From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Market Report: Growth Driven by Defense Orders

Significant changes in Ukraine’s steel market are directly informed by the article “Defense orders named the main driver of steel consumption in Ukraine“ and the observed production increases at major steel plants. Activity reports indicate a potential upward trend in steel consumption, primarily linked to ongoing defense projects stimulating current and future demand.

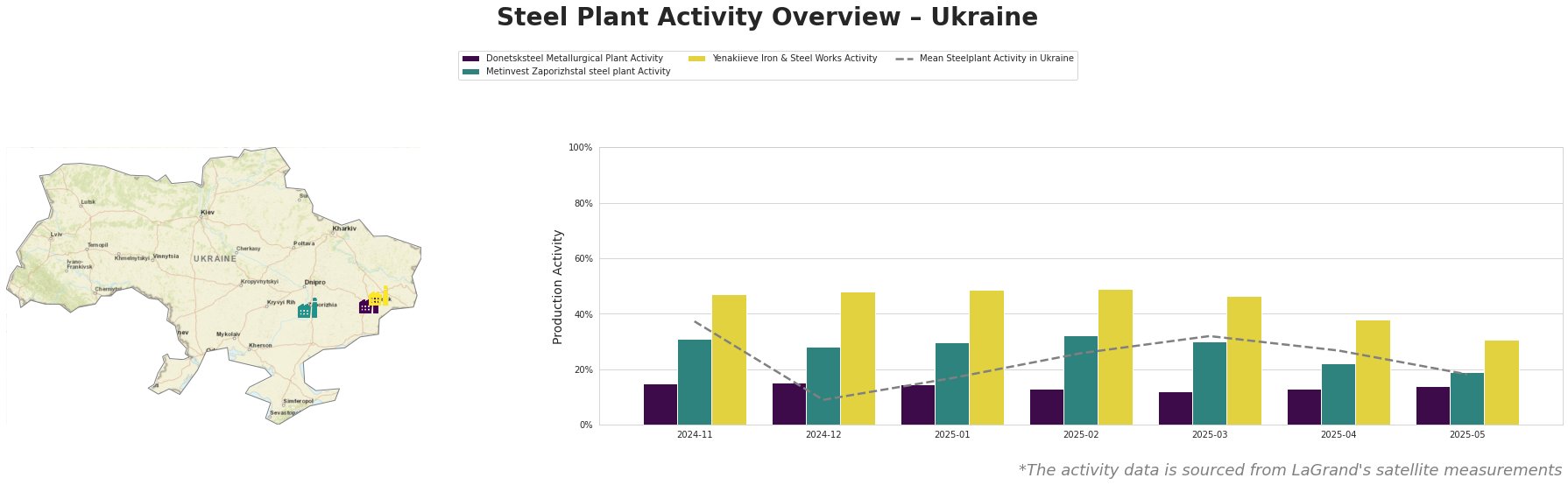

Measured Activity Overview

Recent activity levels across Ukrainian steel plants reflect variability, notably a peak of 49.0% at Yenakiieve Iron & Steel Works in January 2025 before declining to 31.0% in May 2025. “Defense orders named the main driver of steel consumption in Ukraine” aligns with these activity levels, illustrating robust demand linked to military construction, especially prominent at the Yenakiieve plant, which serves various construction sectors, potentially bolstering the upcoming sales pipeline.

Plant Insights

Donetsksteel Metallurgical Plant has exhibited low activity, fluctuating between 12.0% and 15.0% from November 2024 to May 2025, with no established connection to recent increases in demand outlined in “Defense orders named the main driver of steel consumption in Ukraine.” The plant’s operational status remains hampered, impacting its contribution to the market.

Metinvest Zaporizhstal shows reduced activity, down to 19.0% in May 2025 from 30.0% in January. This decline occurred despite production increases reported in the second half of 2024 and early 2025 as highlighted in “Zaporizhstal produced more than 1 million tons of steel in January-April 2025.” The connection to both defense projects and commercial steel demand remains mixed, indicating a cautious market outlook.

Yenakiieve Iron & Steel Works, with activity peaking at 49.0% and declining subsequently, underscores its ability to adapt to defense-oriented priorities. This plant’s deployment of available capacity — primarily for rebar and finished rolled products — puts it in a favorable position for contracts tied to government defense spending and reconstruction efforts.

Evaluated Market Implications

Despite some production fluctuations, demand fundamentals remain strong, primarily driven by government defense projects. Specific procurement strategies for steel buyers should include securing contracts with Yenakiieve Iron & Steel Works, which has demonstrated a robust production capacity supported by defense-related initiatives. In contrast, the persistent lower activity at Donetsksteel signals potential supply interruptions, suggesting buyers should assess alternative suppliers or renegotiate terms with operating plants to mitigate risks.

Attention towards ongoing developments linked to government defense contracts will be critical in shaping procurement strategies and expectations in the coming months.