From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Surges on Energy Infrastructure Projects: EUROPIPE & Interpipe Drive Demand

Europe’s steel market demonstrates strong positive sentiment, propelled by growing demand for energy infrastructure. Activity at key European steel plants is fluctuating, driven by new projects. The increase in activity can be linked to announcements such as “EUROPIPE begins ETL182 pipeline project to bolster Germany’s energy supply,” and “EUROPIPE to become supplier of ETL182 pipeline components in Germany” which indicates a rising demand for large-diameter pipes. “Ukraine’s Interpipe supplies line pipes for Spanish biodiesel project” signals increasing demand for pipes used in green energy projects.

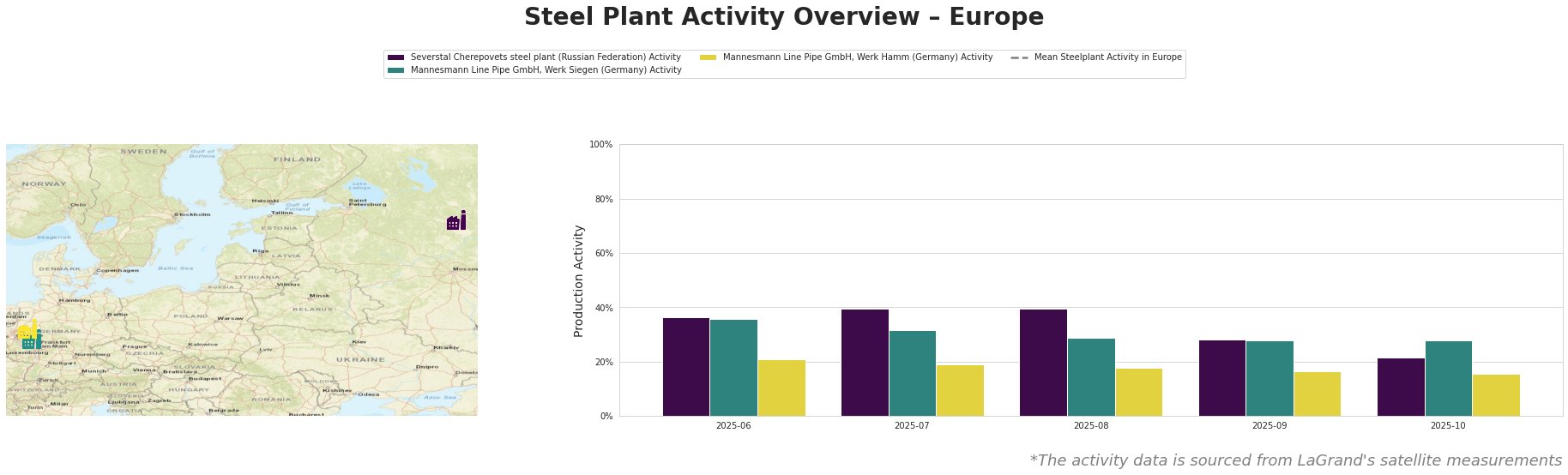

The Mean Steelplant Activity in Europe shows considerable fluctuation. Severstal Cherepovets steel plant activity peaked in July-August at 40% and then dropped to 22% by October. Mannesmann Line Pipe GmbH, Werk Siegen saw a decrease from June to August and stabilized at 28% by October. Mannesmann Line Pipe GmbH, Werk Hamm shows a steady decline, reaching 16% in September-October.

Severstal Cherepovets, a large integrated steel plant in the Vologda region of Russia, has a crude steel capacity of 12 million tonnes per annum, utilizing both BOF (9.8 mtpa) and EAF (2.2 mtpa) technologies. The plant produces a wide range of products, including slabs, bars, and large diameter pipes, serving various sectors such as energy and infrastructure. The observed activity drop from 40% in July-August to 22% in October cannot be directly linked to any of the provided news articles.

Mannesmann Line Pipe GmbH operates pipe production facilities in Siegen and Hamm, Germany. The Siegen plant’s activity decreased from 36% in June to 28% by October. The Werk Hamm plant steadily declined to 16% by September-October. While EUROPIPE secures new pipeline projects, no direct connection between these specific Mannesmann plants and these projects can be explicitly established based on the provided information.

The commencement of projects such as the ETL182 pipeline by EUROPIPE, as referenced in “EUROPIPE begins ETL182 pipeline project to bolster Germany’s energy supply” and “EUROPIPE to become supplier of ETL182 pipeline components in Germany”, suggests a sustained high demand for large-diameter line pipes. Simultaneously, Interpipe’s involvement in the Spanish biodiesel project (“Ukraine’s Interpipe supplies line pipes for Spanish biodiesel project”) confirms diversification of pipe demand related to green energy transition. Given EUROPIPE’s new contracts, steel buyers should proactively secure supply agreements for large-diameter pipes, anticipating potential lead time increases. While Mannesmann Line Pipe GmbH, Werk Siegen and Mannesmann Line Pipe GmbH, Werk Hamm show declining activity, the overall market sentiment indicates positive demand driven by projects undertaken by EUROPIPE and Interpipe, suggesting shifts in project allocation or regional demand variations rather than overall market downturn. Procurement professionals should actively monitor steel plant specific activity data, such as these to stay ahead of localized supply and demand dynamics and mitigate risks in their steel procurement strategies.