From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Indian Trade Cases Clash with Steady Chinese Output, Market Remains Neutral

In Asia, the steel market faces increasing trade remedy actions in India amid relatively stable steel plant activity. Indian producers are actively pursuing antidumping duties, as evidenced by the news articles “Indian stainless steel producers seek antidumping levy on imports” and “Indian alloy steel wire rod producers seek AD duty on ex-China imports,” which describe petitions filed to protect domestic industries. Furthermore, “India’s DGTR recommends AD duty on ex-Vietnam HR flats imports for five years” signals potential shifts in import flows into India, although no direct link to observed plant activity levels can be established based on the provided data. The activity changes at Fangda Special Steel and İÇDAŞ Biga do not correlate with the Indian trade actions, and the Ch’ollima Steel Complex in North Korea operates largely independently of broader market trends.

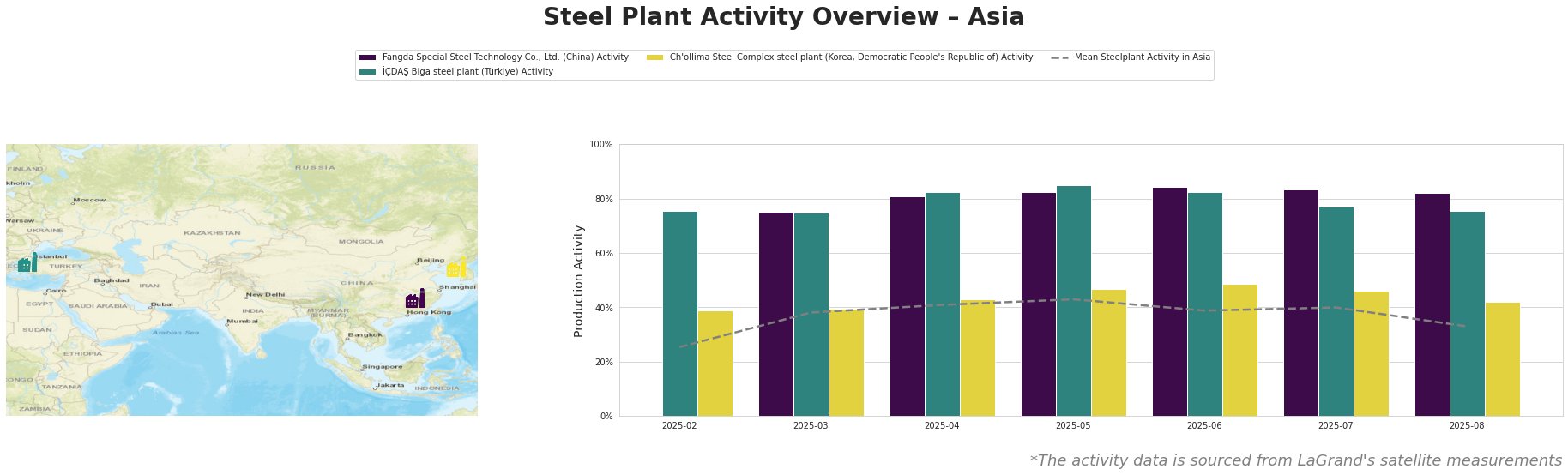

The mean steel plant activity in Asia increased from 25.0% in February to a peak of 43.0% in May before declining to 33.0% in August. Fangda Special Steel in China consistently operated at high levels, ranging from 75.0% to 84.0%, significantly above the Asian average. İÇDAŞ Biga in Turkey also maintained relatively high activity, fluctuating between 75.0% and 85.0%. The Ch’ollima Steel Complex in North Korea showed a gradual increase in activity from 39.0% to 49.0% before decreasing to 42.0% in August.

Fangda Special Steel Technology Co., Ltd., located in Jiangxi, China, primarily utilizes integrated BF-BOF processes with a crude steel capacity of 3.6 million tonnes. The plant’s activity remained consistently high, between 75% and 84% throughout the observed period, indicating stable production of finished rolled products, including alloy structural round steel and hot-rolled ribbed steel bar. This high level of activity does not appear to be directly influenced by the trade remedy actions in India or the EU as highlighted in the article “EU makes further cuts to AD duties on Japanese hot-rolled flat steel,” suggesting a focus on domestic or regional Chinese markets.

İÇDAŞ Biga steel plant, based in Çanakkale, Turkey, relies on EAF technology with a crude steel capacity of 2.5 million tonnes. The plant produces semi-finished and finished rolled products such as billets, rebar, and wire rod, targeting the building, infrastructure, energy, and transport sectors. The activity at İÇDAŞ Biga was also high, ranging from 75% to 85% during the observed period. No direct correlation between İÇDAŞ Biga’s activity and the Indian antidumping cases could be established from the provided data.

The Ch’ollima Steel Complex steel plant in South Pyongan, North Korea, has a relatively small crude steel capacity of 760,000 tonnes and produces plates and wire rod. Activity at this plant was the lowest of the three observed, but still shows an overall increase throughout the period, but again declines towards the end. Due to the limited available information on this plant and its isolated market position, its activity is unlikely to be directly affected by or directly impact global steel trade flows or the trade actions mentioned in the provided news articles.

Given the increasing AD duties being sought in India, steel buyers should:

- Diversify sourcing: Actively explore alternative suppliers outside of China and Vietnam for stainless steel, alloy steel wire rod, and hot-rolled flat products to mitigate potential tariff impacts on Indian imports. The article “EU makes further cuts to AD duties on Japanese hot-rolled flat steel” suggests that Japanese HRFS might offer a viable, albeit potentially more expensive, alternative.

- Monitor DGTR investigations: Closely track the progress of the DGTR investigations mentioned in the news articles “Indian stainless steel producers seek antidumping levy on imports” and “Indian alloy steel wire rod producers seek AD duty on ex-China imports” to anticipate potential duty implementations and adjust procurement strategies accordingly.

- Assess Vietnamese HR flats sourcing: For buyers currently sourcing hot-rolled flats from Vietnam, evaluate the financial impact of the recommended $121.50/mt AD duty and consider alternative sourcing options to maintain cost competitiveness, as highlighted in the article “India’s DGTR recommends AD duty on ex-Vietnam HR flats imports for five years“.