From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Exports Mixed: Pig Iron Surges, Semis Decline Amidst Stable European Plant Activity

Europe’s steel market presents a complex picture, influenced by shifts in Ukrainian exports and relatively stable plant activity across select European facilities. While “Ukraine exported 1.59 million tons of pig iron in January-October,” indicating strong growth in this sector, “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October,” reflecting a significant downturn. Despite these shifts in Ukrainian exports, satellite observations show no immediate or direct correlation with significant fluctuations in activity levels at the monitored European steel plants.

Measured Activity Overview:

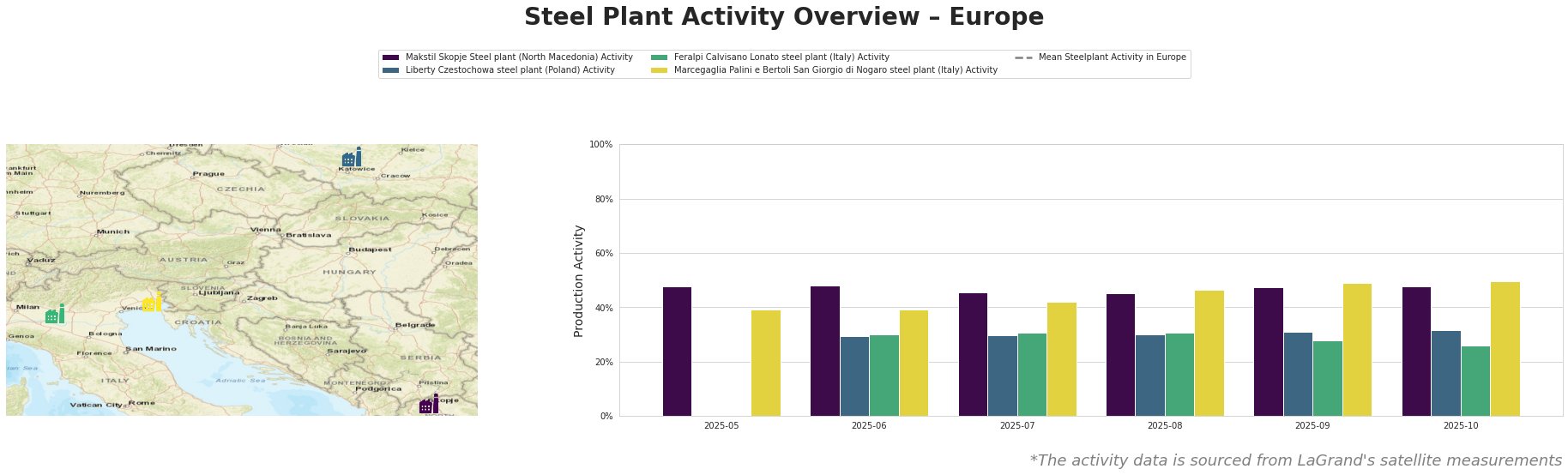

Across the observed period, the “Mean Steelplant Activity in Europe” fluctuated, with highs in July and August. Makstil Skopje Steel plant in North Macedonia maintained a relatively stable activity level around 45-48%. Liberty Czestochowa steel plant in Poland showed a slight upward trend, moving from 30% in June to 32% in October. Feralpi Calvisano Lonato steel plant in Italy experienced a slight decrease, from 30% in June to 26% in October. Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant in Italy demonstrated the most consistent growth, increasing from 39% in May/June to 50% in October, marking the highest activity level among the monitored plants.

Makstil Skopje Steel plant, an EAF-based facility with a 550,000 tonne crude steel capacity, showed consistent activity, holding steady around 45-48% throughout the observed period. No direct link can be established between this stable activity and the provided news articles concerning Ukrainian export dynamics.

Liberty Czestochowa steel plant, also an EAF-based plant, boasting a higher capacity of 840,000 tonnes, displayed a gradual increase in activity, reaching 32% in October. This increase does not appear to be directly influenced by fluctuations in Ukrainian steel exports, as indicated by the news articles.

Feralpi Calvisano Lonato steel plant, a 600,000 tonne EAF-based facility, experienced a slight decrease in activity towards the end of the period, dropping to 26% in October. There is no clear evidence suggesting that this reduction is related to the observed changes in Ukrainian export volumes.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro steel plant, another EAF-based plant with a 600,000-tonne capacity, exhibited the most significant growth, reaching 50% activity in October. This increase does not appear to be directly correlated with shifts in Ukrainian export patterns as described in the provided news articles.

Evaluated Market Implications:

While “Ukraine’s total steel exports down 9.9 percent in Jan-Oct 2025,” the increase in pig iron exports coupled with declines in semi-finished products suggests a shift in Ukraine’s export mix rather than an overall capacity issue. The stable or slightly increasing activity levels observed at the selected European plants suggest that they are not directly compensating for the reduction in Ukrainian semi-finished product exports.

Procurement Action:

Steel buyers should closely monitor pig iron pricing, as the increased Ukrainian exports, as indicated in “Ukraine exported 1.59 million tons of pig iron in January-October,” could exert downward pressure on prices. Conversely, given the 35.5% year-on-year reduction in Ukrainian semi-finished exports reported in “Ukraine reduced exports of semi-finished products by 35.5% y/y in January-October”, steel buyers in Bulgaria, Turkey, and Poland, who have been major importers, should secure alternative sources to mitigate potential supply shortages and price increases. Diversifying suppliers and exploring alternative product types may be beneficial. The stability in European plant activity levels, as indicated by satellite observations, suggests that European mills may not be immediately positioned to fill the gap left by reduced Ukrainian semi-finished exports.