From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Rebar Exports Surge Amidst Sheet/Plate Slowdown, Plant Activity Shifts

Asia’s steel market presents a mixed picture, with rising rebar exports contrasted by declining sheet/plate exports and fluctuating plant activity. As reported in “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025“, sheet and plate exports saw a significant decrease in August. Concurrently, the news “China’s Steel rebar Exports Surge in January–August 2025” and “China’s steel bar exports increase by 52.2 percent in January-August 2025” highlight a substantial increase in rebar and bar exports. The satellite data only provides plant-specific activity and no direct link to these overall developments could be established. “China’s semi-finished steel exports up 292% in January-August 2025” confirms a massive increase in semi-finished product exports

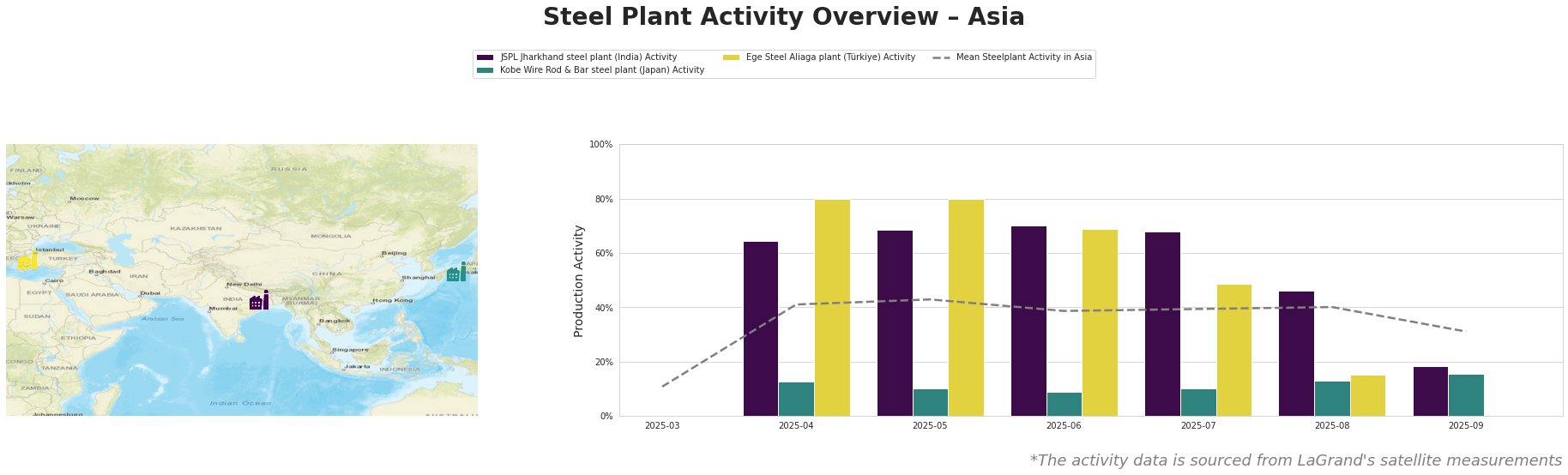

The mean steel plant activity across Asia, as observed via satellite, shows an overall fluctuating trend. From a low of 11% in March, it peaked at 43% in May, then decreased to 31% in September.

JSPL Jharkhand, Kobe Wire Rod & Bar, and Ege Steel Aliaga show substantial individual deviations.

JSPL Jharkhand steel plant, located in Jharkhand, India, operates with a 1.6 million tonnes per annum (ttpa) EAF-based crude steel capacity and produces semi-finished products, specifically wire rod and bar. Activity at JSPL Jharkhand has declined significantly in the past two months from a high of 70% in June, dropping to 46% in August and further to 18% in September. This sharp decline does not have a direct and clear connection to the provided news articles, thus the reason for the reduction cannot be determined from the provided information.

Kobe Wire Rod & Bar steel plant, situated in Kansai, Japan, is an integrated steel plant with a 1.2 million ttpa BOF-based crude steel capacity and a 1.533 million ttpa BF-based iron capacity. It manufactures semi-finished and finished rolled products, including wire rod and bar. Activity at the Kobe plant remained relatively stable and low throughout the observed period, fluctuating between 9% and 16%. No direct connections can be established between the observed relatively low activity levels and the provided news articles.

Ege Steel Aliaga plant, based in İzmir, Türkiye, is an EAF-based steel plant with a 2 million ttpa crude steel capacity, producing rebar and wire rod. Activity at Ege Steel Aliaga experienced a sharp decline, dropping from 80% in April/May to 0% in September. This drastic reduction does not appear to be related to the provided news articles, and therefore the reason for this reduction cannot be determined from the provided information.

Given the surge in Chinese semi-finished steel exports reported in “China’s semi-finished steel exports up 292% in January-August 2025“, procurement professionals should proactively:

- Assess Inventory Levels: Evaluate current stock of steel sheet/plate, anticipating potential supply chain adjustments due to decreased Chinese exports in the short term, as indicated by “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025“.

- Monitor Rebar Pricing: Closely monitor rebar price trends. The news “China’s Steel rebar Exports Surge in January–August 2025” indicates a potential for increased supply, which might exert downward pressure on prices. However, other factors like regional demand and production costs should also be considered.

- Evaluate alternative Suppliers: Identify and evaluate alternative suppliers for steel products, especially for sheet/plate, to mitigate potential risks associated with supply chain disruptions. This diversification strategy can provide a buffer against fluctuations in specific markets.

- Evaluate semi-finished steel supply: Due to very high exports of semi-finished steel from China, consider that supply disruptions for finished product from China could be imminent.