From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: Economic Slowdown and Plant Activity Impact Procurement Strategies

Germany’s steel sector faces headwinds from a weakening economy, impacting plant activity and procurement strategies. The observed activity levels are influenced by factors discussed in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” and “Germany cuts tax forecasts by €81 billion by 2029“. A direct, easily attributable link between these articles and the observed changes in plant activity is difficult to establish definitively, as various operational and market dynamics also play a role.

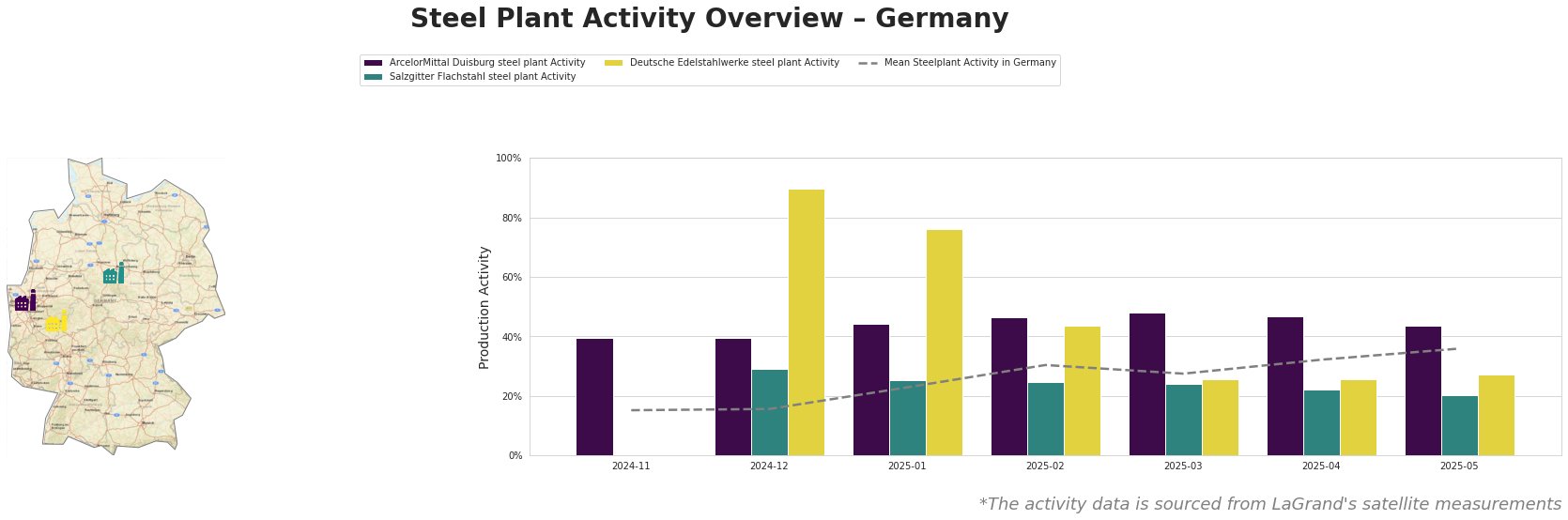

Here’s an overview of steel plant activity levels in Germany:

The mean steel plant activity in Germany shows an increasing trend from November 2024 to May 2025. Deutsche Edelstahlwerke exhibits the highest activity level in December 2024 (90%) but experiences a sharp decline afterwards. Salzgitter Flachstahl shows the lowest activity with a continuos declining trend.

ArcelorMittal Duisburg, a major BOF steel producer in North Rhine-Westphalia with a crude steel capacity of 1.3 million tonnes, showed relatively stable activity, fluctuating between 40% and 48% before declining to 43% in May 2025. This limited change does not directly correlate with any specific information in the provided news articles, although broader economic trends discussed in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” likely have an impact.

Salzgitter Flachstahl, a major integrated BF-BOF steel plant in Lower Saxony with a crude steel capacity of 5.2 million tonnes, showed a declining activity trend from 29% in December 2024 to 20% in May 2025. This decline, while potentially influenced by the economic slowdown noted in “Germany cuts tax forecasts by €81 billion by 2029,” has no direct explicit connection to the article’s content. The plant is transitioning to hydrogen-based steel production under the Salcos Green Steel project, which might also temporarily affect current production levels, but this transition is not explicitly mentioned in the provided news articles.

Deutsche Edelstahlwerke, an EAF steel plant in North Rhine-Westphalia with a crude steel capacity of 600,000 tonnes, experienced a significant drop in activity from 90% in December 2024 to 27% in May 2025. This sharp decline has no direct link to any specific details in the provided news articles, suggesting the decrease may be attributable to plant-specific factors or shifting market demands not covered in the provided news.

Given the declining activity at Salzgitter Flachstahl and the economic uncertainties highlighted in “Deutschland hält Klimaziele ein – dank schlecht laufender Wirtschaft” and “Germany cuts tax forecasts by €81 billion by 2029“, steel buyers should:

- Monitor Salzgitter Flachstahl’s production and delivery times closely. The continued decline in activity may signal potential disruptions in the supply of hot-rolled, cold-rolled, and coated steel products. Diversification of suppliers for these products is recommended.

- Re-evaluate demand forecasts. With Germany’s economic outlook weakening, as suggested by “Germany cuts tax forecasts by €81 billion by 2029“, buyers should reassess their steel demand projections for the coming quarters to avoid overstocking.

While the German steel market is currently neutral, the economic headwinds and plant-specific activity changes warrant careful monitoring and proactive adjustments to procurement strategies.