From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Pig Iron Surge Offsets Steel Dip, but Export Challenges Loom: European Steel Market Update

Ukraine’s steel sector presents a mixed picture. Increased pig iron production contrasts with decreased rolled steel and iron ore exports, creating both opportunities and challenges for European steel buyers. According to “Ukraine reports eight percent rise in pig iron output for January-August 2025” and “Ukraine produced 4.25 million tons of rolled steel in January-August,” pig iron output is up, while rolled steel production faces headwinds. These trends are happening as “Ukraine reduced iron ore exports by 7% y/y in January-August“, suggesting potential raw material supply chain realignments within Europe. The satellite data provides no direct indication to support or refute these claims.

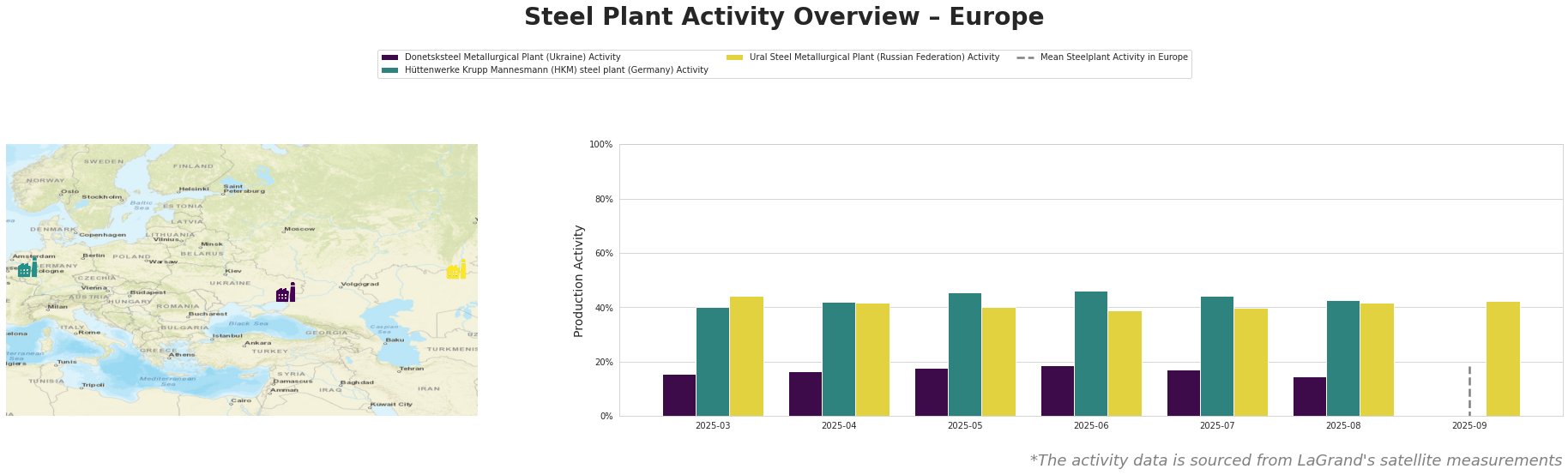

The “Mean Steelplant Activity in Europe” fluctuates with extreme variance, making identifying any real trend impossible.

Donetsksteel Metallurgical Plant activity saw a peak of 19% in June 2025, declining to 15% by August. Hüttenwerke Krupp Mannesmann (HKM) steel plant in Germany showed relatively stable activity, fluctuating between 40% and 46%. Ural Steel Metallurgical Plant in the Russian Federation has also shown stability, with activity hovering around 40-44%. The satellite data does not show an explicit relationship between “Zaporizhcoke increased production to 593,000 tons in January-August” and activity levels in the plants.

Donetsksteel Metallurgical Plant

Donetsksteel, an integrated BF-EAF plant in Ukraine with a pig iron capacity of 1.5 million tons, shows fluctuating activity. From March to August 2025, satellite data indicates activity varied between 15% and 19%, suggesting inconsistent operation. This fluctuation does not directly correlate with the increase in pig iron production reported in “Ukraine reports eight percent rise in pig iron output for January-August 2025.” There is no immediate link established between satellite observed activity and the “ResponsibleSteelCertification”. However, “Ukraine reports eight percent rise in pig iron output for January-August 2025” correlates well with the plant focusing on Pig Iron production.

Hüttenwerke Krupp Mannesmann (HKM) steel plant

HKM, a major integrated BF-BOF steel plant in Germany, boasts a 6 million ton crude steel capacity. Satellite data indicates relatively stable activity between 40% and 46% from March to August 2025. This suggests consistent production, despite broader market fluctuations. The stable activity level doesn’t have an apparent relationship with news from the Ukranian steel market. The company maintains both “ISO14001” and “ISO50001” certifications.

Ural Steel Metallurgical Plant

Ural Steel, an integrated BF-EAF plant in Russia with a 1.6 million ton crude steel capacity, shows steady activity, fluctuating around 40-44% between March and August 2025, aligning with the average steel plant activity for European plants. The company has “ISO14001” and “ISO50001” certifications, but no correlation with any increased production is evident.

Evaluated Market Implications

The increase in Ukrainian pig iron production reported in “Ukraine reports eight percent rise in pig iron output for January-August 2025” combined with decreased iron ore exports reported in “Ukraine reduced iron ore exports by 7% y/y in January-August” may lead to a temporary oversupply of pig iron within Ukraine and potentially the broader European market. Procurement Action: Steel buyers should consider negotiating pig iron contracts with Ukrainian suppliers, leveraging the potential oversupply to secure favorable pricing. Monitor export restrictions from Ukraine, as highlighted in the news, which may limit supply options in the long term. While “Zaporizhcoke increased production to 593,000 tons in January-August” suggests increased coke availability, any potential disruptions to Zaporizhstal’s operations (Zaporizhcoke’s primary customer) could further impact the pig iron market dynamics. Continuously monitor the political and logistical situation in Ukraine to ensure supply chain security.