From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Downturn: Nvidia Chip Ban & Activity Slowdown Impact Supply

In Asia, the steel market faces increasing headwinds due to geopolitical tensions and shifting demand patterns, as indicated by recent satellite-observed activity changes at key steel plants. Nvidia’s struggles in the Chinese market, as reported in “China Bans Top Tech Firms From Buying Nvidia Chips, Report Says“, and “Exclusive-Nvidia’s new RTX6000D chip for China finds little favour with major firms, sources say“, suggest potential downstream impacts on steel demand. While a direct correlation between these news events and observed steel plant activity is not immediately apparent, the timing warrants attention.

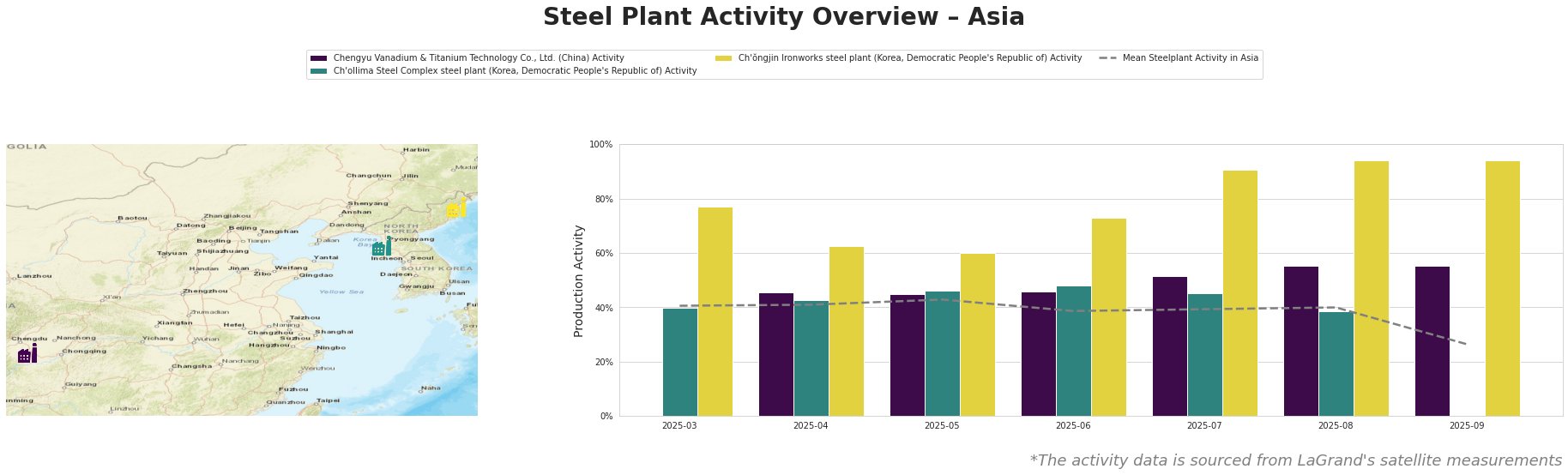

Overall, the mean steel plant activity in Asia dropped significantly to 26% in September, a sharp decline from the 40% level observed in August.

Chengyu Vanadium & Titanium Technology Co., Ltd., a Sichuan-based integrated steel producer with a 6000ktpa BOF capacity focusing on vanadium-containing hot-rolled ribbed steel bars, maintained a consistent activity level from July to September, peaking at 55% in August and September. This stability is in contrast to the overall market downturn but no direct relationship to the Nvidia-related news could be established.

The Ch’ollima Steel Complex, located in South Pyongan, North Korea, produces plates and wire rod and has a capacity of 760ktpa. The plant saw a significant drop in activity from 48% in June to 39% in August. Data is missing for September. No connection could be established to the Nvidia news.

Ch’ŏngjin Ironworks, based in North Hamgyeong, North Korea, with a 2000ktpa crude steel capacity and utilizing DRI and BOF processes, reached its highest activity levels in August and September (94%). This high activity level is in contrast to the overall decline in Asia. Again, no connection can be established to the Nvidia news.

The combination of declining average steel plant activity in Asia and geopolitical uncertainty creates a potentially volatile environment. Steel buyers should closely monitor price fluctuations and consider diversifying their supply sources. The ban on Nvidia chips in China, as detailed in “China Bans Top Tech Firms From Buying Nvidia Chips, Report Says“, coupled with lukewarm demand for the RTX6000D, as noted in “Exclusive-Nvidia’s new RTX6000D chip for China finds little favour with major firms, sources say“, could lead to decreased demand for specific steel products used in data centers and related infrastructure. Procurement strategists should evaluate their exposure to these sectors and explore alternative sourcing options. Given the consistently high activity at Ch’ŏngjin Ironworks, buyers should investigate this source, keeping in mind geopolitical risks associated with the region.