From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Downward Pressure: Italian Rebar Weakness Persists Amid Stable-to-Lower Longs

Europe’s steel market faces downward pressure, particularly in the Italian rebar sector, coinciding with a pessimistic outlook. The situation is reflected in the news that “Rebar prices in Northern Italy are under pressure, the domestic market is expanding downward” and “European longs market stable to lower amid pessimistic mood“. These market reports suggest potential regional weakness, especially in Northern Italy, but no direct relationship to observed activity changes at specific steel plants can be established based on the provided data.

Here is the table with monthly aggregated activities:

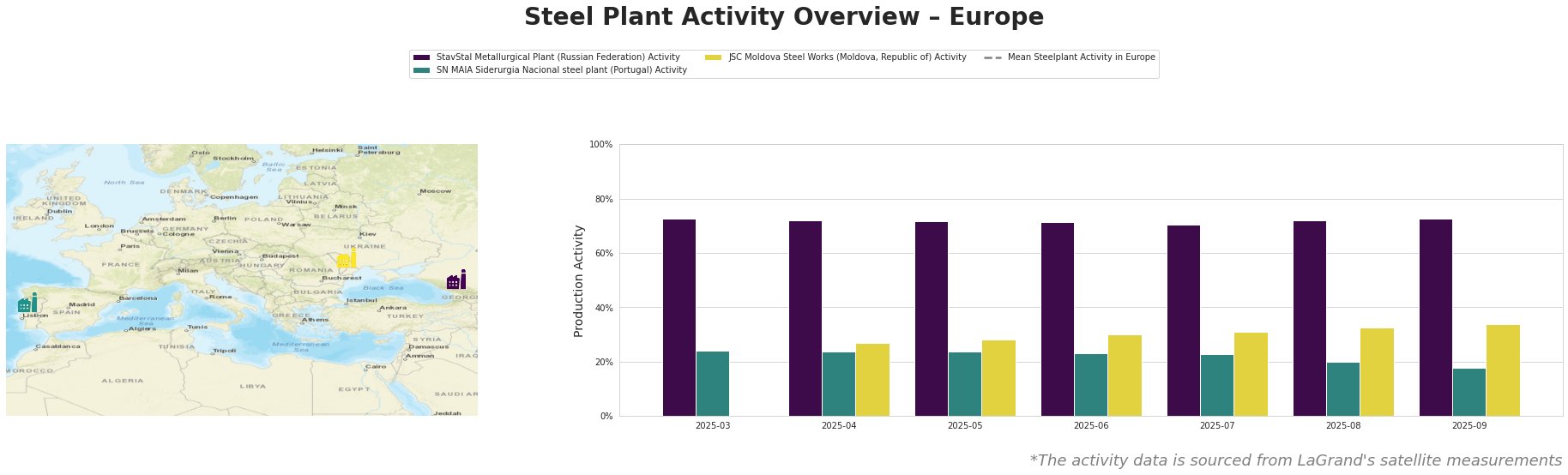

The table indicates stable activity at StavStal Metallurgical Plant while SN MAIA Siderurgia Nacional steel plant experiences a noticeable decline. JSC Moldova Steel Works shows a steady increasing trend. The “Mean Steelplant Activity in Europe” is consistently a large negative number, likely an artifact of the data processing and not representative of actual trends.

StavStal Metallurgical Plant, located in Stavropol Krai, Russia, is an EAF-based mill with a 500ktpa crude steel capacity, producing rebar and wire rod. Its activity has remained relatively stable, fluctuating between 70% and 73% from March to September. Given the stable activity levels, no direct connection to the European market news regarding price declines can be established.

SN MAIA Siderurgia Nacional steel plant, situated in Porto, Portugal, operates a 600ktpa EAF-based steel plant focused on rebar production. The plant’s activity shows a gradual decline, from 24% in March-May to 18% in September. This 6% decrease might suggest a potential response to the downward pricing pressure noted in the Italian and broader European markets, but a direct connection to a specific news event cannot be explicitly established based on the provided data.

JSC Moldova Steel Works, located in Transnistria, Moldova, has a 1000ktpa EAF capacity, producing rebar, wire rod, and billet. The plant’s activity shows a consistent increase from 27% in April to 34% in September, contrasting the general market pessimism. This increase could be due to factors specific to the plant or regional demand, and no direct connection to the provided news articles can be established.

Given the reports of declining rebar prices, particularly in Northern Italy as noted in “Rebar prices in Northern Italy are under pressure, the domestic market is expanding downward“, and the general pessimistic sentiment in the European long steel market described in “European longs market stable to lower amid pessimistic mood“, procurement professionals should:

- Prioritize Short-Term Contracts: Given the downward pressure on prices, particularly in Northern Italy, avoid long-term commitments and focus on securing short-term contracts to capitalize on potential further price declines.

- Monitor Southern European Markets Closely: While Northern Italy faces downward pressure, “Rebar prices in Italy are rising amid reports of new deals and declining supply; traders are taking a wait-and-see attitude” suggests that Southern Italy’s finished steel demand is reportedly good. Closely monitor price developments and potential supply shifts in Southern Europe.

- Diversify Supply Sources: Given the uncertainty and potential for regional disparities, diversify supply sources to mitigate risks associated with localized market fluctuations. Explore options beyond Northern Italy to ensure supply stability.