From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Construction Downturn Hits German Production Despite Positive Sentiment

Europe’s steel market faces headwinds as construction sector weakness impacts German manufacturing and steel production, despite overall economic sentiment showing signs of improvement. The downturn in construction, as highlighted in “Euro area construction output down 0.8 percent in June 2025 from May” and “Construction in the European Union fell by 0.5% m/m in June,” appears to be negatively impacting steel production levels, particularly in Germany, as indicated by “Improving German economic sentiment misses out manufacturing, construction” and “The improvement in economic sentiment in Germany is not reflected in manufacturing and construction.” While a direct causal link cannot be definitively established through the provided satellite data, the trends suggest a potential correlation.

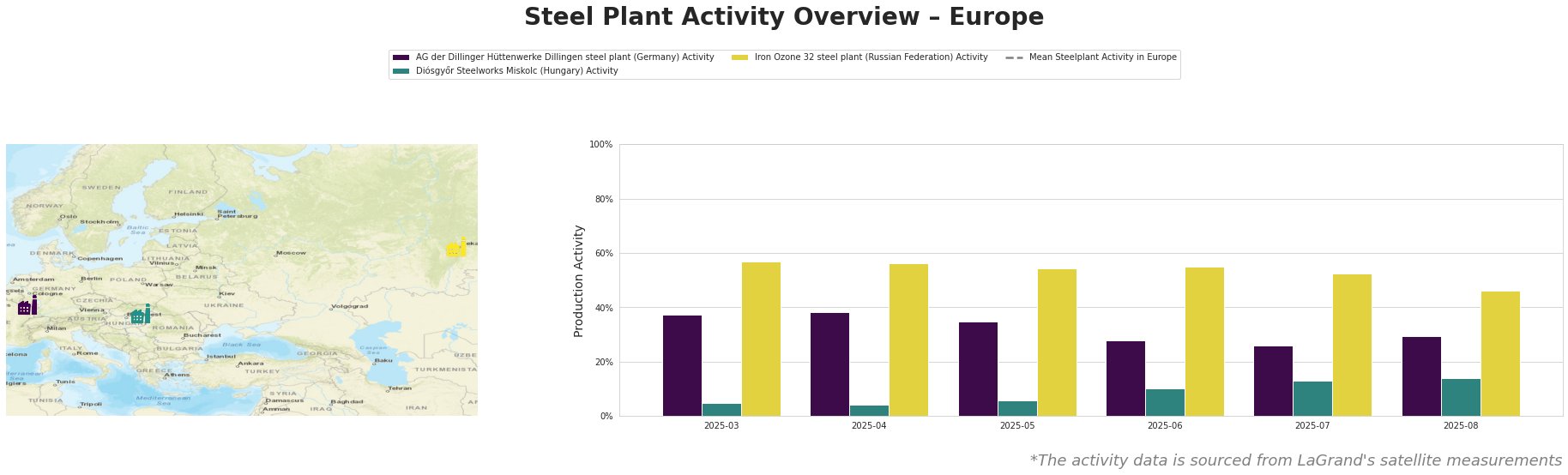

Overall, the mean steel plant activity in Europe has fluctuated throughout the observed period, peaking in May and July. AG der Dillinger Hüttenwerke’s activity has decreased notably since March, with a significant drop from 35% in May to 26% in July and a slight recovery to 30% in August. Diósgyőr Steelworks shows a steady increase in activity from a low base. Iron Ozone 32 steel plant has experienced a consistent decline from 57% in March to 46% in August, although it remains the highest performing plant in the sample.

AG der Dillinger Hüttenwerke, an integrated steel plant in Germany with a 2.76 million tonne BOF capacity producing mainly heavy-plate products for the automotive, building, energy, and machinery sectors, experienced a decline in activity from 35% in May to 26% in July. This drop could be correlated with the weakening construction sector in Germany reported in “Improving German economic sentiment misses out manufacturing, construction,” given its end-user sector exposure. A subsequent rise to 30% in August shows a slight production activity recovery.

Diósgyőr Steelworks in Hungary, an EAF-based plant with a 550,000-tonne crude steel capacity, primarily focused on construction steels, has seen a continuous increase in activity, rising from 5% in March to 14% in August. This increase could align with the reported construction output growth in some EU countries, as stated in “Construction in the European Union fell by 0.5% m/m in June,” where Hungary is explicitly named as seeing a decrease in construction output. However, no direct connection can be firmly established.

Iron Ozone 32 steel plant, an EAF-based plant in Russia with a 1.25 million tonne capacity focused on billet production for the energy sector, showed a steady decline from 57% in March to 46% in August. No direct links to the provided news articles can be established for this decline.

Given the downturn in the German construction sector and the corresponding decrease in activity at AG der Dillinger Hüttenwerke, steel buyers should:

- Diversify supply sources for heavy plate: Mitigate potential disruptions by increasing procurement from alternative suppliers, especially those less exposed to the struggling German construction market.

- Closely monitor German economic indicators: Track the IFO Business Climate Index and construction output data for early signs of recovery or further decline, which could impact steel availability and pricing.

- Factor in potentially increased lead times: The reduced activity at AG der Dillinger Hüttenwerke could lead to longer lead times for heavy plate products. Adjust procurement timelines accordingly.

Market analysts should:

- Evaluate the impact of construction slowdown on German steel demand: Further research is needed to quantify the precise impact of the construction sector’s weakness on overall German steel consumption.

- Assess the competitiveness of European steel producers: Analyze how increased production costs (e.g., energy, raw materials) and weakening demand are affecting the competitiveness of European steel mills compared to global competitors.