From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimistic on US-China Trade Deal, Kalyani Steels Holds Strong

Asia’s steel market sentiment is positive, influenced by potential resolutions in US-China trade relations. The news articles “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish” and “Trump and Xi set for first face-to-face meeting in 6 years as major trade war looms over both nations” signal a potential easing of trade tensions. However, no direct relationship between these negotiations and observed activity changes at the regional steel plants is apparent from the satellite data.

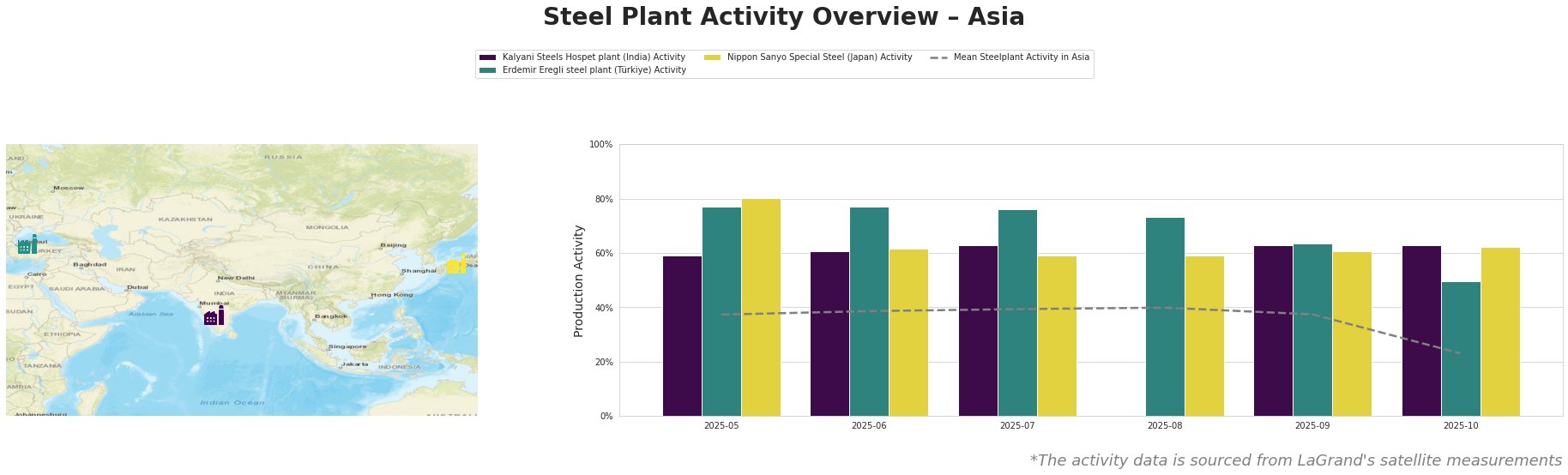

Observed mean steel plant activity in Asia peaked in August at 40% and then sharply declined to 23% in October. Kalyani Steels Hospet plant in India has demonstrated stable activity, holding steady at 63% from July to October. Erdemir Eregli steel plant in Turkey showed a notable decrease, dropping from 77% in June to 50% in October. Nippon Sanyo Special Steel in Japan experienced fluctuations, with a high of 80% in May and a low of 59% in July and August, before settling at 62% in October. Kalyani Steels has consistently exceeded the mean regional activity, while Erdemir Eregli and Nippon Sanyo have fluctuated above and below the mean.

Kalyani Steels Hospet plant, an integrated steel producer (BF and DRI) with a crude steel capacity of 860 ttpa, primarily serves the automotive, building, and energy sectors with rolled bars and rounds. Despite the regional downturn, Kalyani Steels maintained a consistent activity level of 63% between July and October, indicating robust demand and potentially reliable supply from this plant. There is no observable connection between Kalyani Steels’ activity and the news articles concerning US-China trade negotiations.

Erdemir Eregli steel plant, an integrated BF producer in Turkey with a crude steel capacity of 4000 ttpa, produces hot and cold-rolled steel, plates, and coated flat steel for various sectors. The plant experienced a significant activity decrease from 77% in June to 50% in October. This decline could be attributed to various factors unrelated to the US-China trade talks, as no direct link can be established.

Nippon Sanyo Special Steel, a Japanese electric arc furnace (EAF) steel plant with a crude steel capacity of 1596 ttpa, manufactures billets, rolled products, tubes, and bars. Its activity levels fluctuated, with a notable drop to 59% in July and August, before recovering to 62% in October. Similar to Erdemir, no direct connection can be established between Nippon Sanyo Special Steel’s activity fluctuations and the developments discussed in the provided news articles.

The stability of Kalyani Steels, in contrast to the activity decrease at Erdemir Eregli, suggests geographically isolated supply considerations. Given the potential for easing trade tensions described in “US, China Tee Up Sweeping Trade Deal For Trump, Xi To Finish,” steel buyers should closely monitor price trends and inventory levels, especially for products sourced from Erdemir Eregli, as its reduced activity in October might result in short-term supply constraints. Simultaneously, buyers reliant on Kalyani Steels should consider securing mid-term contracts to capitalize on their consistently high production levels. The “Gipfel in Südkorea: Trump senkt die Zölle und China die Exportrestriktionen” suggests a possible future reduction in tariffs. For steel buyers, this means they should monitor tariff adjustments on steel imports to seize cost-saving opportunities. If tariffs decrease, evaluate the competitiveness of different suppliers and adjust procurement strategies accordingly.