From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineRobust Steel Market Signals in Europe as Defense Projects Drive Growth

Recent trends in the European steel market, particularly in Ukraine, indicate a very positive sentiment fueled by increasing defense-related steel consumption. The article titled Defense orders named the main driver of steel consumption in Ukraine emphasizes the substantial impact of government investments in defense projects, which have significantly elevated rolled steel demand. This increase is further corroborated by the reports of growing production at major Ukrainian plants, such as Zaporizhstal produced more than 1 million tons of steel in January-April 2025 and Consumption of rolled steel in Ukraine increased by 23% y/y in Q1.

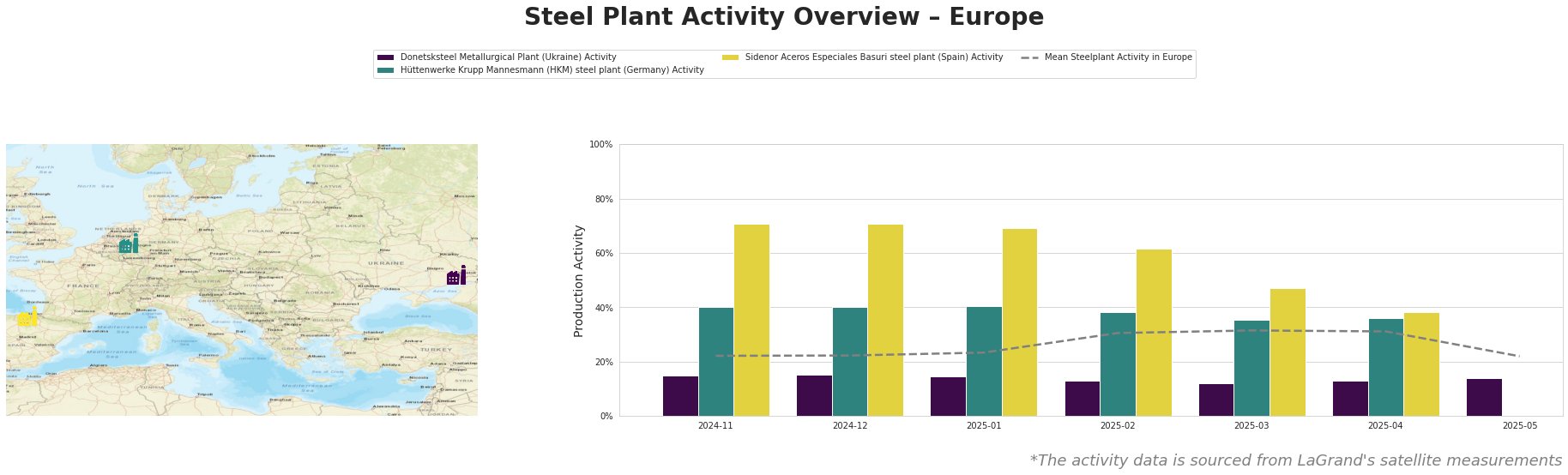

The activity levels of the Donetsksteel Metallurgical Plant remain below the European mean, with a notable decline, reaching a low of 12.0% in March 2025. No direct connection can be established with the recent articles regarding the overall defense situation or market demand directly impacting this specific plant’s activity. Conversely, the Hüttenwerke Krupp Mannesmann (HKM) steel plant demonstrates consistent performance at around 36-40%, significantly contributing to the European steel supply chain. Still, this level marks a decrease from earlier peaks observed in the previous year. Sidenor Aceros Especiales Basuri has shown the highest activity levels, maintaining around 62-71%, reflecting strong demand in sectors such as automotive and construction, though not directly linked to the recent news pieces.

The Ukrainian steel industry’s resurgence, particularly through Zaporizhstal, highlights the significant growth in rolled steel consumption driven primarily by defense contracts. With a reported 23% increase year-over-year and a predicted 41.4% surge in overall demand by early 2025, there is a clear linkage between market optimism and plant activities. The potential for reconstruction projects post-conflict also adds a layer of demand expected to propel market activity further.

Implications for Steel Buyers:

1. Procurement Focus: Buyers should prioritize sourcing from Sidenor Aceros Especiales Basuri to capitalize on its strong activity levels and product availability, particularly in rolled steel products critical for high-demand sectors like construction and automotive.

-

Long-term Engagement: Engage with suppliers in Ukraine following the upward trajectory noted in production forecasts, especially with defense sectors driving increased demand for key steel products. Awareness of potential regional supply disruptions is crucial, given the uncertainties surrounding the Donetsk region’s steel production capabilities.

-

Supply Chain Strategy: Define procurement strategies that include flexibility for sourcing from both stable European sources like HKM and emerging opportunities in the Ukrainian markets where government contracts are set to sustain growth, shaped by the defense sector needs.

Applying these actionable insights will enable strategic positioning in a recovering but still volatile steel market landscape shaped by geopolitical factors.