From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Shows Resilience: Production Up Despite Industrial Slowdown

Ukraine’s steel sector demonstrates signs of recovery, despite a general industrial production decline, as evidenced by increased coke production and construction steel price adjustments. “Zaporizhkcoke increased production to 749,000 tons in January-October,” indicating a positive trend in upstream production, though a direct relationship to specific plant activity levels cannot be explicitly established from the provided data. This increase comes despite a broader industrial slowdown reported in “Industrial production in Ukraine fell by 2% y/y in January-September“.

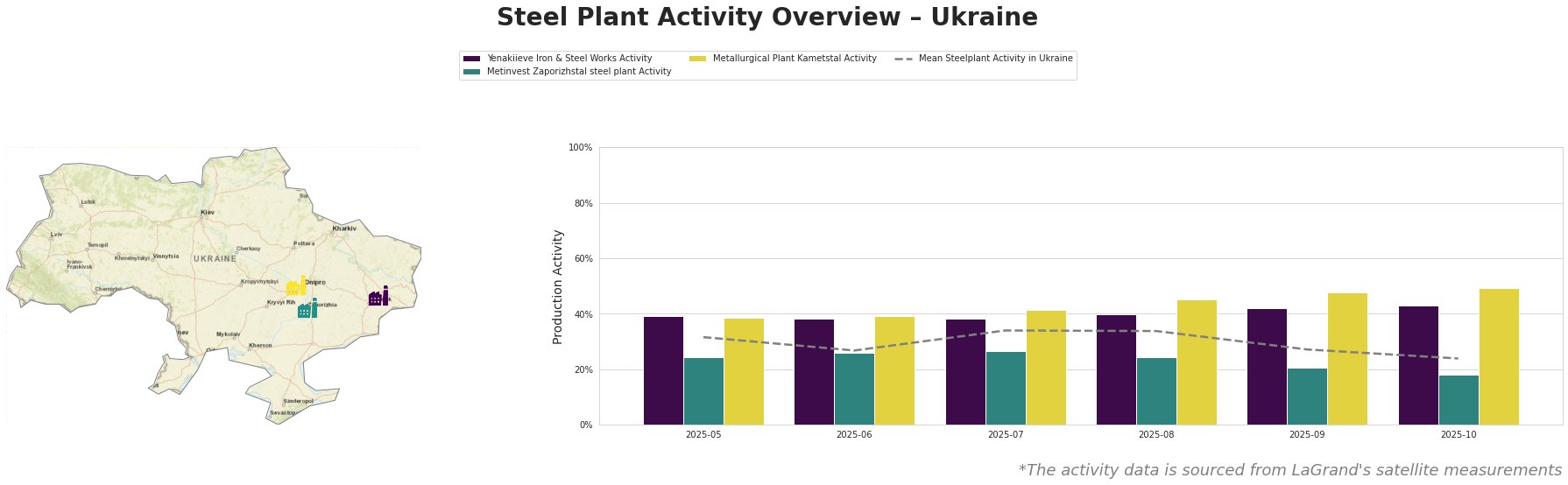

Here’s a summary of steel plant activity, based on satellite observations:

The mean steel plant activity in Ukraine shows a fluctuating trend, decreasing to 24% in October, the lowest value in the observed period. Yenakiieve Iron & Steel Works consistently operates above the mean, reaching a peak activity of 43% in October. Metinvest Zaporizhstal steel plant consistently shows activity levels below the mean, dropping to 18% in October. Metallurgical Plant Kametstal has exhibited a steady increase in activity, reaching its highest point at 49% in October, significantly above the national mean.

Yenakiieve Iron & Steel Works, located in Donetsk, uses integrated (BF) production with BF and BOF equipment. It produces semi-finished and finished rolled products, including rebar and channels. Despite operating above the national mean, its coking operations are dependent on suppliers. The stable high satellite observed activity levels do not clearly align with the news articles provided.

Metinvest Zaporizhstal steel plant, in Zaporizhzhia, also employs integrated (BF) production using BF and OHF equipment, producing finished rolled products like hot-rolled coil. The decreasing activity, dropping to 18% in October, shows an inverse relationship with the news that “Zaporizhkcoke increased production to 749,000 tons in January-October“. The provided information does not establish any clear connection between activity levels at Metinvest Zaporizhstal steel plant and the increased production at Zaporizhkcoke, but the increased coke production could be used by other steel facilities. The drop in activity at Metinvest Zaporizhstal steel plant and increase in coke production are contradictory and worth investigating further.

Metallurgical Plant Kametstal, located in Dnipropetrovsk, utilizes integrated (BF) production with BF and BOF equipment, manufacturing semi-finished and finished rolled products, including wire rods and rails. Its observed increasing activity, reaching 49% in October, could be linked to the domestic construction steel price increases detailed in “Domestic prices for construction steel products rose slightly in October,” which cites an increased demand in the construction sector.

Based on these observations:

- The lower activity level at Metinvest Zaporizhstal steel plant coupled with increased construction steel demand and the increased coke production suggest potential future price increases for hot-rolled coil coming from other producers, as supply from this plant could be constrained. Steel buyers should investigate alternative suppliers for hot-rolled coil and black tin.

- Given the rising activity at Metallurgical Plant Kametstal and its product mix including rails, buyers needing rails should consider securing contracts now, anticipating potential price increases linked to its increased activity and the general rise in construction steel prices.