From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineWeak Demand and Oversupply Pressures Continue to Decline European Steel Prices

European steel demand is showing a negative trajectory, largely attributed to weak market conditions and supply concerns. Recent reports such as “EU HRC prices inch down amid weak demand and holiday lull“ and “Steel prices in the EU are gradually decreasing amid weak demand and holiday lull“ illustrate the downward trend in hot-rolled coil (HRC) prices as producers reduce prices to secure orders in light of thin order books and consumer hesitance. This aligns with observed reductions in activity at major steel plants over the past month.

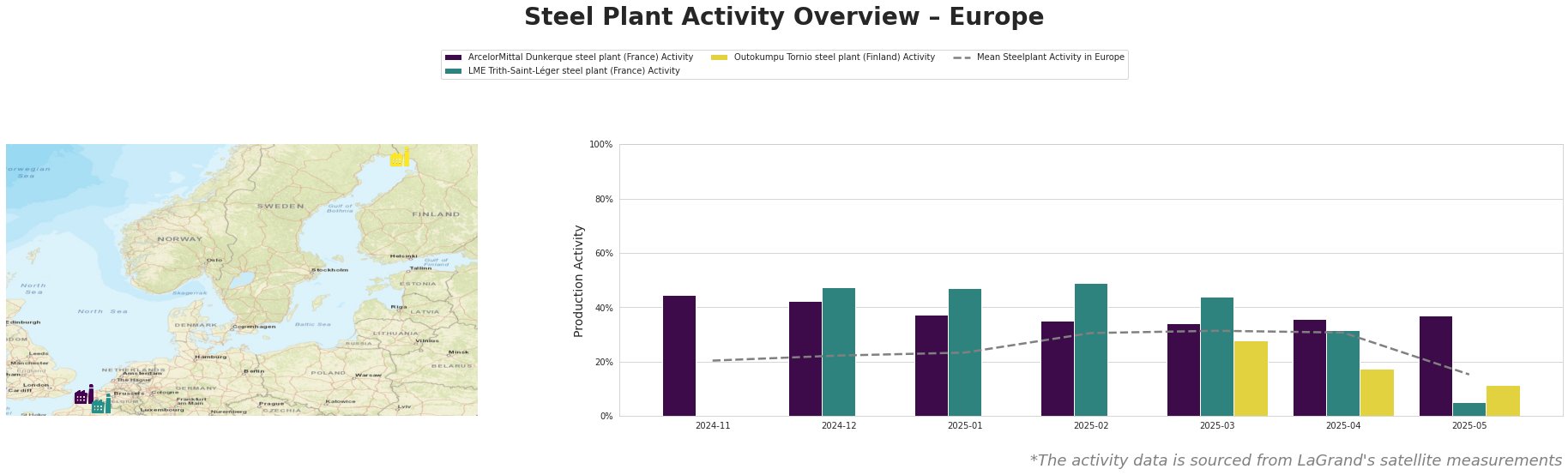

In April 2025, the ArcelorMittal Dunkerque steel plant saw a 36% activity level, but in May, it contrasted sharply with a 37% recovery despite the overall market mood reflected in “No support for higher HRC offers in Europe, prices hold steady on tepid demand.” The report indicates a lack of increase in demand, suggesting potential risks in maintaining output and pricing amidst low buyer interest.

Conversely, LME Trith-Saint-Léger plunged to 5% in May from 32% in April. This aligns with insights from the aforementioned articles that emphasize declining buyer confidence and further supports the argument for reduced production levels, especially as distributors in Germany are urging this approach.

The Outokumpu Tornio steel plant also registered a worrying drop from 18% in April to 11% in May, mirroring deteriorating market conditions. This decline may be seen as a reaction to the prevailing sentiment that demand is unlikely to recover swiftly, as stated in “Bread prices in the EU are gradually decreasing amid weak demand and holiday lull.”

Market Implications:

Steel buyers should anticipate supply disruptions, especially from plants showing significant activity declines, such as LME Trith-Saint-Léger, which may lead to extended delivery times and inconsistent pricing. Immediate procurement strategies should include front-loading orders and exploring alternative suppliers to mitigate risks posed by potential production cuts, particularly from the vulnerable sectors in Hauts-de-France and Lapland.

Further decisive actions, such as locking in pricing with reliable suppliers, can pre-empt the anticipated oversupply scenario discussed in the articles, thereby safeguarding procurement budgets amid fluctuating prices and diminishing buyer activity.