From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Nippon Sanyo Activity Surges Amid US-EU Trade Tensions

The Asian steel market shows mixed signals amid escalating trade tensions between the US and EU. The activity levels at selected steel plants show variable patterns that, at present, do not correlate to explicit changes stemming from the news articles “EU presents new trade proposal to the US – Bloomberg,” “Trump’s tariff threat risks a trade war with Europe years in the making,” and “US eyes 50% tariff on EU-origin imports.” However, these potential tariffs could indirectly impact Asian steel demand if they disrupt global trade flows.

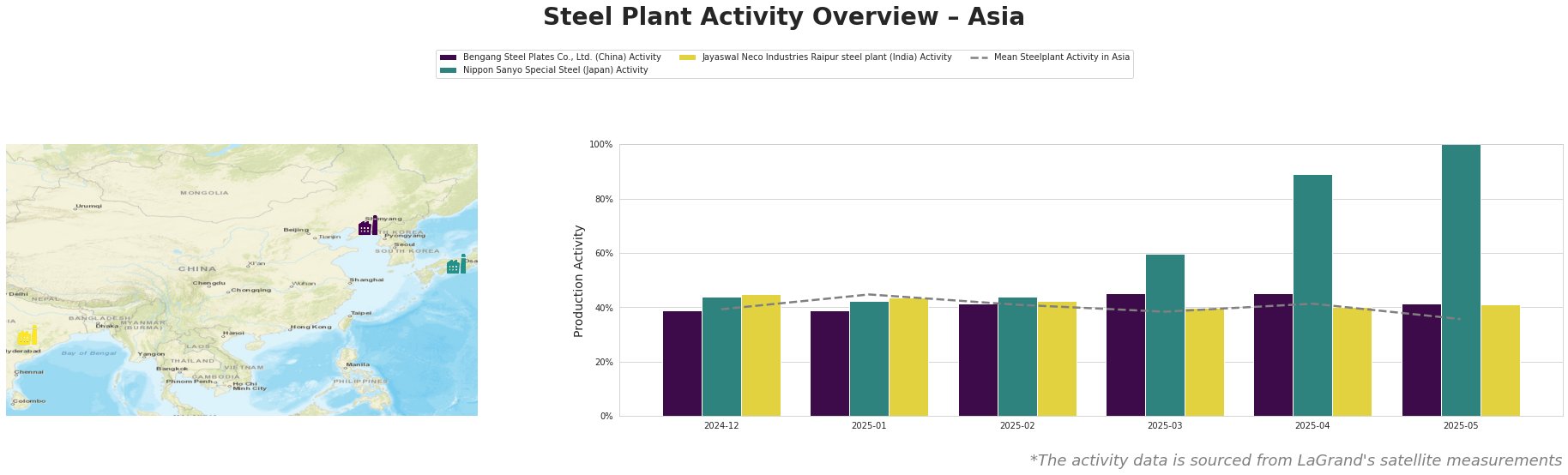

Overall, the mean steel plant activity in Asia declined to 36% in May, after reaching a high of 45% in January.

Bengang Steel Plates Co., Ltd. (China), an integrated BF steel plant with a crude steel capacity of 12.8 million tonnes, showed fluctuating activity. Activity stood at 39% at the end of 2024 and remained near this level until a peak of 45% in March and April of 2025, before settling at 41% in May. This steel plant focuses on finished rolled products, including automotive and home appliance plates, oil pipeline steel, and container plates. Given its focus on domestic end-user sectors such as automotive, infrastructure and energy, the observed activity changes do not have an obvious connection to the cited news articles about US-EU trade tensions.

Nippon Sanyo Special Steel (Japan), an EAF-based plant with a crude steel capacity of 1.596 million tonnes and a focus on semi-finished and finished rolled products, experienced a sharp increase in activity. Starting at 44% at the end of 2024, activity steadily rose to 100% in May 2025. This substantial increase does not have an apparent direct connection to the cited news articles regarding US-EU trade relations.

Jayaswal Neco Industries Raipur steel plant (India), an integrated BF and DRI plant with a crude steel capacity of 1.2 million tonnes, saw relatively stable activity. Fluctuations remained within a narrow range of 40% to 45% throughout the observed period. This plant produces crude, semi-finished, and finished rolled products including pig iron, DRI, blooms, billets and rolled products. As with Bengang Steel, the observed activity changes do not have an obvious connection to the cited news articles about US-EU trade tensions.

Given the potential for increased global trade uncertainty stemming from the “US eyes 50% tariff on EU-origin imports” and related articles, steel buyers should:

-

Monitor Nippon Sanyo Special Steel’s output closely. Given its surge to peak capacity, assess the potential for increased availability of its products (billets, rolled products, and bars) and negotiate for favorable supply contracts. This plant mainly uses EAF technology, providing more flexibility in material input, but still the rapid expansion to maximum capacity has to be carefully assessed.

-

Prepare for possible indirect impacts on demand. Although no direct impacts are yet evident, the trade tensions described in “Trump’s tariff threat risks a trade war with Europe years in the making” could reshape global steel demand. Steel buyers should stress-test their supply chains and explore alternative sources, as shifts in demand could lead to regional price volatility.