From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Shows Mixed Signals Despite US Export Declines: Plant Activity Analysis

Asia’s steel market presents a mixed picture amidst declining US steel exports. The impact of decreased US exports on Asian steel markets requires monitoring, particularly in segments like tool steel. Satellite data reveals fluctuating activity levels across key Asian steel plants, though direct links to specific export trends are not always evident.

Measured Activity Overview

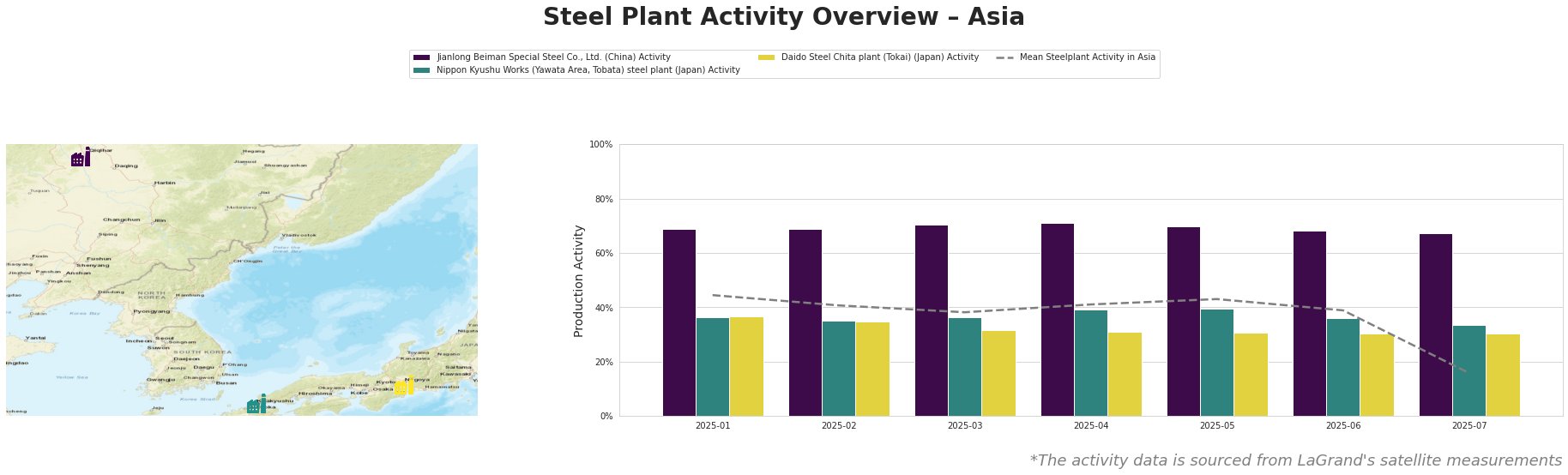

Average steel plant activity in Asia has seen a significant decline in July, dropping to 16.0%, a considerable decrease from 39.0% in June. Jianlong Beiman Special Steel Co., Ltd. consistently operated well above the mean, with activity hovering around 70%, experiencing a slight decrease to 67% in July. Nippon Kyushu Works showed relatively stable activity, ranging from 34% to 40%. Daido Steel Chita plant has displayed a steady decrease in activity levels since January, reaching its lowest observed level of 30% in June and July. The recent overall drop in Asia’s mean steel plant activity is significant and requires further investigation to understand the underlying causes.

Plant Information

Jianlong Beiman Special Steel Co., Ltd., an integrated steel plant in Heilongjiang, China, with a crude steel capacity of 2.2 million tonnes, has maintained high activity levels, averaging around 70% over the observed period. While US tool steel exports are down as per the article “US tool steel exports down 22.6 percent in April 2025“, impacting destinations like Mexico, no direct correlation can be established to this specific plant’s output based on the provided data, despite the fact that the plant produces tool steel.

Nippon Kyushu Works (Yawata Area, Tobata) steel plant, an integrated BF/BOF plant in Kyūshū, Japan, with a crude steel capacity of 3.727 million tonnes, has exhibited stable activity ranging between 34% and 40%. Given its product mix including thin plate and steel bars, the plant might be indirectly affected by the decreases in US merchant bar exports as stated in “US merchant bar exports down 12.7 percent in April 2025” and “US tin plate exports down 13.3 percent in April 2025“. However, the article summaries do not describe Asia as export desitnation and no direct connection can be established.

Daido Steel Chita plant (Tokai), a Japanese EAF-based plant with a 1.5 million tonne crude steel capacity, has shown a gradual decline in activity, reaching 30% in July. The plant produces tool steel, stainless steel, and superalloys. Given the production focus and the article titled “US tool steel exports down 22.6 percent in April 2025“, the activity reduction at Daido Steel could indicate adjustments to offset effects of declining US tool steel exports into other markets. However, no direct connection can be established based on the provided information.

Evaluated Market Implications

Despite US export declines in products like tool steel and merchant bar, the provided data doesn’t explicitly link these declines to the observed activities in selected Asian steel plants. However, the overall decrease in average Asian steel plant activity, particularly in July, warrants attention.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor price fluctuations in the Asian market, especially for tool steel and related products. Diversify suppliers to mitigate potential supply chain disruptions if other plants reduce output.

- Market Analysts: Investigate the causes behind the significant drop in average Asian steel plant activity in July to determine if it’s a temporary correction or a sign of broader market weakness. Further analysis of the supply chains and sales market should be carried out to correlate reported declines in US exports to shifts in Asian steel production.