From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Demand Drives Turkish Imports: European Plant Activity Shows Mixed Signals

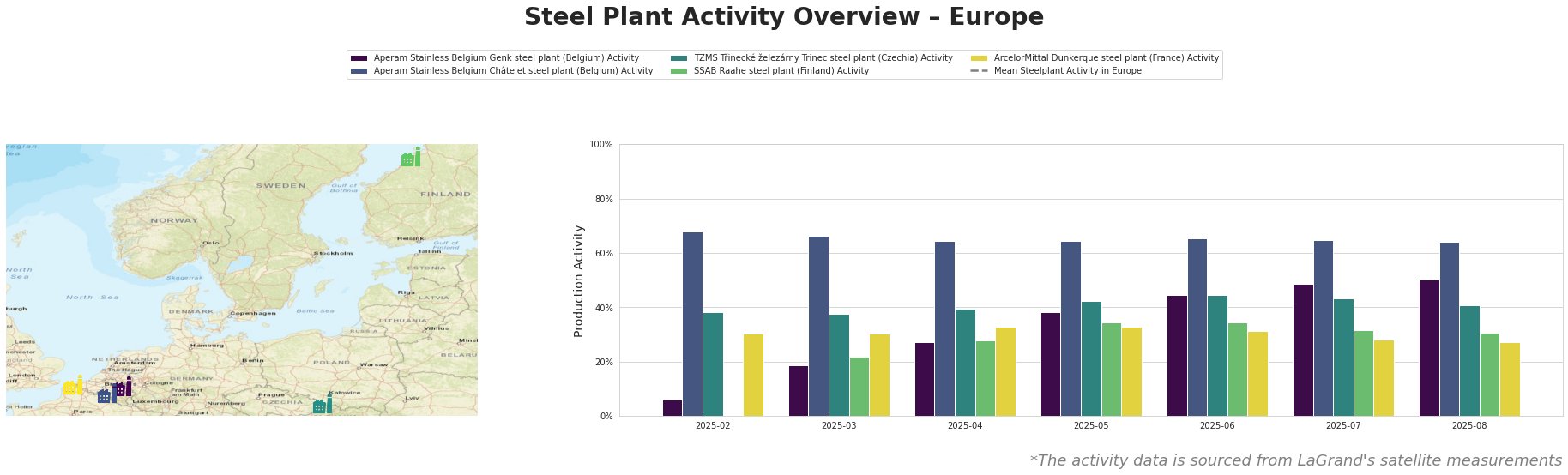

Europe’s steel market is experiencing a complex interplay of factors, with increased Ukrainian demand impacting import patterns in Turkey, while observed steel plant activity across Europe shows mixed trends. The increase in Turkish billet imports from Ukraine, as highlighted in “Turkey increased imports of billets from Ukraine by 70.6% year-on-year during January–June,” may be related to overall consumption of metal products in Ukraine in January–July as indicated in “Consumption of metal products in Ukraine in January–July increased to 2.3 million t“. Satellite data of European steel plant activities does not seem to directly reflect the observed changes reported in these articles.

The mean activity level in Europe does not provide meaningful data due to data anomaly.

The Aperam Stainless Belgium Genk steel plant, an EAF-based producer with a capacity of 1.2 million tons of crude steel, primarily producing stainless steel slabs and cold-rolled products, has shown a consistent increase in activity from 6% in February to 50% in August.

The Aperam Stainless Belgium Châtelet steel plant, another EAF-based stainless steel producer with a 1 million ton capacity, has maintained a relatively stable activity level, fluctuating between 64% and 68% over the observed period.

The TZMS Třinecké železárny Trinec steel plant in Czechia, an integrated BF-BOF steel plant with a 2.8 million ton capacity producing a range of products including rails and billets, showed relatively stable activity between February and August, ranging from 38% to 45%.

The SSAB Raahe steel plant in Finland, an integrated BF-BOF steel plant with a 2.6 million ton capacity producing hot-rolled coil and billets, has shown a fluctuating activity level, peaking at 34% in May and subsequently decreasing to 31% in August.

The ArcelorMittal Dunkerque steel plant in France, an integrated BF-BOF steel plant with a 6.75 million ton capacity producing slabs and hot-rolled products, has exhibited a gradual decline in activity from 30% in February/March to 27% in August.

The news article “Turkey’s slab imports up by 5.3 percent in H1 2025” highlights Turkey’s increased reliance on slab imports, particularly from Russia, but no explicit link to the activity levels of the ArcelorMittal Dunkerque plant could be established from the available data. It is possible that increased imports may offset any potential supply disruptions, but data limitations prevent definitive conclusions.

Given the increased billet imports from Ukraine to Turkey reported in “Turkey increased imports of billets from Ukraine by 70.6% year-on-year during January–June” amid increasing consumption of metal products in Ukraine as reported in “Consumption of metal products in Ukraine in January–July increased to 2.3 million t“, steel buyers should diversify their billet sourcing and monitor Ukrainian export trends closely. Specifically, European buyers should investigate alternative suppliers to mitigate potential risks associated with shifts in Ukrainian export strategies.