From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineNorth American Steel Market Faces Downturn Amid Trump’s Trade Threats: Activity Plummets

The North American steel market is showing signs of weakness as trade tensions escalate. Recent activity declines at key steel plants coincide with announcements of new tariffs. The article “US-Handelspolitik: Trump verkündet Zölle von 35 Prozent gegen Kanada – EU-Zollbrief steht bevor” directly links the threat of tariffs to overall market uncertainty; however, a direct link between the tariffs and the specific activity decline in observed plants for July cannot be definitively established from the provided information alone. Similarly, the article “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll” further reinforces the protectionist stance but doesn’t provide direct insight into individual plant operations.

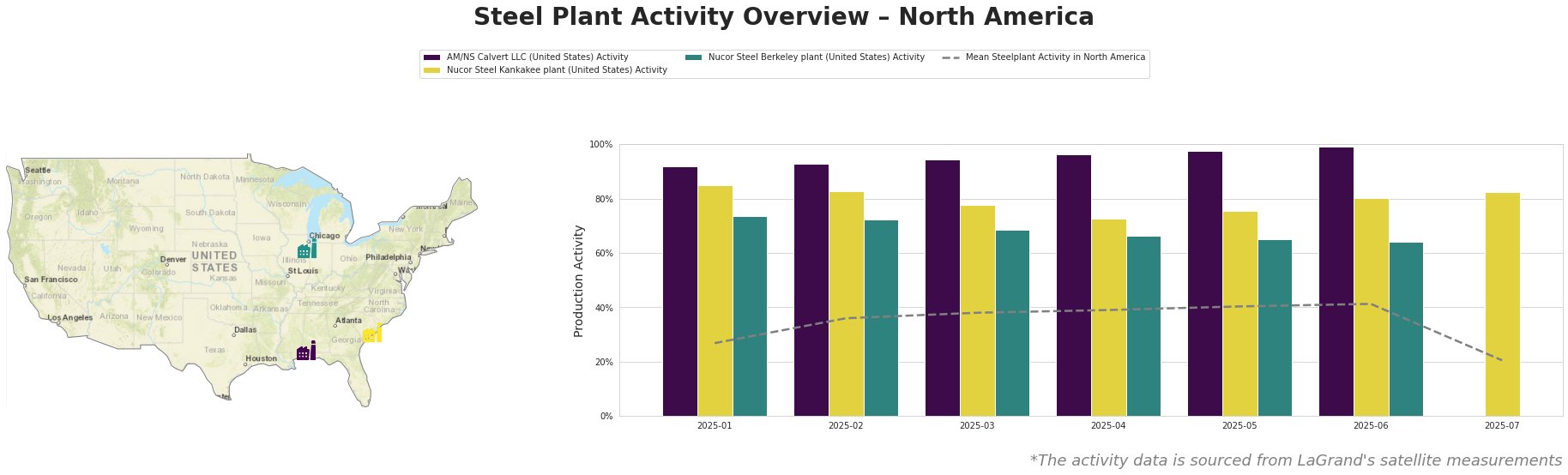

The mean steel plant activity in North America steadily increased from January (27.0%) to June (41.0%) before experiencing a significant drop to 20.0% in July. AM/NS Calvert LLC operated at consistently high levels (above 90%) until July, when activity data is unavailable. Nucor Steel Kankakee plant activity decreased from January (85.0%) to April (73.0%), then recovered to 82.0% in July. Nucor Steel Berkeley plant activity exhibited a gradual decline from January (74.0%) to June (64.0%), with July data missing. The sharp decline in the mean North American activity in July seems to be related to the missing values for AM/NS Calvert LLC and Nucor Steel Berkeley plant, and does not necessary reflect general activity decline across the entire region.

AM/NS Calvert LLC, located in Alabama, has a crude steel production capacity of 1.5 million tonnes per annum (ttpa) using electric arc furnaces (EAF). It focuses on finished rolled products, including hot-rolled, cold-rolled sheet, and advanced coated products for the automotive, building, and energy sectors. The plant maintained very high activity levels during the first half of the year. The missing activity data for July coincides with the escalating trade tensions described in “US-Handelspolitik: Trump verkündet Zölle von 35 Prozent gegen Kanada – EU-Zollbrief steht bevor“, but a direct causal relationship cannot be established without further data.

Nucor Steel Kankakee plant in Illinois, with a crude steel capacity of 794 ttpa using EAF technology, specializes in bar and grating products. Its activity fluctuated throughout the observed period, decreasing until April and increasing afterwards. There is no direct connection between observed news developments and the slight activity fluctuation.

Nucor Steel Berkeley plant, situated in South Carolina, has a larger crude steel capacity of approximately 2.9 million metric tons using EAFs, producing beams and sheet products. Its activity gradually decreased from January to June. Again, a causal connection between observed news developments and this drop in activity can’t be directly established from the provided information.

Based on the observed data and news, the most significant implication is the increased uncertainty surrounding steel supply due to potential trade barriers and fluctuations in plant activity. The announcement of tariffs in the article “US-Handelspolitik: Trump verkündet Zölle von 35 Prozent gegen Kanada – EU-Zollbrief steht bevor” and “US-Handelspolitik: Donald Trump droht Kanada mit 35 Prozent Zoll” creates an environment where buyers should prioritize securing existing supply lines and diversifying their sources where possible. Procurement professionals should closely monitor any announcements related to AM/NS Calvert LLC, particularly regarding potential production disruptions, as the lack of data for July warrants close inspection.