From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: US Tariffs and Production Slowdowns Impact Outlook

Asia’s steel market is facing downward pressure due to the potential impact of US tariff disputes and observed production slowdowns at key steel plants. This negative sentiment is driven by uncertainty surrounding US trade policy, as indicated by the news articles “Wie Trump die Wirtschaft umbaut – und wie die Märkte darauf reagieren,” “Trump’s tariff push overstepped presidential powers, appeals court says,” “US-Gericht erklärt Donald Trumps Strafzölle für illegal,” “US-Berufungsgericht erklärt Großteil von Trumps Zöllen für unzulässig,” “Experten-Analyse: US-Zölle: «Chancen vor Supreme Court sind eher gering»,” “FAQ: Wie es mit den US-Zöllen nach dem Gerichtsentscheid weitergeht,” and “US court rules against Trump emergency tariffs.” The articles highlight the legal challenges and potential reversals of US tariffs, creating market instability. However, no direct relationship could be explicitly established between these news articles and the satellite-observed changes in activity levels at the selected steel plants.

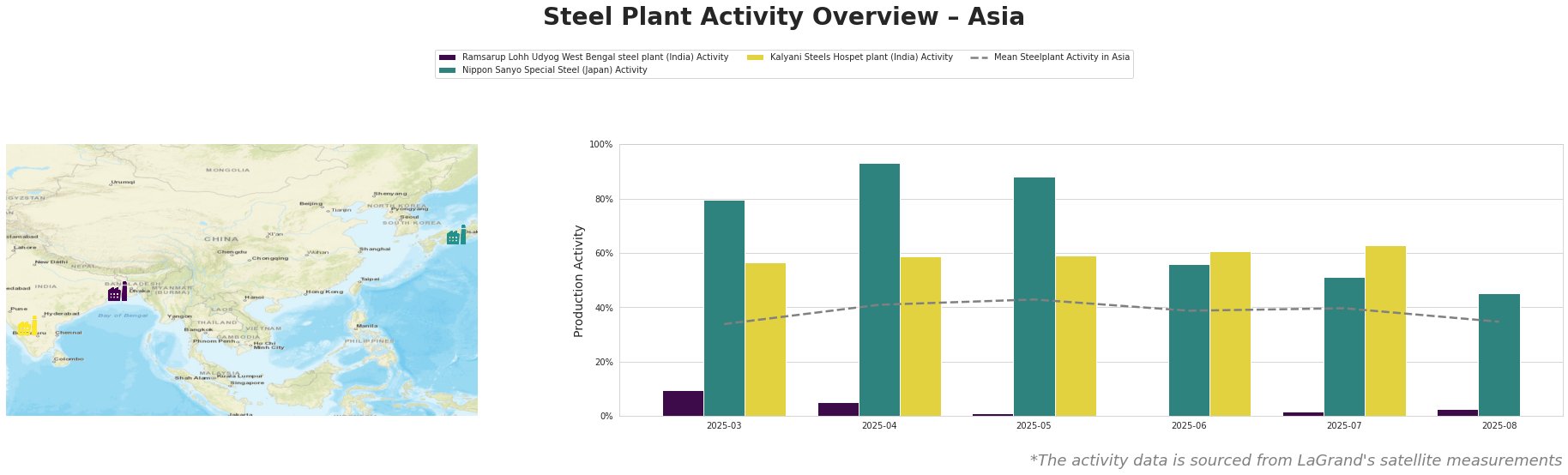

Measured Activity Overview

The mean steel plant activity in Asia has fluctuated, peaking at 43% in May and declining to 35% by August. Ramsarup Lohh Udyog in West Bengal, India, consistently operates far below the Asian mean, with activity hovering near 0% from May to June, showing a slight rise to 3% in August. Nippon Sanyo Special Steel in Japan shows significantly higher activity than the mean, but has experienced a notable decline from a peak of 93% in April to 45% in August. Kalyani Steels Hospet plant in India shows more consistent activity levels, fluctuating between 57% and 63% and remaining above the Asian average.

Ramsarup Lohh Udyog West Bengal steel plant, an integrated steel plant with BF and DRI processes and a 70-tonne EAF, producing billets, transmission lines, and wires for the energy sector, displays significantly lower activity than the Asian average. The plant’s activity remained very low from May to August, reaching a low of 0% in June. No direct connection could be established with the named news articles.

Nippon Sanyo Special Steel, an electric steel plant in the Kansai region of Japan with two EAFs (1×150-tonne, 1×60-tonne), producing semi-finished and finished rolled products for various sectors including automotive and energy, has experienced a significant decline in activity. The activity decreased from 93% in April to 45% in August. No direct connection could be established with the named news articles.

Kalyani Steels Hospet plant, an integrated steel plant in Karnataka, India, with BF and DRI processes and a BOF and EAF, producing rolled bars and rounds for automotive and infrastructure sectors, demonstrates relatively stable activity levels above the Asian mean. Activity remained between 57% and 63% during the observed period. No direct connection could be established with the named news articles.

Evaluated Market Implications

Given the potential for continued trade uncertainty stemming from the US tariff situation, and the recent production slowdowns at Nippon Sanyo Special Steel, steel buyers should consider the following:

- Potential Supply Disruptions: The significant drop in activity at Nippon Sanyo Special Steel (Japan) could lead to supply constraints for specific steel products, particularly those used in the automotive and energy sectors.

- Recommended Procurement Actions: Buyers sourcing steel from Nippon Sanyo Special Steel should proactively engage with the supplier to understand the reasons behind the production decline and potential impact on delivery schedules. Diversification of suppliers, particularly for products sourced from this plant, should be considered to mitigate potential disruptions. For buyers dependent on steel from the Indian market, monitor Ramsarup Lohh Udyog’s output.