From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSignificant Activity Decline at Finarvedi Steel Plant Raises Supply Concerns

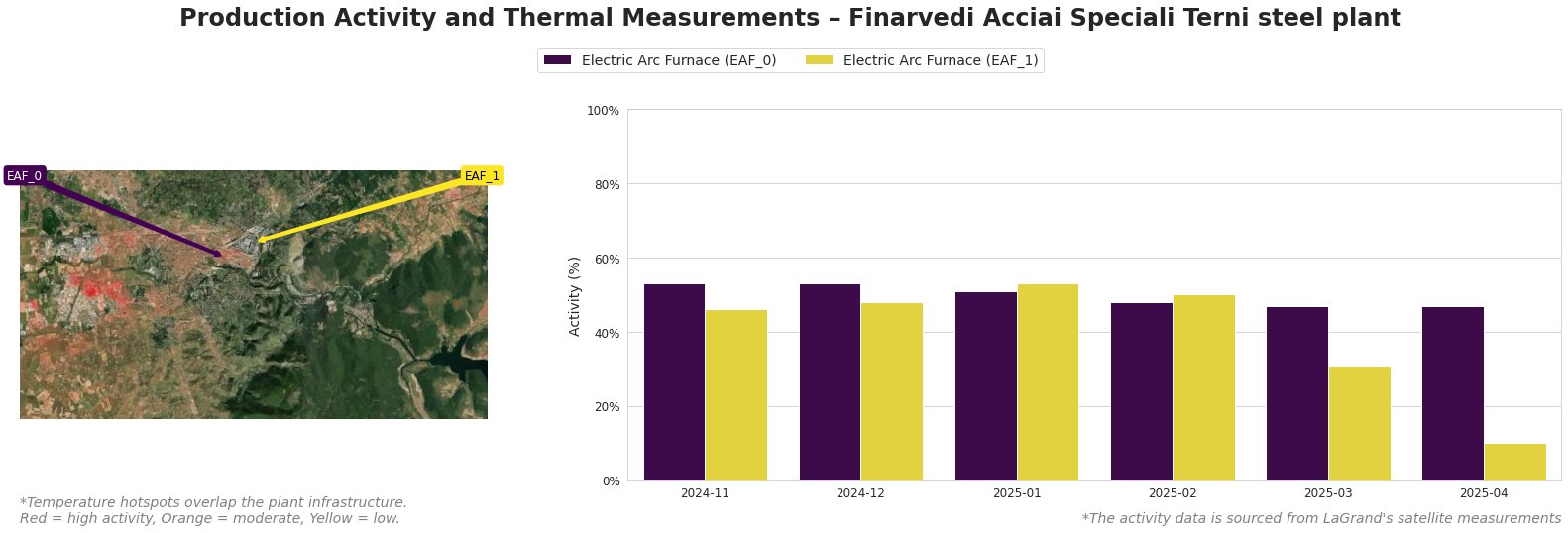

The Finarvedi Acciai Speciali Terni steel plant in the Province of Terni, Italy, is facing a notable reduction in operational activity, with its annual production capacity of 1.45 million tons now under threat. As a major player in the production of hot-rolled, cold-rolled, and stainless steel products catering to key sectors including automotive, construction, and steel packaging, this downturn raises alarms for supply chain stability.

Activity Trends Over Time

Recent satellite observations reflect concerning shifts in operational outputs from the Electric Arc Furnaces (EAFs) at the facility:

Over the past several months, the operational capacity of EAF_1 has plummeted, reaching a mere 10% in April 2025—signifying a stark decline of 27.33% in overall activity. The continuous drops, particularly in EAF_1, reflect broader challenges that could affect the plant’s ability to meet market demands as steel production in Italy rises, with recent reports indicating an 11.2% month-over-month increase in national steel output for March 2025.

During a time when the Italian steel sector shows growth in areas such as long products (up 20% monthly), Finarvedi’s diminishing activity may hinder its competitiveness and ability to service sectors experiencing increased demand.

Implications for Steel Buyers and Market Analysts

The observed decline in activity at the Finarvedi plant could signal potential supply bottlenecks for customers reliant on its products. Buyers should prepare for possible disruptions, as the plant grapples with operational instability in an environment where overall Italian steel production is on the rise, highlighted by a 6% year-over-year increase reported by Federacciai. The situation calls for strategic reassessment from steel buyers, as the contrasting trends pose risks to fulfilling lateral demands within automotive and construction sectors. Amid market expansions in steel production elsewhere, monitoring Finarvedi’s recovery will be critical to navigating supply challenges in the upcoming months.