From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Signals Strength: ArcelorMittal Price Hikes & Plant Activity Divergence

The Asian steel market presents a mixed outlook. Activity data suggests potential fluctuations, while price pressures in Europe may create opportunities in Asia. “Global prices for hot-rolled coil came under pressure in most regions in July,” highlighting the price volatility in the region. However, a direct connection between this article and specific plant activity changes in Asia cannot be explicitly established based on the provided information. Furthermore, “ArcelorMittal increases northern Europe coil prices again: sources” indicates strengthening prices in Europe, which could indirectly impact Asian export dynamics, though no direct link to Asian plant activity is immediately apparent.

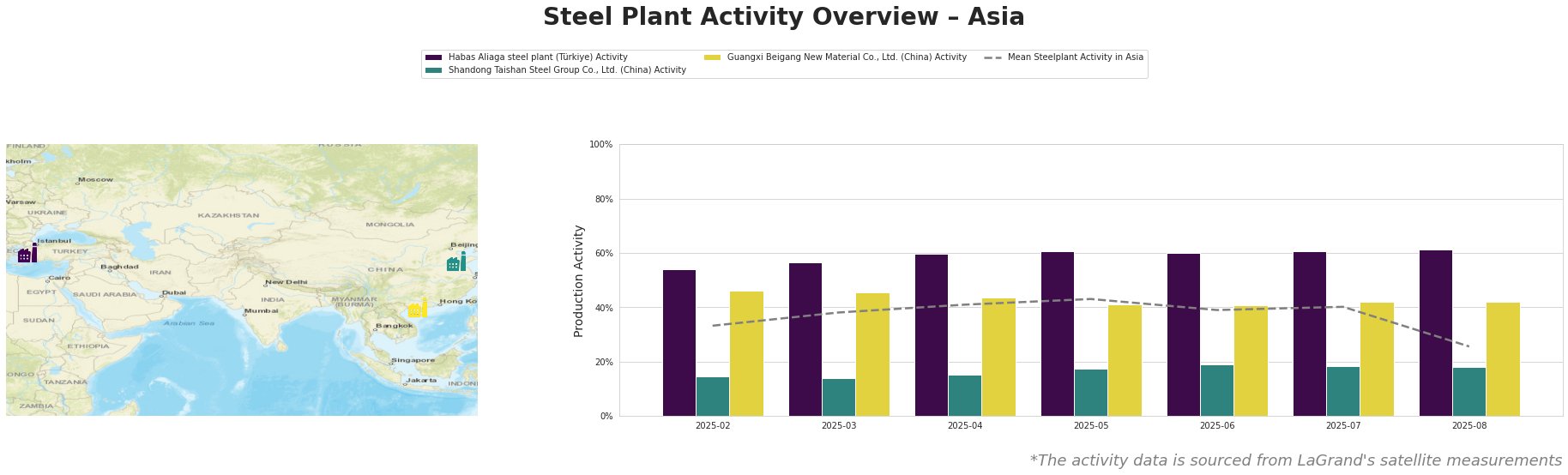

The mean steel plant activity in Asia shows a significant drop in August to 26.0% from 40.0% in July. Habas Aliaga steel plant in Türkiye consistently exhibits higher-than-average activity, holding steady at 61.0% from May to August. Shandong Taishan Steel Group Co., Ltd. in China has relatively low activity, ranging between 14.0% and 19.0%. Guangxi Beigang New Material Co., Ltd. in China shows more consistent activity, fluctuating between 41.0% and 46.0%. The sharp drop in the overall mean activity in Asia is notable. No direct links could be established between the news articles and the satellite-observed activity data.

Habas Aliaga, located in İzmir, Türkiye, primarily uses EAF technology to produce 4.5 million tonnes per annum (ttpa) of crude steel, focusing on semi-finished and finished rolled products like billets, slabs, and hot rolled coil. Its activity remained consistently high at 61% from May to August, despite the overall Asian average dropping significantly in August. This suggests a stable or increasing demand for its products in its served markets.

Shandong Taishan Steel Group Co., Ltd., situated in Shandong, China, operates an integrated BF steelmaking process with a crude steel capacity of 5 million ttpa. The plant produces finished rolled products like hot-rolled coil and cold-rolled coil. Its activity levels have remained relatively low and stable throughout the observed period, fluctuating between 14% and 19%. This suggests potential production adjustments or market-specific challenges.

Guangxi Beigang New Material Co., Ltd., located in Guangxi, China, uses both BF and EAF processes, with a crude steel capacity of 3.4 million ttpa and a ferronickel capacity of 3.4 million ttpa. The plant produces hot rolled coil and cold rolled coil. The plant’s activity has remained relatively stable, suggesting consistent production levels, even with the overall market fluctuations.

The drop in average Asian steel plant activity, combined with the “ArcelorMittal increases northern Europe coil prices again: sources” article, suggests a potential shift in global steel trade dynamics. The European price increase, partly driven by import restrictions, may make Asian steel exports more attractive.

Evaluated Market Implications and Procurement Actions:

- Potential Supply Disruptions: The significant decrease in average Asian steel plant activity in August may indicate potential supply disruptions in the coming months.

- Recommended Procurement Actions: Given ArcelorMittal’s price increases in Europe and the potential for reduced Asian production, steel buyers should:

- Diversify Sourcing: Explore alternative suppliers, particularly those less affected by production cuts, to mitigate risks associated with supply disruptions. Consider increasing procurement from Habas Aliaga, given its stable, high activity.

- Monitor Chinese Export Prices: Closely monitor export prices from Shandong Taishan Steel Group Co., Ltd. and Guangxi Beigang New Material Co., Ltd., as they may become more competitive due to the European price increases, despite the observed lower-than-average activity for some of the producers.

- Secure Forward Contracts: Negotiate and secure forward contracts with key suppliers to lock in current prices and guarantee supply, anticipating potential price increases due to the shifts in global dynamics.