From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePositive Outlook for Germany’s Steel Market: Insights from Political and Plant Activity Trends

The steel market in Germany is showing a positive sentiment driven by political shifts and plant activity data. The anticipated leadership of Friedrich Merz Set To Become Germany’s Chancellor, Ending Political Stalemate signals a renewed focus on economic recovery, which bodes well for the steel sector. This is evident as observed changes in the activity levels of key steel plants, particularly noted in articles such as Friedrich Merz Set To Become Germany’s Chancellor, Ending Political Stalemate, highlight the importance of stable governance during challenging economic times.

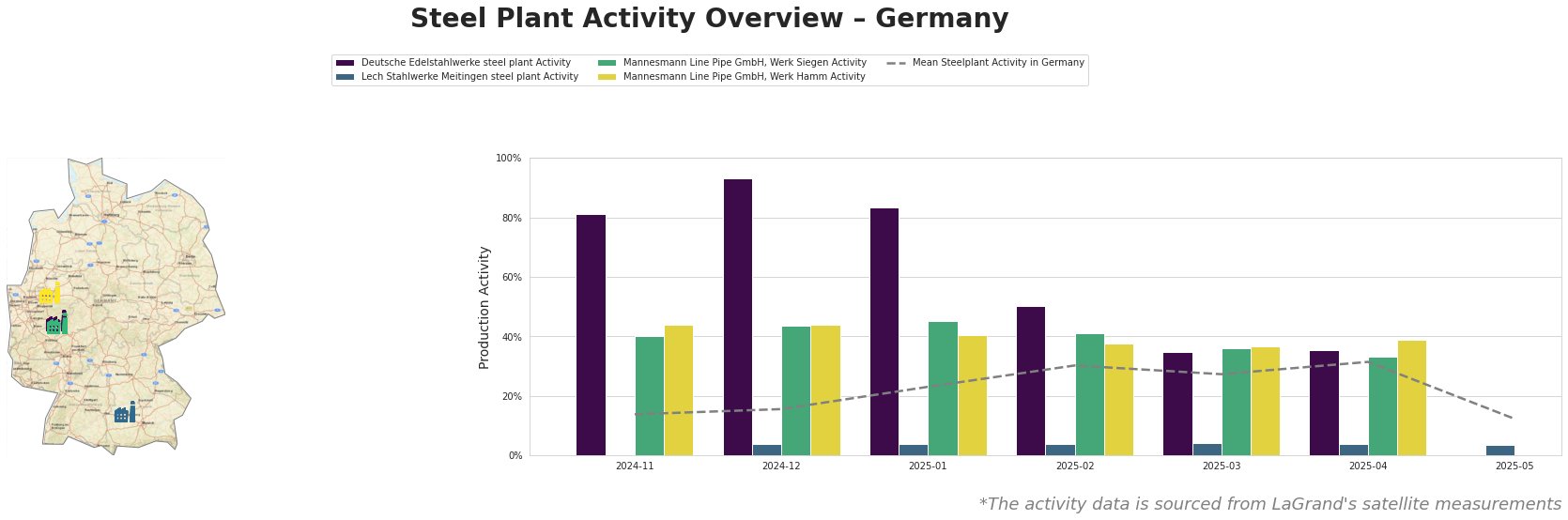

Deutsche Edelstahlwerke in North Rhine-Westphalia is experiencing fluctuations, peaking at 93.0% in December 2024, aligning with heightened political stability expectations as articulated in Friedrich Merz Set To Become Germany’s Chancellor, Ending Political Stalemate. In contrast, Lech Stahlwerke Meitingen’s low activity—recorded at 4.0% consistently from December through April—suggests challenges that are not explicitly linked to recent news. The Mannesmann Line Pipe plants show moderate activity, generally stable but experiencing a decline.

The appointment of Merz could likely support future activity increases by promoting investment in infrastructure that will directly benefit steel demand. Notably, the significant drop to 12.0% mean activity in May 2025 could indicate a temporary supply shortage exacerbated by shifts in political climate and economic strategies as highlighted in recent discussions about rebuilding trust in governance.

Given the upward trajectory in the previous months, steel buyers should consider securing procurement contracts ahead of projected demand increases driven by the infrastructure initiatives expected under Merz’s government. Additionally, closer monitoring of production levels at Deutsche Edelstahlwerke could inform strategies, especially as they currently present risks of unfulfilled supply amidst recent activity dips that bear no clear ties to current news developments.