From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEU Budget Overhaul: German Contributions Rise Amidst Stable Steel Production

The European steel market remains relatively stable despite proposed EU budget changes. Satellite data indicates steady activity at key pipe manufacturers in Germany, while news of potential budget restructuring raises concerns about future regional funding. Specifically, the news article “The European Commission has proposed a new EU budget for 2028-2034” details plans impacting the bloc’s financial landscape. While the budget proposal may affect long-term investments and regional development, no direct impact on the observed steel plant activities could be established through the provided data. The article “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?” highlights that Germany is expected to contribute significantly more, potentially setting a new record, while receiving less in return.

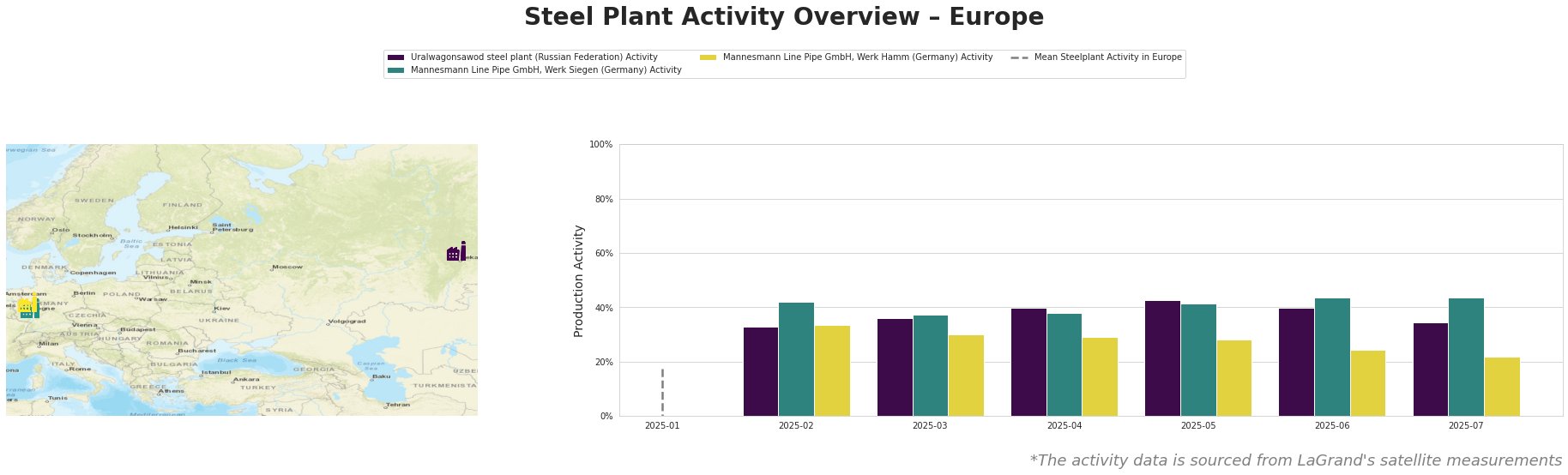

The provided data shows the “Mean Steelplant Activity in Europe” with negative values for the time after January 2025, which makes the value not interpretable.

Activity at Uralwagonsawod steel plant increased from 33% in February to 43% in May, before dropping to 35% in July. The Mannesmann Line Pipe GmbH, Werk Siegen plant exhibited a slight fluctuation, peaking at 44% in June and July. Mannesmann Line Pipe GmbH, Werk Hamm plant showed a gradual decline in activity from 34% in February to 22% in July.

Uralwagonsawod steel plant, located in the Rostov region, is a facility with unknown crude steel production capacity and focuses on the defense sector. The plant activity increased from 33% in February to a peak of 43% in May before declining to 35% in July. The news articles “Radikalreform für EU-Haushalt: Nur die Bauern können aufatmen“, “The European Commission has proposed a new EU budget for 2028-2034“, and “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?” do not present any obvious connection to this Russian steel plant.

Mannesmann Line Pipe GmbH, Werk Siegen, located in Nordrhein-Westfalen, Germany, utilizes EAF technology to produce pipes. Activity at the Werk Siegen facility has been relatively stable, with a slight increase to 44% in June and July. There is no immediately apparent direct impact of the proposed EU budget changes detailed in the news articles “Radikalreform für EU-Haushalt: Nur die Bauern können aufatmen“, “The European Commission has proposed a new EU budget for 2028-2034“, and “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?” on production at this specific plant.

Mannesmann Line Pipe GmbH, Werk Hamm, also in Nordrhein-Westfalen, uses EAF for pipe production. The Werk Hamm plant has seen a decrease in activity, from 34% in February to 22% in July. No direct connection between this decrease and the EU budget discussions in the articles “Radikalreform für EU-Haushalt: Nur die Bauern können aufatmen“, “The European Commission has proposed a new EU budget for 2028-2034“, and “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?” could be established.

While the provided news articles highlight potential shifts in EU funding priorities, the satellite data reveals stable or slightly declining activity levels at key German pipe producers. Given the steady production at Mannesmann Line Pipe GmbH, Werk Siegen, and the slightly declining production at Mannesmann Line Pipe GmbH, Werk Hamm, steel buyers should monitor these plants closely for potential future supply adjustments if the budget impacts on steel production become clear in the future. Given that Germany is expected to contribute more to the EU budget while potentially receiving less in return (per “Neue Zahlen zum EU-Budget: Neuer deutscher Beitragsrekord?“), cost pressures on German steel producers may increase.