From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market Analysis: Growth Driven by Strategic Trade Initiatives and Plant Activity

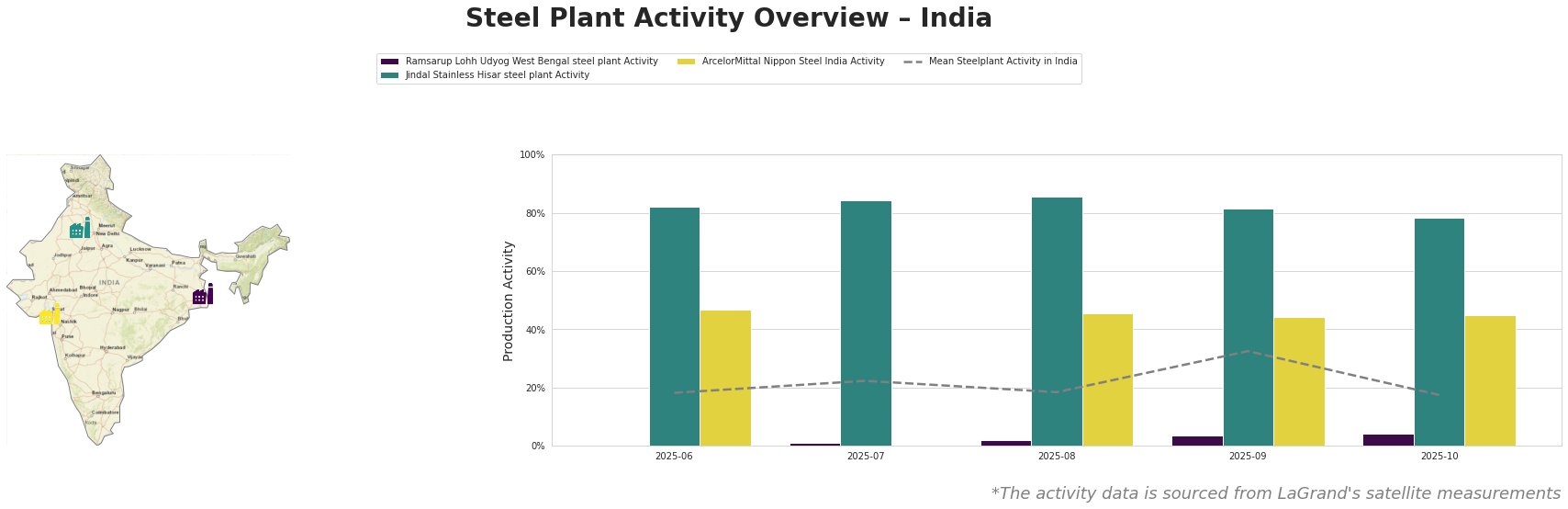

India is experiencing a robust growth trajectory in its steel market, largely stemming from strategic trade initiatives outlined in India-Russia Trade May Touch $100 Billion Before 2030, Says PM Modi and PM Modi-Putin Press Meet: India, Russia Agree To Turbocharge Economic Ties By 2030, Push For FTA. Concurrently, recent satellite data indicating a 33% activity spike in September 2025 (with a decrease to 17% in October) from the mean levels demonstrates the fluctuating dynamics of domestic production capacity closely tied to international trade efforts.

The Ramsarup Lohh Udyog West Bengal steel plant, primarily engaging in integrated processes including DRI, has seen a gradual increase in activity from 0.0% in June to 4.0% by October 2025. This steady growth may not directly correlate with the highlighted trade discussions but signals a slow recovery in operational efficiency.

In contrast, the Jindal Stainless Hisar plant has shown consistent productivity, reaching a peak of 86% in August before a slight drop to 78%. The sustained levels of activity could be indirectly linked to increased domestic steel demand as trade relations evolve and enhance logistics, particularly with projects under the INSTC corridor as discussed in the aforementioned news articles.

The ArcelorMittal Nippon Steel India facility reported varying levels of activity averaging around 45% during the latter months of 2025, which could imply stabilized operations in alignment with ongoing trade agreements but also warrants scrutiny due to decreased activity in September.

The overarching theme shows a Very Positive sentiment in the market, spurred by fresh trade dialogue between India and Russia aimed at achieving a substantial FTA. Procurement professionals should monitor the ongoing developments and consider securing quotas from the Jindal Stainless Hisar and Ramsarup Lohh Udyog facilities, both showing signs of increased production as trade enhancements take effect.

In conclusion, while there are indications of a strong economic environment for steel in India, fluctuations in specific plant activities signal that potential supply disruptions could arise, particularly from Ramsarup Lohh if inefficiencies persist. Strategic procurement should focus on Jindal as a reliable supplier amidst these evolving trade dynamics.