decarbonization efforts and observed plant activity. Industry initiatives, such as the one detailed in “Industry Consortium Launches CCUS Hub Study“, and “Global steel leaders launch pre-feasibility study to accelerate decarbonization in Asia“, highlight the sector’s commitment to reducing emissions. While these ambitious CCUS projects have not yet translated into direct changes in plant activity, they signal a long-term shift.

Here’s a summary of recent plant activity levels:

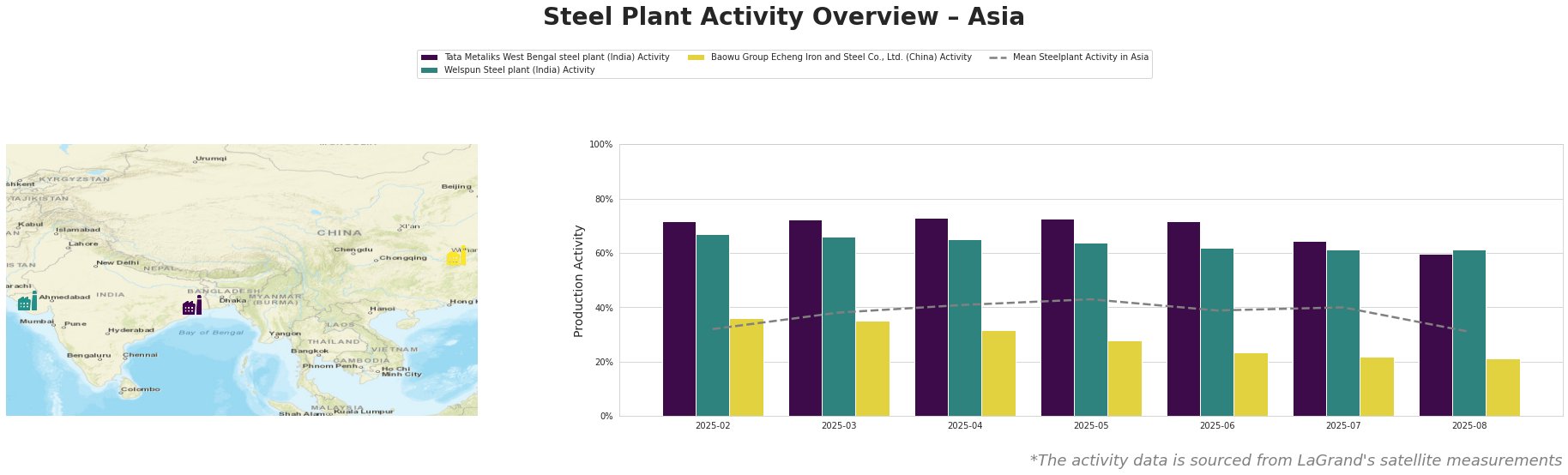

Overall, the mean steel plant activity in Asia fluctuated, peaking at 43% in May 2025 and subsequently declining to 31% by August 2025.

- Tata Metaliks West Bengal steel plant: This integrated BF-based plant, producing pig iron and ductile pipes with a crude steel capacity of 255ktpa, showed relatively high activity levels compared to the Asian average. Activity remained stable around 72-73% until July 2025, before dropping significantly to 60% by August 2025. No direct correlation could be established with the news articles provided regarding CCUS initiatives.

- Welspun Steel plant: This DRI-based plant in Gujarat, India, focuses on TMT rebars, billets, and DRI with a crude steel capacity of 288ktpa. Its activity levels were also consistently above the Asian average, starting at 67% in February 2025 and gradually decreasing to 61% by August 2025. There is no explicit link between the CCUS news articles and the observed activity at this DRI-based plant.

- Baowu Group Echeng Iron and Steel Co., Ltd.: This large integrated BF/BOF plant in Hubei, China, with a crude steel capacity of 4.4 million tonnes per annum, produces a wide range of finished rolled products. Its activity levels were consistently below the Asian average, showing a clear downward trend from 36% in February 2025 to 21% in August 2025. The observed decrease in activity at this plant doesn’t appear to be directly related to the news on CCUS initiatives, and may be due to other market factors.

Evaluated Market Implications:

The news articles “Industry Consortium Launches CCUS Hub Study,” “Global steel leaders launch pre-feasibility study to accelerate decarbonization in Asia,” and “BHP will lead a consortium to explore CCUS opportunities in Asia” suggest a long-term positive outlook for the Asian steel market, driven by the potential for green steel production.

The consistent decline in activity observed at Baowu Group Echeng Iron and Steel Co., Ltd. (China), coupled with the general downward trend of the mean steel plant activity in Asia, could signal localized supply constraints within China.

Recommended Procurement Actions:

Given the potentially constrained supply from Baowu Group Echeng Iron and Steel Co., Ltd., and the overall dip of the Asian mean steel plant activity levels steel buyers sourcing specific finished rolled products such as spring steel, high-strength ring chain steel, bearing steel wire rods, high-quality carbon structural steel from this region should consider:

- Diversifying Suppliers: Identify alternative suppliers of similar steel products, particularly outside of the Hubei region, to mitigate potential disruptions.

- Securing Long-Term Contracts: Given the positive long-term outlook and the potential for short-term supply tightness, explore securing longer-term contracts with reliable suppliers to lock in prices and ensure supply.

- Monitoring Regional Inventory Levels: Closely monitor inventory levels of the products sourced from Baowu Group Echeng Iron and Steel Co., Ltd. in the Hubei region to anticipate and manage potential shortages.