From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Braces for Impact as Chip Shortage Threatens Auto Sector

Asia’s steel market faces mounting downward pressure due to potential automotive production cuts linked to the ongoing chip shortage. The “Critical chip shortage worsens, production stoppages expected: ACEA” news suggests potential disruptions to automotive steel demand, but no immediate link to specific Asian steel plant activity is observable through satellite data. The lifting of the Nexperia Semiconductor Export Ban, described in “China signals easing of Nexperia Semiconductor Export Ban“, might provide some relief; however, the extent and timing of this impact remain uncertain.

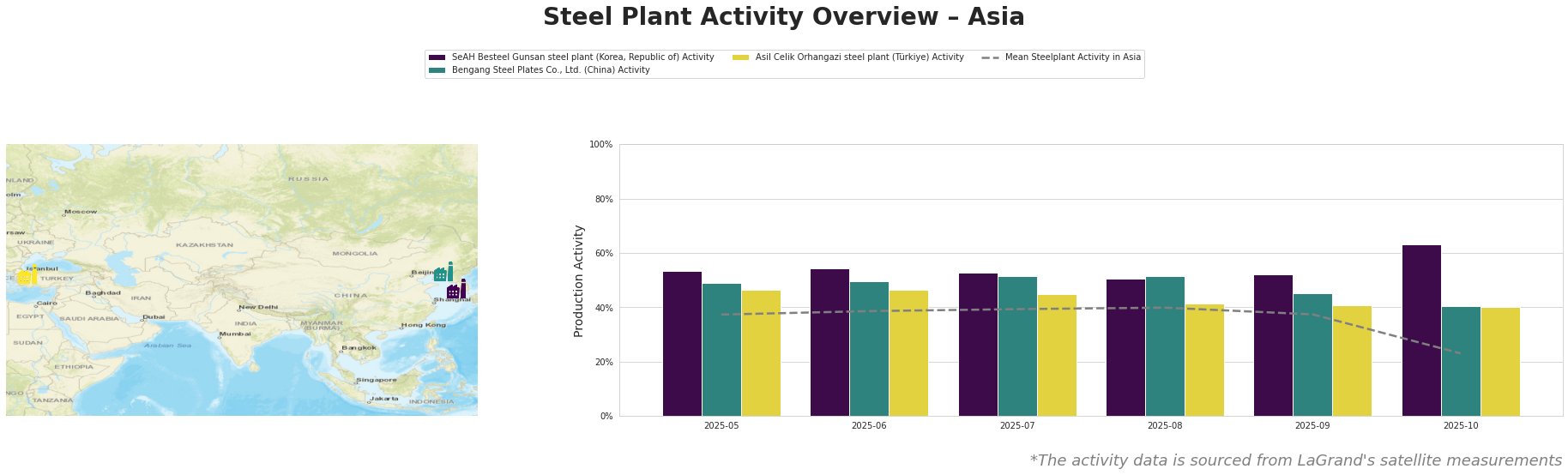

Observed activity levels show a notable decline in the mean steel plant activity across Asia in October, dropping to 23% from 37% in September, indicating a significant downturn.

SeAH Besteel Gunsan steel plant (Korea, Republic of), a South Korean EAF-based special steel producer with a capacity of 2.1 million tonnes, saw its activity increase to 63% in October, a significant jump from 52% the previous month and consistently above the mean. This rise is contrary to the overall Asian downtrend, and no direct connection to the provided news articles could be established.

Bengang Steel Plates Co., Ltd. (China), an integrated BF-BOF steel plant with a significant capacity of 12.8 million tonnes, produces automotive plates and other products. Its activity decreased to 40% in October from 45% in September, moving closer to the general Asian activity level. As it is an automotive plate producer, the drop may be linked to potential automotive production cuts detailed in the “Critical chip shortage worsens, production stoppages expected: ACEA” news, although a definitive link cannot be explicitly confirmed.

Asil Celik Orhangazi steel plant (Türkiye), a smaller EAF-based producer with a capacity of 0.55 million tonnes, maintained a relatively stable activity level around 40-46% throughout the observed period, but is also slighlty below the mean. The last reading for october shows no change and no direct link to the provided news articles could be established.

The potential for decreased automotive production due to the chip shortage, as highlighted in “Critical chip shortage worsens, production stoppages expected: ACEA” and “German auto parts sector rushes to get China exemptions for Nexperia chip exports“, may further impact steel demand, particularly for producers like Bengang Steel Plates that are heavily reliant on the automotive sector.

Evaluated Market Implications & Recommended Procurement Actions:

- Potential Supply Disruptions: While SeAH Besteel Gunsan’s activity is increasing, Bengang Steel Plates’ decline, in conjunction with automotive sector warnings, suggests potential localized disruptions to automotive-grade steel supply chains.

- Procurement Actions: Steel buyers heavily reliant on Asian automotive-grade steel should immediately:

- Closely monitor Bengang Steel Plates production updates and assess alternative suppliers, if possible.

- Engage in frequent and proactive communication with existing steel suppliers, especially those producing automotive-grade plates, to understand their exposure to the semiconductor shortage and potential impact on delivery schedules.

- Factor in potential price volatility due to supply chain uncertainties into procurement strategies.

- Consider forward buying or hedging strategies where appropriate, to mitigate price risk.

- Further Analysis: Continuously monitor for further news on the Nexperia Semiconductor Export Ban situation and its impacts. No influence could be established for Asil Celik steel plant.