From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Reacts Positively to US Tariff Delay; Plant Activity Shows Mixed Trends

The Asian steel market exhibits a positive sentiment following a delay in US tariffs on Chinese goods, as detailed in “Marktbericht: Anleger freuen sich über Zoll-Aufschub.” Although positive, this sentiment does not translate directly into a correlating surge in all plant activity, as observed via satellite. More complex trends are at play with activity levels varying by plant.

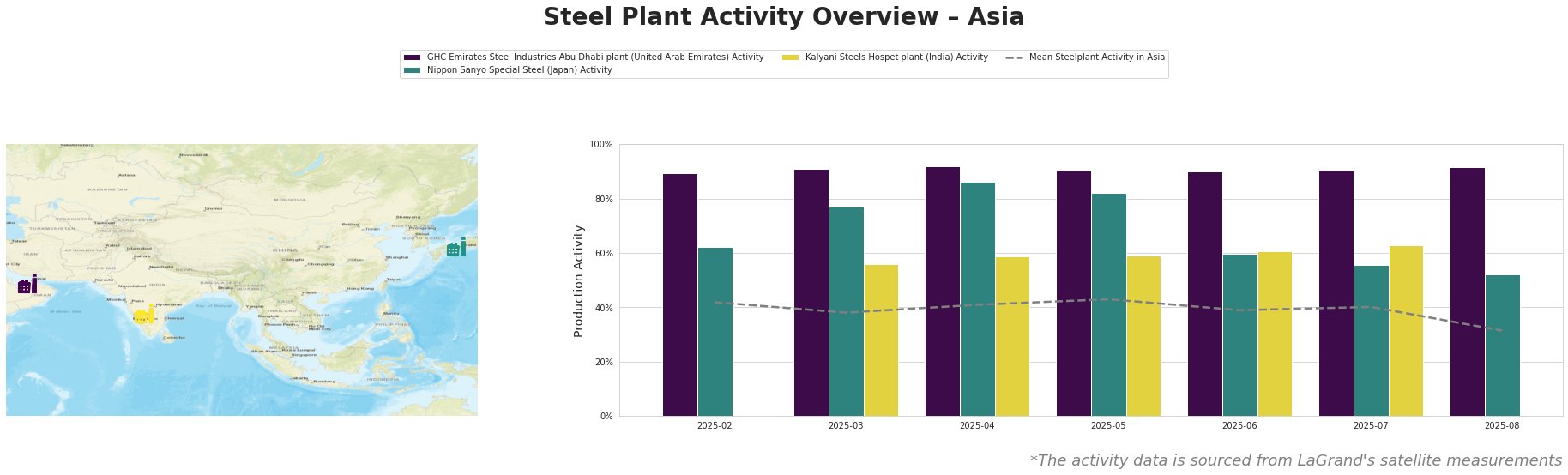

Steel Plant Activity Levels in Asia

The mean steel plant activity in Asia peaked in May 2025 at 43% and experienced a notable drop to 31% by the end of August. GHC Emirates Steel Industries in Abu Dhabi consistently operated at high activity levels, above 90% throughout the observed period. Nippon Sanyo Special Steel in Japan saw a gradual increase in activity from February to April (62% to 86%), followed by a decline to 52% in August. Kalyani Steels Hospet plant in India showed relatively stable activity between 56% and 63% from March to July, with no data available for February or August.

GHC Emirates Steel Industries Abu Dhabi plant

GHC Emirates Steel Industries in Abu Dhabi, a DRI-based integrated steel plant with a 3.5 million tonnes per annum (ttpa) EAF crude steel capacity, maintained a consistently high activity level, ranging from 90% to 92%, throughout the observed period. This suggests a stable production output of rebar, wire rod, and heavy sections for the automotive, construction, and energy sectors. No immediate impact from US tariff changes, as discussed in “Trumps US-Zölle im Liveticker: Trump verschiebt Zölle auf chinesische Waren um 90 Tage“, is directly observable on this plant’s activity.

Nippon Sanyo Special Steel

Nippon Sanyo Special Steel, an EAF-based plant in the Kansai region of Japan with a 1.596 ttpa crude steel capacity, produces billets, rolled products, tubes, and bars for various sectors. Plant activity declined from 86% in April to 52% in August. It is uncertain whether the tariff delay described in “Marktbericht: Anleger freuen sich über Zoll-Aufschub” has any influence on the recent drop of activity.

Kalyani Steels Hospet plant

Kalyani Steels Hospet plant, an integrated BF and DRI-based facility in Karnataka, India, has a crude steel capacity of 860 ttpa producing rolled and machined bars. The plant’s activity remained relatively stable between 56% and 63% from March to July. No direct correlation can be established between this stable activity and the news articles provided.

Evaluated Market Implications

Despite the positive market sentiment driven by the US tariff delay, the observed decline in overall Asian steel plant activity (from 43% in May to 31% in August) warrants careful monitoring. The “Marktbericht: Anleger freuen sich über Zoll-Aufschub” highlights investor optimism, but real-world production levels, as indicated by satellite data, show a mixed picture.

- Potential Supply Disruptions: The notable drop in activity at Nippon Sanyo Special Steel in Japan from April to August could potentially impact the supply of specialized steel products for the automotive, tooling, and machinery industries.

- Recommended Procurement Actions: Steel buyers who rely on products from Nippon Sanyo should actively engage with their suppliers to understand the reasons behind the production decrease and assess potential delivery delays. Consider diversifying sourcing to mitigate potential disruptions, especially if the decline continues.

- Additional Recommendation: Closely monitor US inflation data, as described in “US-Inflation stagniert trotz Zollkonflikten bei 2,7 Prozent” because this data could influence the Federal Reserve’s interest rate decisions. It is uncertain how the rates could effect plant activity and steel product costs.