From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Dips Amidst Uncertain Oil Outlook

In Asia, steel plant activity shows signs of recent fluctuation. This report examines satellite-observed activity alongside recent energy market forecasts. While no direct connections can be established between the news and Asian steel plant activity, global energy market sentiments reflected in articles like “Opec cuts US supply view, Brazil to lead in 2026“, “US EIA forecasts crude oil to average below $60 by 2026” and “IEA trims global oil demand forecasts again” may indirectly influence broader economic activity impacting steel demand.

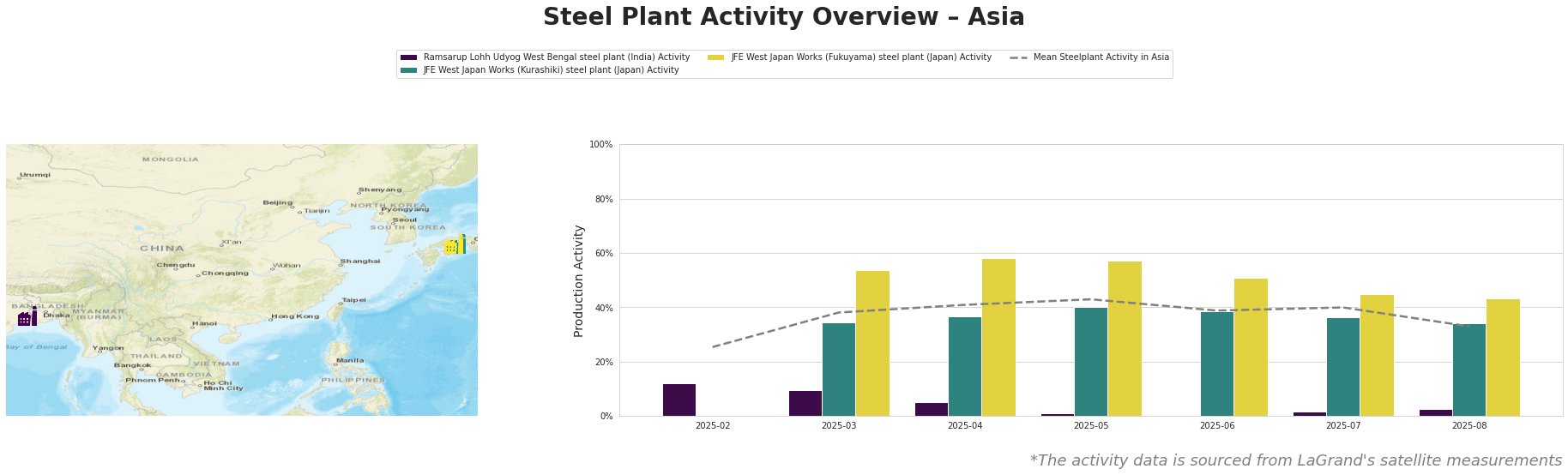

Here’s a summary of recent steel plant activity:

The Mean Steelplant Activity in Asia peaked in May 2025 at 43.0% and decreased to 33.0% by August 2025.

Ramsarup Lohh Udyog, a West Bengal-based steel plant in India with a capacity of 482 ttpa iron (including 182 ttpa DRI and 300 ttpa BF), and a 70-tonne EAF, producing billets and wires for the energy sector. The plant’s activity has been consistently below the Asian average, reaching a low of 0% in June 2025. The plant’s activity showed marginal rise to 3% in August, but it is too early to call this a trend. No direct link between its activity and the named news articles could be established.

JFE West Japan Works (Kurashiki) is an integrated steel plant in the Chūgoku region of Japan, possessing a crude steel capacity of 10,000 ttpa and relying on BF/BOF processes. The plant manufactures hot/cold rolled sheets, coated/electrical sheets, plates, H-profiles, rails, bars, wire rods and UOE pipes for automotive, infrastructure, energy, and transport sectors. Its activity shows a peak in May 2025 (40%) followed by a decrease to 34% in August, slightly above its measured low in March (35%). No direct link between its activity and the named news articles could be established.

JFE West Japan Works (Fukuyama), similar to the Kurashiki plant, is an integrated BF/BOF steel plant with a higher crude steel capacity of 13,000 ttpa. Its product range includes hot/cold rolled sheets, coated/electrical sheets, plates, H-profiles, rails, bars, wire rods and UOE pipes. This plant recorded the highest activity among the observed plants peaking in April and May (57% and 58% respectively). The activity, however, fell to 43% in August 2025. No direct link between its activity and the named news articles could be established.

Given the overall decrease in Asian steel plant activity, combined with uncertain energy market outlooks as reflected in articles “Opec cuts US supply view, Brazil to lead in 2026“, “US EIA forecasts crude oil to average below $60 by 2026” and “IEA trims global oil demand forecasts again“, procurement professionals should:

- Closely monitor the JFE West Japan Works (Fukuyama) for potential supply adjustments if the observed decrease in activity continues.

- Consider diversifying sources for billets and wires, given the consistently low activity at Ramsarup Lohh Udyog.