From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine’s Steel Export Surge & Italian Plant Stability Signal Positive European Outlook

Ukraine’s steel sector demonstrates resilience amid increased trade flows, while Italian plant activity remains stable, suggesting a broadly positive, albeit complex, outlook for European steel buyers. “Ukraine increase exports of long products by 26% y/y in January-April” and “Ukraine increased exports of ferrous scrap by 95% year-on-year” indicate a growing export capacity. Simultaneously, “Ukraine increased imports of long products by 81.1% y/y in January-April” suggests a recovering domestic demand being met by imports, partially offsetting the increased exports. The satellite data shows stable activity at Italian steel plants (Acciaierie Venete), yet no direct relationship can be explicitly established between these developments and the Ukrainian trade news.

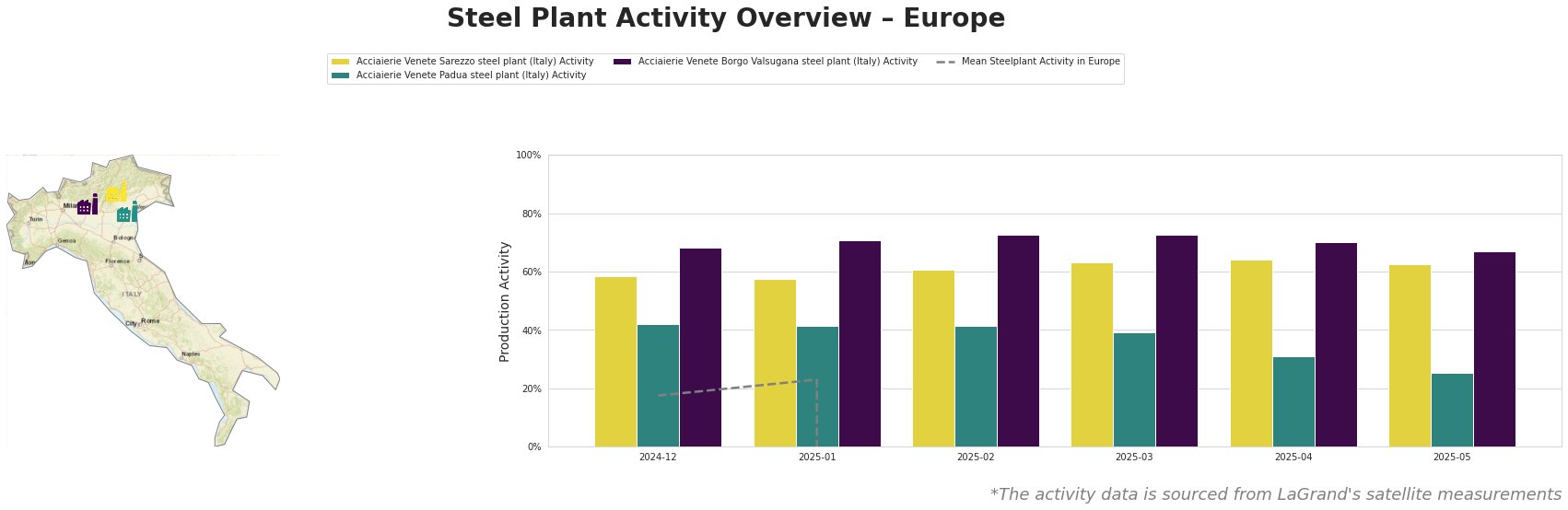

Observed steel plant activity (in %) based on satellite data:

The provided “Mean Steelplant Activity in Europe” values appear to be corrupted, showing significant negative values from February 2025 onwards, making any meaningful comparison to the Italian plants impossible. Acciaierie Venete Sarezzo maintained a consistently high activity level, hovering between 58% and 64%. Acciaierie Venete Padua experienced a gradual decline from 42% in December 2024 to 25% in May 2025. Acciaierie Venete Borgo Valsugana showed a stable, high activity, ranging from 67% to 73%.

Acciaierie Venete Sarezzo, located in the Province of Brescia, Italy, operates a 540 ttpa EAF-based steel plant focusing on semi-finished and finished rolled products, including bars, round bars, and wire rod for the automotive, building, and energy sectors. The plant maintained a consistently high activity level above 58% from December 2024 to May 2025. This stable performance does not directly correlate with any of the provided news articles concerning Ukrainian exports and imports; therefore, no direct connection can be established.

Acciaierie Venete Padua, situated in the Province of Podova, Italy, also utilizes EAF technology with a 600 ttpa capacity, producing similar long products for comparable end-user sectors. The plant’s activity saw a decline from 42% in December 2024 to 25% in May 2025. This activity decrease does not directly correlate with any of the provided news articles concerning Ukrainian exports and imports; therefore, no direct connection can be established.

Acciaierie Venete Borgo Valsugana, located in the Province of Trentino-Alto Adige, operates a 600 ttpa EAF-based steel plant that focuses on the production of bars, round bars, and wire rod for the automotive, building, and energy sectors. The plant’s activity level remained stable above 67% throughout the observed period, peaking at 73% in February and March 2025. This stable performance does not directly correlate with any of the provided news articles concerning Ukrainian exports and imports; therefore, no direct connection can be established.

Given Ukraine’s increased long product exports, as reported in “Ukraine increase exports of long products by 26% y/y in January-April,” and the simultaneous rise in scrap exports (“Ukraine increased exports of ferrous scrap by 95% year-on-year”), steel buyers should monitor pricing trends for long steel products, particularly in Poland, Moldova, and Romania, which are identified as key export destinations. Simultaneously, the increase in Ukrainian long product imports indicates a potential redirection of supply chains. While Italian EAF plant activity remained relatively stable, procurement professionals should closely track the impact of Ukrainian export patterns on European long steel product availability and pricing, particularly regarding the potential for disruptions in the supply of raw materials like ferrous scrap. Evaluate alternative sourcing options for long steel products, considering Turkey and China, identified as significant exporters to Ukraine in “Ukraine increased imports of long products by 81.1% y/y in January-April”.