From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorway Steel Market: Activity Up Despite EU Ferro-Alloy Safeguards

Norway’s steel market demonstrates resilience despite potential headwinds from new EU trade measures. Recent activity levels at Norwegian steel plants have increased, but the imposition of “EU states to vote on TRQ, variable duty alloy safeguard,” “EU proposes TRQ to reduce ferro-alloy imports by 25 percent,” and “EC imposes safeguard measures on FeSi, SiMn, Mn alloys” may present challenges to producers in the region due to the inclusion of Norway and Iceland in these safeguards. These measures are designed to protect EU ferro-alloy producers but may indirectly impact Norwegian steelmakers. The following analysis explores activity trends and potential ramifications, although a direct cause-and-effect relationship between the news articles and the observed plant activity cannot be definitively established at this time.

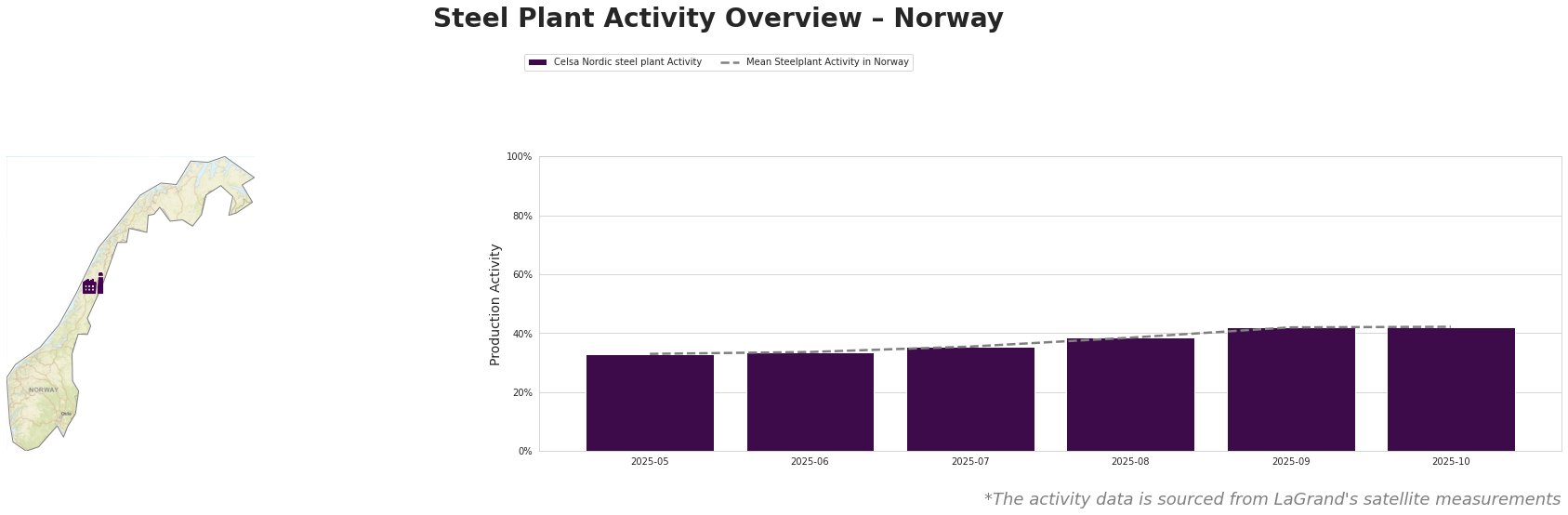

Observed Monthly Activity:

From May to October 2025, the Mean Steelplant Activity in Norway steadily increased from 33.0% to 42.0%. Similarly, the Celsa Nordic steel plant activity mirrored this trend, rising from 33.0% to 42.0% over the same period. Both the average and the individual plant reached their highest observed activity levels in September and October, indicating a robust production phase.

Steel Plant Name: Celsa Nordic steel plant

Celsa Nordic, located in Mo i Rana, operates a 700,000 tonne per annum Electric Arc Furnace (EAF) for crude steel production, specializing in semi-finished and finished rolled products such as billet, rebar, and wire rod for the building and infrastructure sectors. The plant holds ResponsibleSteel certification. Activity at Celsa Nordic increased from 33% in May 2025 to 42% in September and October 2025. This increase coincides with the period leading up to the EU’s implementation of safeguard measures on ferro-alloys. While a direct relationship cannot be definitively established, it’s possible the plant increased production in anticipation of potential disruptions or price increases related to the new trade barriers. The news articles “EU states to vote on TRQ, variable duty alloy safeguard,” “EU proposes TRQ to reduce ferro-alloy imports by 25 percent,” and “EC imposes safeguard measures on FeSi, SiMn, Mn alloys” all raise concerns about the availability and cost of essential alloys for steel production, potentially impacting Celsa Nordic.

Evaluated Market Implications

The EU’s safeguard measures on ferro-alloys present a potential risk of supply disruption and price volatility for Norwegian steel producers, even as activity has been increasing. The news articles “EU states to vote on TRQ, variable duty alloy safeguard,” “EU proposes TRQ to reduce ferro-alloy imports by 25 percent,” and “EC imposes safeguard measures on FeSi, SiMn, Mn alloys” explicitly mention the inclusion of Norway and Iceland in the safeguard measures. While 75% of traditional imports from these countries will continue duty-free, uncertainty remains regarding the impact on alloy availability and pricing. Given the exclusion of silicon metal from these measures, a potential strategy for Celsa Nordic and other Norwegian steelmakers may be to adjust their alloy mix to rely more heavily on silicon metal, if technically feasible for their product lines.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor ferro-alloy prices, particularly ferromanganese, ferrosilicon, ferrosilicomanganese, and ferrosilicomagnesium. Establish clear communication channels with suppliers to assess potential impacts from the new EU safeguards and their quotas. Consider diversifying supply sources, including those within the EU and outside the scope of the restrictions, where possible, to mitigate risks.

- Market Analysts: Track import/export data between Norway and the EU for the affected ferro-alloys to quantify the actual impact of the safeguards. Monitor the performance of Norwegian steel producers, such as Celsa Nordic, to assess whether their production levels are affected by alloy availability or pricing pressures. Also, analyze whether the companies shift into different alloy mixes to optimize prices.