From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGerman Steel Market: Salzgitter Delays Green Steel Plans Amidst Stable Plant Activity

Germany’s steel sector faces headwinds as decarbonization efforts are delayed, while plant activity shows mixed signals. Salzgitter’s postponement of its green steel project, as reported in “Salzgitter delays green steel plan amid economic, regulatory headwinds,” “Salzgitter postpones Green Steel plan amid economic and regulatory difficulties,” and “Salzgitter postpones Salcos Hydrogen Steel Project for three years,” introduces uncertainty into long-term supply projections. Satellite-observed activity levels at key steel plants show fluctuating but overall stable operations throughout the recent months, with some plants showing marked discrepancies to the average activity level.

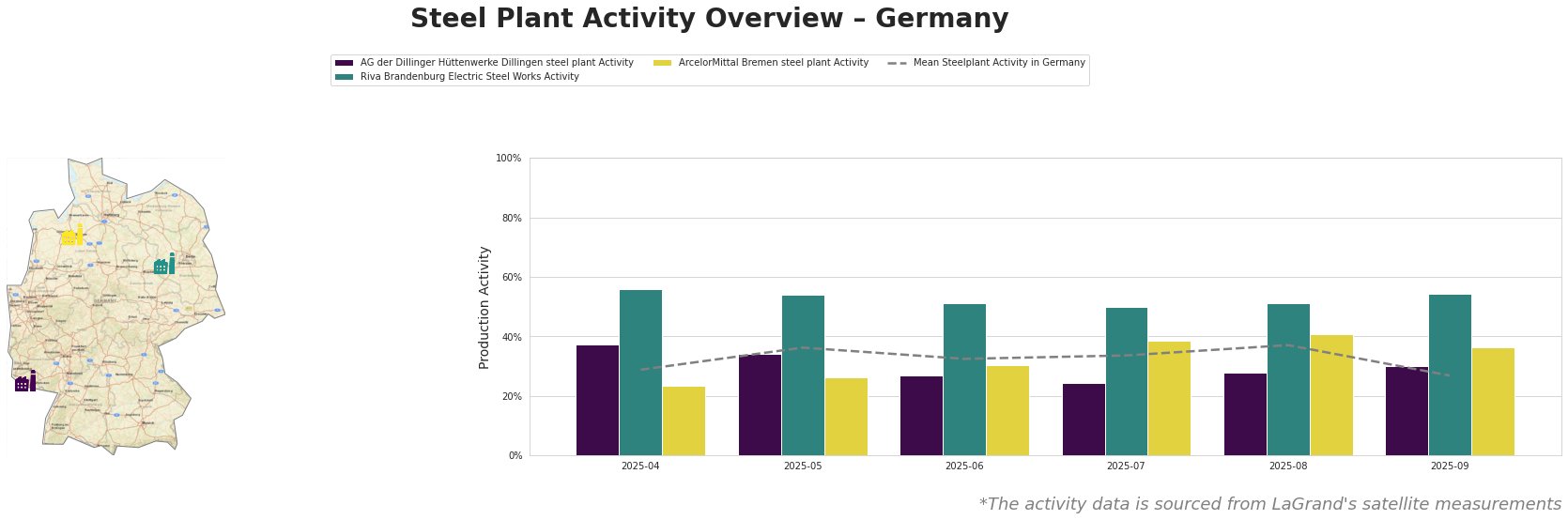

The mean steel plant activity in Germany fluctuated between 27% and 37% from April to September 2025. AG der Dillinger Hüttenwerke Dillingen steel plant activity mirrored this trend, ranging from 24% to 37%. Riva Brandenburg Electric Steel Works consistently operated well above the mean, ranging from 50% to 56%. ArcelorMittal Bremen steel plant activity was consistently below the mean, with values from 23% to 41%. No direct connection can be established between the activity levels and the Salzgitter news articles.

AG der Dillinger Hüttenwerke Dillingen steel plant, located in Saarland, operates using integrated (BF) processes with a crude steel capacity of 2760 ttpa (thousand tonnes per annum) primarily through BOF. Its product range includes various semi-finished and finished rolled products, serving sectors like automotive and energy. The plant’s activity fluctuated, dropping to 24% in July 2025, before recovering to 30% in September 2025. No direct connection between the plant’s activity and the Salzgitter news articles can be established.

Riva Brandenburg Electric Steel Works, situated in Brandenburg, relies on electric arc furnaces (EAF) for its 1800 ttpa crude steel production. Specializing in wire rod, rebar, and steel billets, its output supports the building, infrastructure, and transport sectors. Notably, the plant’s activity consistently remained above the German average, ranging from 50% to 56% between April and September 2025. No direct connection between the plant’s activity and the Salzgitter news articles can be established.

ArcelorMittal Bremen steel plant, based in Bremen, utilizes integrated (BF) processes to achieve a crude steel capacity of 3800 ttpa through BOF. Its production focuses on finished rolled products, including hot and cold-rolled coils, serving the automotive and construction industries. The plant’s activity level from April to September 2025 was consistently below the German mean, ranging from 23% to 41%. No direct connection between the plant’s activity and the Salzgitter news articles can be established.

Given Salzgitter’s delayed green steel investments announced in “Salzgitter postpones Salcos Hydrogen Steel Project for three years“, steel buyers should anticipate potential shifts in the availability of low-carbon steel options in the long term. Procurement strategies should be adapted to account for the delayed availability of green steel from Salzgitter, potentially requiring diversification of suppliers or adjustments to sustainability targets. Monitor future regulatory developments, as highlighted in “Salzgitter delays green steel plan amid economic, regulatory headwinds,” to assess their impact on steel production costs and market competitiveness.